Quantifying risk and return is essential for efficient trading. At the heart of this process lies backtesting, a method used to analyse a trading strategy’s historical performance and predict its future potential. Unlike hasty, random trading tips, backtesting trading strategies offer a systematic, data-driven approach to trading strategy development. Read on to learn more about how to effectively backtest a trading strategy for success.

The Significance of Backtesting

- Risk and Return Analysis: Successful traders rely on backtesting to evaluate their strategies, quantifying the potential risks and rewards before committing real capital to the strategies.

- Historical Performance: Backtesting allows traders to study how a strategy performed in the past, helping them make informed decisions for the future.

- Disciplined Trading: It encourages traders to stick to a well-tested plan, reducing emotional, impulsive trading decisions.

Getting Started with Backtesting

- Selecting a Trading Strategy: Begin by choosing a strategy backtesting. Define all the parameters that comprise your strategy, including the asset class you are trading and the chart timeframe. Keep in mind that different asset classes possess distinct characteristics, which will impact the amount of historical data required. For example, bonds may necessitate up to 20 years of data, while short-term currency traders can work with data spanning just a few weeks.

- Identify Trade Opportunities: Seek out trades that align with the criteria of your strategy. Analyse and meticulously document the entry and exit signals generated by the strategy for all the potential trades. Ensure that all valid trades, whether winners or losers are recorded to calculate the gross return.

- Calculate the Net Return: Calculate the net return by considering other trading-related expenses such as transaction costs, commissions, or relevant subscriptions. Compare the net return to the initial capital invested over the backtested period to determine the net percentage return.

- Data and Tools: Gather historical market data for the assets you plan to trade. Specialised backtesting software and strategy backtesting platforms offer access to such data and tools for in-depth analysis.

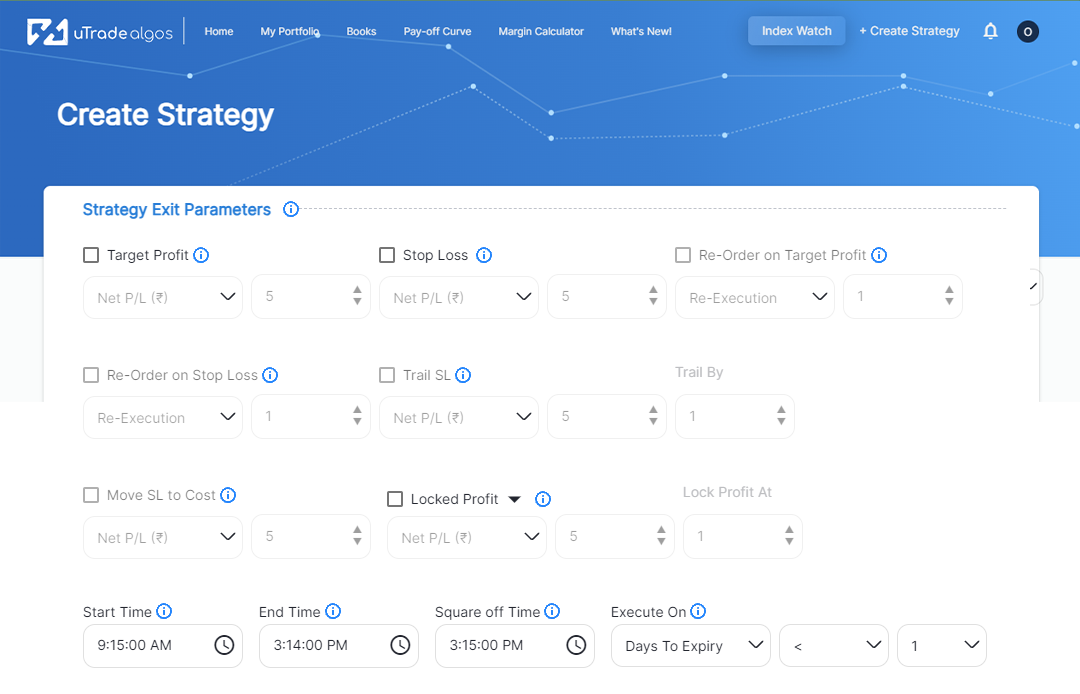

- Define Strategy Parameters: Clearly outline your strategy’s parameters, such as entry and exit rules, stop-loss levels, and take-profit targets.

- Timeframes: Determine the timeframe for your backtest, which could range from daily to minute-by-minute data, depending on your trading style.

The Backtesting Process

- Manual Backtesting: This approach involves analysing historical data, applying your strategy’s rules, and meticulously recording results. Although time-consuming, manual backtesting provides a deep understanding of your strategy’s intricacies.

- Automated Backtesting: Use specialised software on platforms like uTrade Algos for automated backtesting, which is more efficient. These strategy backtesting platforms allow you to program your strategy and test it against historical data swiftly.

