Algorithmic trading, often referred to as algo trading, has revolutionised the world of financial markets. This approach to trading involves the use of computer programs and automated systems to execute trading strategies. Algorithmic trading leverages technology, quantitative analysis, and complex algorithms to make split-second trading decisions. In this comprehensive guide, we’ll delve into the fundamentals of algorithmic trading and its key concepts and provide real-world examples to illustrate its impact on today’s financial landscape.

Introduction to Algorithmic Trading

What Is Algorithmic Trading?

Algorithmic trading, often referred to as algo trading, is a trading strategy that relies on the use of computer programs to execute a series of predefined trading instructions. These instructions are based on a set of rules, technical indicators, or statistical models. The primary objective of algorithmic trading is to automate the trading process and execute orders with speed and precision. Algo trading has gained immense popularity in recent years due to its ability to analyse vast amounts of data, make rapid trading decisions, and eliminate human emotions from the equation. Traders and institutions use algorithmic trading to capitalise on price discrepancies, seize trading opportunities, and manage their portfolios efficiently.

Historical Evolution of Algorithmic Trading

Algorithmic trading made its debut in the 1970s, marking the advent of highly computerised trading systems in the American financial markets.

- The New York Stock Exchange introduced its system in 1976, a significant development that contributed to the growing acceptance of electronic trading by market participants.

- The popularisation of algorithmic trading owes much to Michael Lewis, an author whose work drew the attention of both traders and the public to the realm of high-frequency algorithmic trading.

- In the 2000s, High-frequency trading (HFT) emerged as a dominant force in the financial markets. HFT algorithms execute a large number of orders at incredibly high speeds, often within milliseconds or even nanoseconds.

- Since the 2010s, algorithmic trading has become accessible to retail traders and investors, thanks to the proliferation of user-friendly trading platforms. Machine learning and Artificial Intelligence (AI) have started to play a significant role in algo trading strategies as well.

Key Concepts in Algorithmic Trading

Algorithm Development

The core of algorithmic trading lies in algorithm development. Traders and quantitative analysts create algorithms that define the rules and conditions for executing trades. These algorithms can be as simple as moving average crossovers or highly complex, incorporating machine learning models.

Data Analysis

Data analysis is a fundamental aspect of algo trading. Traders rely on historical and real-time market data to inform their trading decisions. Advanced data analysis techniques, including statistical analysis and machine learning, help in identifying patterns and trends within the data.

