In trading, the validation and optimisation of strategies are pivotal for success. Backtesting, the process of testing a trading strategy using historical data, is a crucial step in this journey. While both algorithmic and manual testing methods have their merits, algo backtesting holds several advantages over manual testing. Let’s find out the specific benefits of utilising algorithmic backtesting for refining trading strategies.

Speed and Efficiency

- Algo backtesting excels in processing vast amounts of historical data swiftly.

- It conducts analysis, tests multiple strategies, and generates results at a significantly faster pace compared to manual methods.

- This rapid processing enables traders to iterate through various scenarios efficiently.

- uTrade Algos is a valuable algo backtesting platform that leverages accurate historical data to facilitate backtesting processes. The platform’s commitment to precision ensures the generation of comprehensive and accurate reports, providing traders with reliable insights into their strategies. By utilising this service, traders can make informed decisions and refine their trading strategies effectively.

- On the other hand, manual backtesting is time-consuming and labour-intensive, often requiring significant effort to go through historical data, execute trades, and record results manually. It lacks the speed and efficiency of automated methods, as it cannot process large datasets or simultaneously test multiple strategies across diverse market conditions within a short timeframe.

Precision and Consistency

- Algorithms execute backtests precisely according to predefined rules, ensuring consistent application across all tested scenarios.

- Automation in backtesting mitigates human errors that frequently occur during manual testing, ensuring a higher level of precision and accuracy in evaluating trading strategies.

- By removing human emotions from the testing process, it maintains a consistent and unemotional approach to assessing strategies, leading to more reliable results.

- This precision in eliminating human errors, emotions, and subjective biases contributes significantly to the objectivity and trustworthiness of the results obtained through automated backtesting.

- However, manual backtesting lacks consistency due to human emotions, varying interpretations, and potential inconsistencies in trade execution, resulting in unreliable evaluations of strategies over different testing periods.

Automation and Scalability

- These algorithms have the capability to assess trading strategies across a multitude of securities (stocks, bonds, commodities, etc.). They can simultaneously analyse the performance of a strategy when applied to different assets, providing insights into its effectiveness across various markets.

- Automated algorithms can test strategies across different timeframes such as intraday, daily, weekly, or monthly. This capability allows traders to understand how a strategy performs in different market conditions over varying durations, identifying strengths and weaknesses within different time intervals.

- These algorithms enable the simulation of trading strategies under different market conditions (bullish, bearish, volatile, stable). They can assess how a strategy behaves and performs across various market environments, providing valuable insights into its robustness and adaptability.

- One of the significant advantages of automated algorithms is their ability to perform these evaluations concurrently. This means they can test a strategy across multiple securities, timeframes, and market conditions at the same time, saving considerable time and allowing for a comprehensive analysis.

- Automated algorithms can handle large datasets and execute complex calculations swiftly, making them highly efficient for testing strategies across diverse parameters. They are scalable, enabling traders to assess numerous scenarios efficiently.

- Unlike automated methods, manual testing struggles to scale up for comprehensive evaluations across various securities, timeframes, and market environments simultaneously.

Comprehensive Data Analysis

- Systems that algo backtest can handle extensive datasets effectively.

- They can analyse minute details within historical data, capturing subtle market movements and behaviours that might go unnoticed in manual testing.

- By scrutinising fine details in historical data, automated algorithms offer insights into how a strategy reacts to and performs under specific market circumstances. This understanding is invaluable for traders as it helps in refining strategies to better respond to subtle market dynamics.

- Additionally, automated backtesting often provides detailed visual representations like payoff graphs. These graphs depict the profit and loss potential of a trading strategy across various price levels or timeframes. For example, on the uTrade Algos platform, you can generate payoff graphs to visualise and assess the influence of the underlying asset’s price movements on your strategy’s profit and loss.

- Payoff graphs, coupled with the minute-detail analysis from automated algorithms, offer traders a comprehensive decision-making tool. They help in evaluating not only the potential profitability of a strategy but also its associated risks, assisting traders in making informed decisions.

- Manual backtesting, though, often lacks the ability to comprehensively analyse large volumes of data efficiently, resulting in limited coverage of various market conditions, timeframes, and securities.