- Data Selection: Ensure that your historical data is accurate and representative of the assets and timeframes you intend to trade. uTrade Algos provides users with the capability to assess the historical performance of their strategy logic by utilising precise historical data and our proprietary Algo Engine. Clean and reliable data is essential for meaningful results.

- Simulate Real Trading: Consider slippage and transaction costs to simulate realistic trade execution, giving you a more accurate picture of your strategy’s performance.

Common Mistakes in Backtesting

- Over-Optimisation: Be cautious about over-optimising your strategy for historical data, as this can lead to poor real-time performance. Strive for a balanced approach.

- Neglecting Transaction Costs: Failing to account for spreads, commissions, and other transaction costs can lead to overly optimistic backtest results.

- Ignoring Risk Management: Ensure your backtest incorporates realistic risk management strategies, including position sizing and stop-loss placement. uTrade Algos is one platform that provides sophisticated risk management tools.

- Sample Size: A small sample size may not provide statistically significant results. Your backtest should cover a reasonable period to validate your strategy.

Interpreting Backtest Results

- Returns and Metrics: Evaluate metrics like total return, maximum drawdown, win-loss ratio, and risk-adjusted return to assess your strategy’s performance.

- Risk Assessment: Analyse risk metrics, including standard deviation and Sharpe ratio (this evaluates the excess return, i.e., the return achieved beyond a risk-free rate) per unit of risk taken, to understand the level of risk your strategy carries.

- Robustness: A robust strategy performs consistently in various market conditions. Ensure your strategy exhibits this quality.

Tips for Successful Backtesting

- Define Clear Objectives: Before you begin, have a clear understanding of your objectives. What do you want to achieve with your trading strategy? Knowing your goals will help you create relevant backtesting parameters.

- Quality Data: Use accurate and reliable historical data. The quality of your data is critical for meaningful results. Ensure that the data you use is free from errors and gaps.

- Maintain Objectivity: Steer clear of confirmation bias by objectively analysing your backtest results, even if they don’t align with your expectations.

- Iterate and Refine: Use the insights gained from the backtesting trading strategies to refine your strategy. Make gradual adjustments and retest to observe their impact on performance.

- Set Realistic Expectations: Past performance doesn’t guarantee future results. Establish realistic expectations and only risk what you can afford to lose.

- Set Risk Management Rules: Incorporate risk management rules into your backtesting. Determine position sizing, stop-loss levels, and take-profit targets, as this will have a significant impact on the success of your strategy.

- Paper Trading: After strategy backtesting, simulate your strategy in a risk-free environment before committing real capital to it.

- Consider Market Conditions: Be mindful of different market conditions, including trends, ranges, and volatile periods. Test your strategy across various market conditions to ensure its robustness.

- Diversify Your Portfolio: If you’re backtesting a portfolio, consider diversification. A well-diversified portfolio can help mitigate risk and enhance long-term returns.

- Understand Drawdowns: Pay attention to maximum drawdowns, which indicate the largest loss experienced during your backtest. Understanding drawdowns helps you assess the strategy’s risk.

- Minimise Volatility: Strive to minimise volatility within your strategy. Excessive volatility can be particularly detrimental in leveraged markets and increase the risk of margin calls.

- Tailor Backtesting Parameters: Customise your backtesting parameters to align with your unique requirements for accurate results. These parameters may encompass position sizes, margin prerequisites, and transaction expenses.

- Exercise Caution Regarding Over-Optimisation: Remember that the goal is to develop a profitable strategy with sustainable wins, not necessarily flawless ones. Avoid over-optimising your strategy to the point of impractical perfection.

- Be Patient: Avoid making hasty decisions based on initial backtest results. It’s essential to test your strategy over a reasonable time frame to gain confidence in its performance.

- Regularly Review and Update: Market conditions change, and strategies that performed well in the past may require adjustments. Regularly review and update your strategies as needed.

- Learn from Mistakes: Don’t be discouraged by unsuccessful backtests. Mistakes and losses provide valuable learning opportunities. Analyse why a strategy failed and use that knowledge to improve.

- Seek Feedback: Consider sharing your backtest results with experienced traders or mentors. They can provide valuable insights and constructive feedback.

Backtesting trading strategies is a critical tool for traders seeking to enhance their strategies, mitigate risk, and make more informed decisions. Although it can’t guarantee future success, it serves as a solid foundation for confident trading. By following the steps outlined in this guide, avoiding common mistakes, and adhering to best practices, you can leverage backtesting to refine your trading strategies and improve your odds of success in the dynamic world of financial markets. Remember, consistency and discipline are paramount for long-term profitability, and backtesting is an indispensable part of the journey to success.

November 7, 2023

November 7, 2023