Risk Management

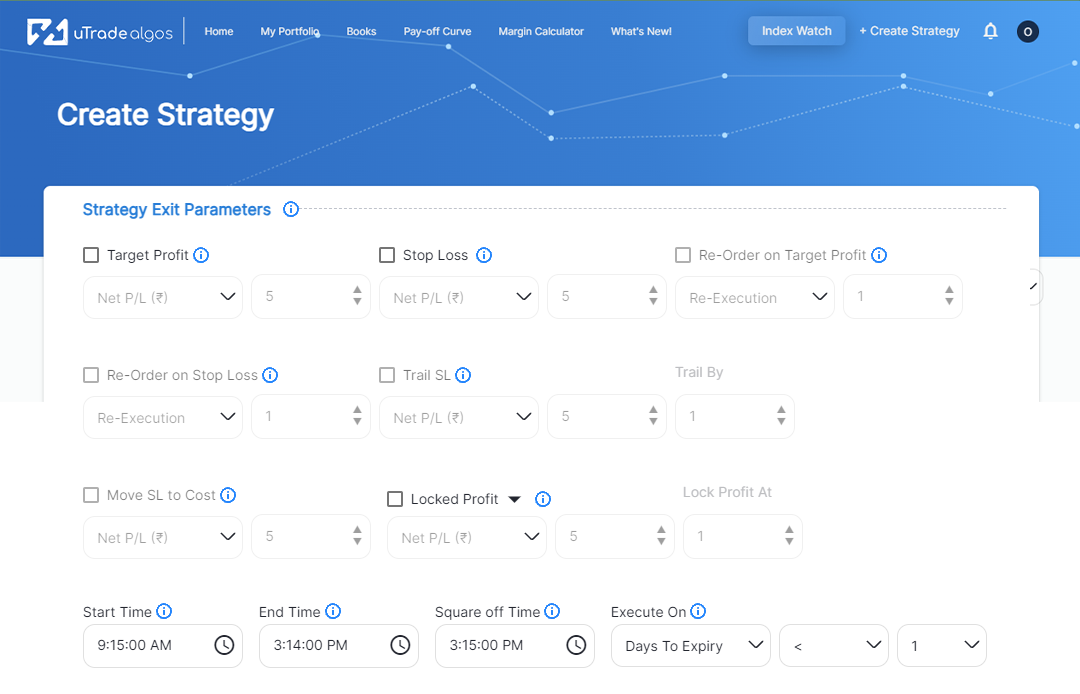

Effective risk management is crucial in algorithmic trading. Algo traders employ risk controls such as stop-loss orders and position size limits to protect their capital. These risk management measures are often automated, ensuring that losses are minimised.

High-Frequency Trading (HFT)

High-frequency trading is a subset of algorithmic trading that focuses on executing a large volume of trades at exceptionally high speeds. HFT strategies are designed to capitalise on minuscule price differentials and market inefficiencies. These strategies often require co-location services and low-latency trading infrastructure.

Market Making

Market making is a common algo trading strategy used by financial institutions. Market makers provide liquidity by continuously quoting buy and sell prices for financial instruments. They profit from the spread between the bid and ask prices. Market-making algorithms aim to maintain balanced order books.

Tools and Technologies in Algorithmic Trading

Algorithmic Trading Software

Algorithmic trading programs on platforms like uTrade Algos provide the tools for creating, testing, and executing trading strategies. These platforms offer user-friendly interfaces and robust backtesting capabilities.

Data Feeds and APIs

Access to real-time and historical market data is essential for algorithmic trading. Data feeds and APIs allow traders to gather the information required for strategy development and execution.

High-Performance Computing

Algo traders often require high-performance computing infrastructure to process vast amounts of data and execute trades with low latency. High-performance servers and low-latency network connections are critical components.

Cloud Computing

Cloud computing provides scalability and flexibility for algo traders. It allows them to access vast computational resources and storage capacity, making it easier to develop and run sophisticated algorithms.

Machine Learning and AI

Machine learning and AI are increasingly integrated into algorithmic trading programs. These technologies can analyse data, identify patterns, and adapt strategies in real time.

The Role of Algo Trading Software

Algo trading software serves as the foundation for implementing and executing algorithmic trading strategies. These platforms offer several essential functions:

- Strategy Development: Algo trading software enables traders to create, test, and refine trading strategies based on predefined rules and algorithms.

- Data Analysis: The software provides access to real-time and historical market data, facilitating data-driven decision-making.

- Automation: Algo trading software automates order execution, enabling rapid, precise, and emotion-free trades.

- Risk Management: Many platforms include risk management features, such as setting stop-loss orders and position size limits

As an example, the uTrade Algos platform is a browser-based platform where one can create trading strategies without any coding. It has a fast backtesting engine, is reliable, helps to generate comprehensive reports, and provides accurate historical data via its proprietary Algo Engine. On this platform, one can explore interactive payoff graphs and customise his strategy’s performance as well. Via uTrade Originals, which has pre-built algos that have been crafted by industry professionals for diverse market conditions, one can optimise his trading experience. It also provides a simple, flexible pricing structure that can meet all pockets together with a 7-day free trial as well.

Examples of Algorithmic Trading Strategies

Momentum Trading

Momentum trading strategies capitalise on the continuation of existing price trends. Algo traders identify assets that are exhibiting strong price momentum and enter positions in the direction of the trend. These strategies are often used in conjunction with technical indicators.