Risk Management and Strategy Optimisation

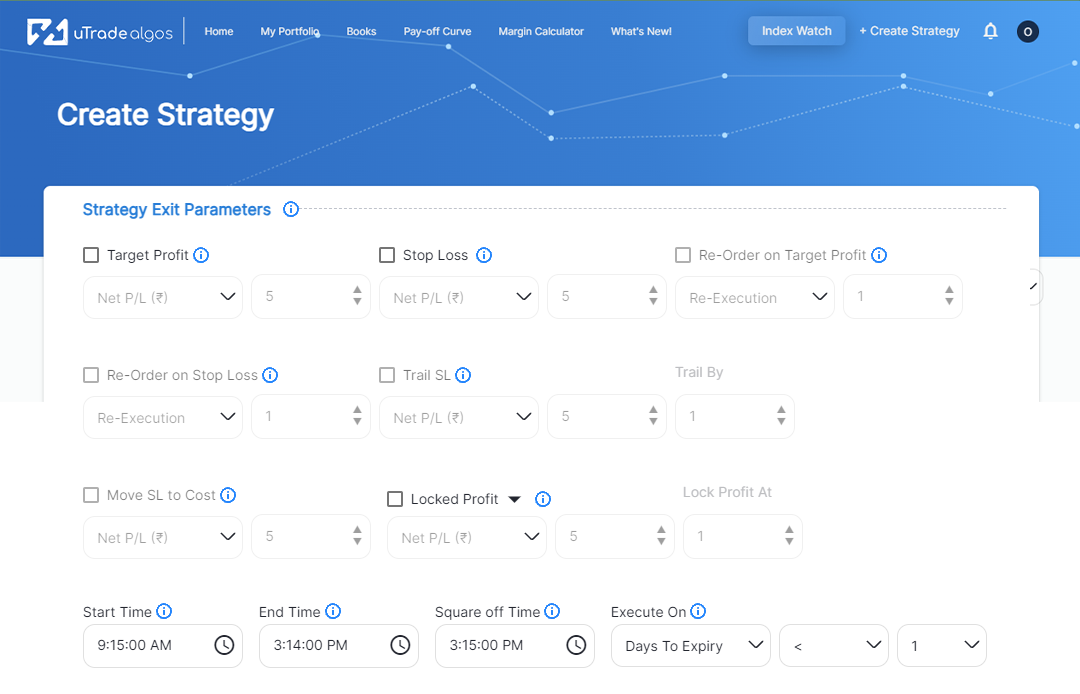

- Systems that algo backtest enable the incorporation of advanced risk management parameters into testing.

- Traders can fine-tune risk metrics, implement stop-loss orders, position sizing strategies, and optimise performance based on specific risk-adjusted return objectives, something more challenging to achieve manually.

- On the other hand, manual backtesting has limitations in swiftly exploring a wide range of parameters or variables for strategy optimisation. Also, human errors, subjective judgment, and limited computational abilities may lead to underestimating or overlooking potential risks associated with trading strategies.

Iterative Improvements and Strategy Refinement

- Algorithmic testing facilitates an iterative approach to strategy refinement.

- Traders can easily modify parameters, test different scenarios, and rapidly iterate strategies based on performance insights obtained from backtesting results.

- This iterative process allows for continual improvement and adaptation.

Statistical Analysis and Strategy Validation

- Algo backtesting platforms often offer robust statistical tools.

- These tools aid in a comprehensive assessment of strategy performance.

- They provide detailed statistical analyses, such as Sharpe ratios, maximum drawdowns, factor analysis, and other performance metrics critical for a deeper understanding of strategy viability.

- Manual backtesting, however, often lacks robust statistical analysis tools, leading to limited quantitative evaluation of strategies. This deficiency can result in incomplete insights into the strategy’s performance metrics, such as risk-adjusted returns, Sharpe ratio, or other statistical measures, hindering a comprehensive assessment.

Overall, algorithmic backtesting stands out for its ability to streamline and optimise strategy evaluation. Its capacity to process data swiftly, its objectivity, and its consistent approach make it an indispensable tool for traders seeking robust and reliable insights into their trading strategies in the dynamic and ever-evolving landscape of financial markets.

November 29, 2023

November 29, 2023