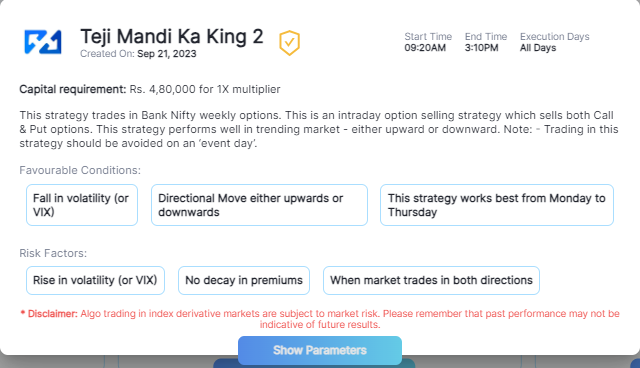

Teji Mandi Ka King 2

This strategy is also known as Intraday Directional Strangle within uTrade Originals, an intraday option selling strategy which sells both Call & Put options. This strategy performs well in trending markets – either upward or downward. It’s advised to avoid trading on designated event days.

Factor: Intraday Directional strangle

Margin required: Rs. 4,80,000 for 1X multiplier

Start Time: 09:20 AM

End Time: 3:10 PM

Execution Days: All days

Preferable Days: Monday to Thursday

Favorable Conditions:

- Fall in volatility (or VIX)

- Directional Move either

- upwards or downwards

Risk Factors:

- Rise in volatility (or VIX)

- No decay in premiums

- When market trades in both directions

Default Parameters:

- Logs: 0,1

- Net Loss: 9600

- Net Profit: NA

- Option Type: Sell Call (x3), Sell Put (x3)

- Order Fill Price: 7

- Order Lot Slice: 8

- Premium Price: 150

- Premium Range: 20

- Stop Loss for each leg: 25

- Strike Depth: 30

- Strike Diff: 20

- Symbol: BANK NIFTY

- Time Interval (sec): NA

This strategy trades in BANK NIFTY weekly options. This is an intraday option selling strategy which sells both Call & Put options. This strategy performs well in trending markets – either upward or downward.

Note: – Trading in this strategy should be avoided on an ‘event day’.