Backtesting is a method used in finance to evaluate the effectiveness of a trading strategy by applying it to historical market data. It involves simulating trades using past market conditions to assess how a strategy would have performed. Traders analyse metrics like returns, drawdowns, and risk exposure to identify the strategy’s strengths and weaknesses. This process aids in refining and optimising trading strategies to make them more robust and adaptable to different market conditions. It stands as a cornerstone in algorithmic trading, and one of its significant impacts lies in shaping risk management practices. Let us find out how.

Strategy Validation and Risk Assessment

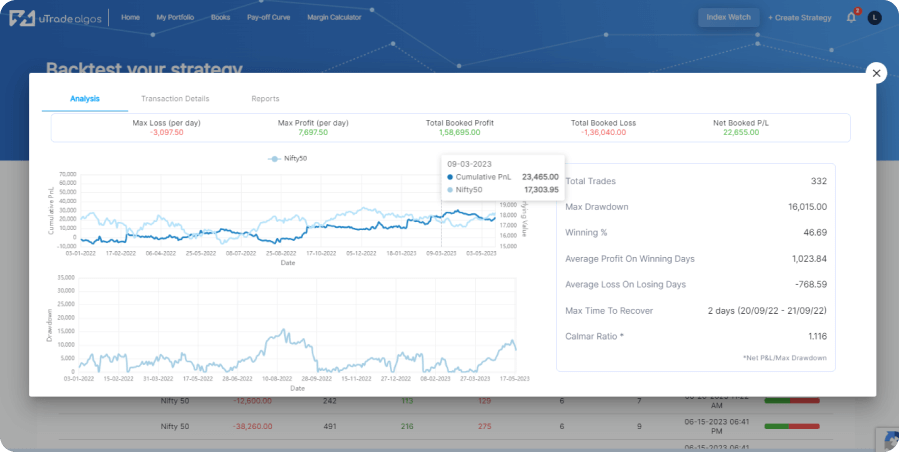

Backtesting allows traders to validate trading strategies by simulating them against historical market data. This process helps in quantifying risks associated with strategies, enabling traders to understand potential drawdowns, volatility, and the probability of losses under various market conditions.

For this, accurate historical data is needed. uTrade Algos is a platform that provides historical market information that has been meticulously curated and extensively vetted. By leveraging this, traders and analysts can make informed decisions, perform analysis, and conduct backtests with confidence.

Insights into Strategy Performance

- Quantifying Risks: Backtesting provides a quantitative assessment of risks associated with specific strategies. It helps in evaluating the maximum drawdowns (the peak-to-trough decline) a strategy might experience, highlighting potential losses during unfavourable market scenarios.

- Volatility Analysis: By subjecting strategies to historical data, traders can analyse the volatility experienced by the strategy. This includes assessing the standard deviation of returns, and offering insights into the strategy’s stability and the level of risk it might encounter.

- Probability of Losses: Backtesting helps in estimating the probability of incurring losses across different market conditions. Traders gain a clearer understanding of the likelihood of losses within specific risk parameters, aiding in the establishment of risk tolerance levels.

Risk Quantification and Management

- Understanding Risk Exposure: It allows traders to comprehend the extent of risk exposure associated with particular strategies. This insight is crucial in setting risk mitigation measures and determining the adequacy of potential risk-adjusted returns.

- Optimising Risk-Return Ratio: By identifying potential risks through algo backtesting, traders can optimise strategies to achieve a better risk-return balance. This might involve adjusting parameters or optimising stop-loss levels to minimise losses while maximising potential gains.

Identification of Weaknesses

By subjecting strategies to historical data, an algo backtest uncovers weaknesses or vulnerabilities. Traders can pinpoint scenarios where the strategy underperforms or faces excessive risk exposure. This identification aids in refining strategies to mitigate such weaknesses, bolstering risk management practices. These are some of the ways by which it is done:

- Parameter Sensitivity: Many trading strategies involve parameters, such as moving averages, indicators, or entry/exit rules. Backtesting platforms allow traders to adjust these parameters and observe how changes impact the strategy’s performance. Identifying sensitivity to parameter changes helps refine the strategy to make it more robust across various market conditions.

- Performance Measurement: Traders evaluate the strategy’s performance metrics during backtesting, such as returns, drawdowns, win rates, and risk-adjusted returns. These metrics help in identifying specific points where the strategy didn’t perform as expected or where the risk levels were too high compared to the returns generated.

Optimisation and Calibration

Algo backtesting facilitates strategy optimisation by adjusting parameters based on historical performance.

- This iterative process fine-tunes strategies to achieve a balance between risk and reward.

- The iterative nature encourages continuous improvement.

- Traders can calibrate strategies to exhibit more desirable risk-adjusted returns.

- They can also constantly adapt and enhance strategies based on backtesting results, further refining risk management protocols to adapt to evolving market conditions.

- At uTrade Algos, a backtesting platform, the process has been made user-friendly and streamlined, thus making it remarkably fast. The platform, hence, helps to generate detailed performance reports and uncover actionable insights through quick evaluations of trading strategies.

Setting Realistic Expectations

Through an algo backtest, traders develop a more realistic view of a strategy’s potential performance. By observing how strategies behaved historically, traders gain insight into their risk profile and can set more achievable profit targets and risk thresholds.

Scenario Analysis and Stress Testing

Backtesting allows traders to conduct scenario analysis and stress tests. By simulating extreme market conditions or unexpected events, traders can gauge how their strategies perform under adverse scenarios. This information aids in preparing for and managing risks during turbulent market periods.

In algorithmic trading, backtesting significantly contributes to risk management by validating, refining, and optimising strategies. There exists online algo trading platforms that offer backtesting. uTrade Algos, a specialised and proprietary backtesting engine, serves as a powerful tool, enabling you to harness and maximise the full potential inherent in your trading strategies. Through meticulous analysis and simulation of historical market data, the backtesting platform empowers you to thoroughly evaluate, refine, and optimise your trading approaches. Embracing the insights gleaned from backtesting helps traders to better manage risks and navigate the complexities of dynamic financial markets with confidence.

November 14, 2023

November 14, 2023