Arbitrage

Arbitrage strategies seek to profit from price discrepancies between different markets or assets. For example, a trader might simultaneously buy an asset in one market and sell it in another, exploiting variations in prices to secure risk-free profits.

Statistical Arbitrage

Statistical arbitrage relies on quantitative models and statistical analysis to identify mispriced assets. Algo traders create portfolios of long and short positions to profit from these discrepancies.

Market-Neutral Strategies

Market-neutral strategies aim to hedge against overall market movements. Algo traders construct portfolios that consist of both long and short positions, effectively balancing their exposure to market fluctuations.

Pairs Trading

Pairs trading involves identifying two correlated assets and taking long and short positions in them. Algo traders profit when the spread between the two assets converges or diverges based on historical relationships.

Trend Following

Trend-following strategies involve identifying and following established market trends. Algorithms analyse historical price data and indicators to determine the trend’s strength and potential continuation.

Regulations and Risks in Algorithmic Trading

- Regulatory Framework: Algorithmic trading is subject to regulatory oversight in financial markets. Regulatory bodies enforce rules to maintain market stability and fairness, with algo traders required to comply.

- Risks and Challenges: Algo trading carries inherent risks, such as technical glitches and market surprises. Effective risk management is crucial to mitigate these challenges and safeguard trading capital.

- Risk Management Strategies: Strategies encompass stop-loss orders, portfolio diversification, and vigilant algorithm monitoring. These measures control losses and ensure portfolio stability.

Benefits of Algorithmic Trading

- Speed and Efficiency: Algorithmic trading can execute trades within milliseconds, ensuring that opportunities are not missed in fast-moving markets. Speed and efficiency are key advantages.

- Eliminating Emotional Biases – Algorithms trade based on predefined rules, eliminating emotional biases that often lead to poor trading decisions for human traders.

- Backtesting and Optimisation: Traders can backtest their strategies using historical data to assess performance and optimise algorithms before deploying them in live markets.

- Risk Management: Automated risk management tools help control losses and protect trading capital, ensuring that risks are managed effectively.

- Enhanced Market Monitoring: Algorithmic trading enables traders to monitor multiple markets and instruments simultaneously, maximising profit potential and saving time.

Risks of Algorithmic Trading

- Technical Failures: Algo trading systems are vulnerable to technical glitches or failures that can disrupt trading activities.

- Market Risks: Algorithms are exposed to market risks and can result in losses if market conditions rapidly or unexpectedly change.

- Regulatory Risks: Algo trading is subject to regulatory oversight and compliance requirements that traders must be cognisant of and adhere to.

- Lack of Human Involvement: Algorithms lack human intervention and may not consider qualitative factors or unforeseen events that can influence market dynamics.

- Traders must have a thorough understanding of these risks and institute robust risk management strategies when participating in algorithmic trading to safeguard their investments and optimise their trading outcomes.

Getting Started with Algorithmic Trading

- Required Knowledge and Skills: To begin with algorithmic trading, traders should possess skills in computer programming, analytical thinking, and an understanding of financial markets.

- Learning Resources: Online courses, educational platforms, and books provide valuable resources for learning the intricacies of algorithmic trading.

- Choosing the Right Algorithmic Trading Software: Selecting the appropriate algorithmic trading software is essential. Traders should consider factors such as functionality, ease of use, and cost when making this choice.

- Simulated Trading: Simulated trading allows traders to practice and refine their strategies without risking capital. It’s an essential tool for learning and testing.

As technology continues to advance and data analysis techniques evolve, algorithmic trading is likely to become an even more prominent force in the world of finance. By mastering the concepts, strategies, and technologies associated with algo trading, traders can navigate the complex and dynamic world of financial markets with confidence and efficiency. Whether you’re a professional trader or an aspiring enthusiast, algorithmic trading has the potential to enhance your trading journey and deliver exceptional results.

November 6, 2023

November 6, 2023