Algorithmic trading, a sophisticated method of executing trades based on pre-defined algorithms, demands a comprehensive set of tools for success. This article explores essential tools crucial for algorithmic traders to navigate financial markets effectively. Moreover, it delves into the characteristics of an algo trader, potential pitfalls to avoid, and the future landscape of algorithmic trading.

Who is an Algo Trader?

An algo trader is an individual or entity specialising in algo trading strategies. They employ technological tools and quantitative analysis to develop and deploy trading algorithms. Algo traders often possess expertise in programming languages, quantitative analysis, and financial markets to design algorithms that aim to generate profits from market movements.

Essential Tools Every Algorithmic Trader Needs

1. Robust Trading Platforms

Sophisticated trading platforms serve as the nucleus of algorithmic trading. These platforms, like uTrade Algos, offer a suite of advanced tools such as customisable charts, technical indicators, and order execution capabilities. Algorithmic trading programs also provide access to historical data and real-time market updates, crucial for developing and deploying algorithmic strategies.

2. Data Analytics Software

Data analytics tools are prized for their comprehensive data analysis capabilities. Algo platforms offer access to a vast array of financial data, news, and analytics, enabling traders to conduct in-depth research and make informed decisions. Additionally, specialised data feeds cater to traders seeking specific market insights for precise strategy development.

3. Programming Languages

Proficiency in programming languages like Python, R, or C++ has traditionally been crucial for algorithmic traders to efficiently code and implement their trading algorithms. However, contemporary platforms like uTrade Algos have democratised algo trading, allowing traders to engage in algo trading without requiring any coding knowledge. This accessibility has been instrumental, enabling individuals without programming skills to partake in and enjoy the benefits of algorithmic trading.

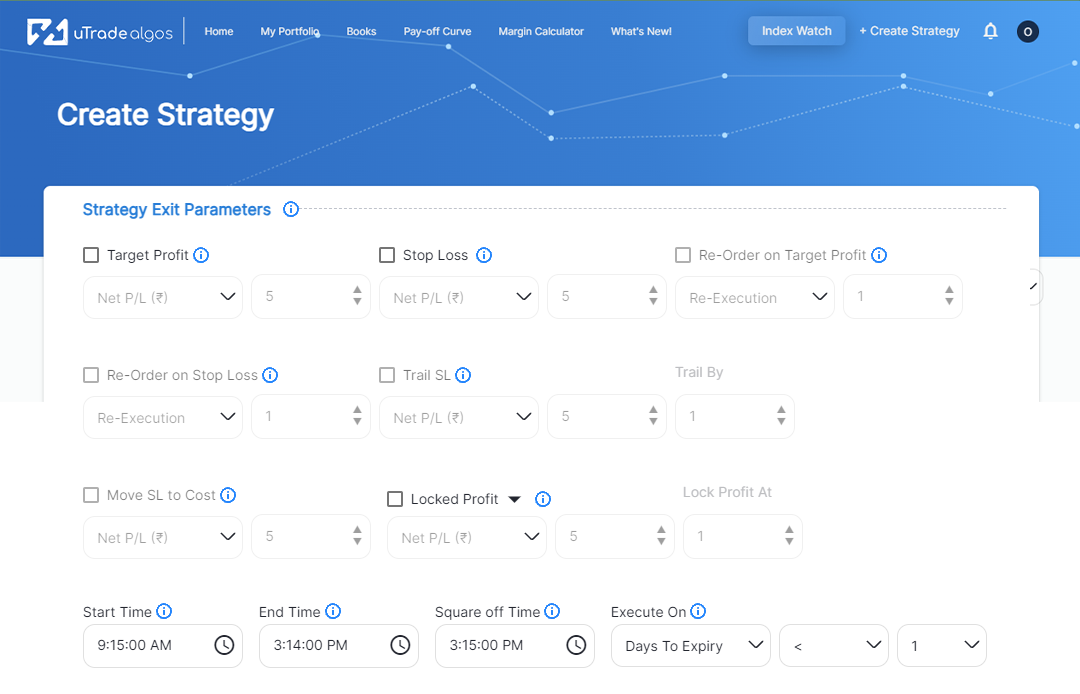

4. Risk Management Tools

- Effective risk management is a cornerstone of successful trading. Dedicated risk management tools equipped with position sizing calculators, scenario analysis, and risk assessment features to aid in mitigating potential losses.

- Additionally, uTrade Algos provides traders with intuitive payoff charts, a valuable tool for understanding the potential outcomes of their trading strategies. These charts offer a visual representation of the profit or loss a trader might incur at different price levels or under various market conditions. By customising these charts, traders can gain insights into how alterations in specific parameters might impact their potential trading outcomes.

- These tools assist traders in defining risk parameters and optimising position sizes, ensuring prudent risk management practices.

5. Backtesting Platforms

Backtesting platforms, like uTrade Algos, allow traders to simulate their strategies using historical market data. This simulation is vital for evaluating strategy performance, identifying strengths and weaknesses, and refining algorithms before deploying them in live markets. Robust backtesting platforms help traders make data-driven decisions and improve strategy effectiveness.

6. APIs and Connectivity Solutions

APIs and connectivity solutions are indispensable for accessing markets and data sources. Broker-provided APIs and data vendor integrations enable seamless connectivity, facilitating efficient trade execution and access to real-time market data. These connections ensure traders can swiftly execute trades based on their algorithms’ signals.

7. Performance Monitoring and Analysis Tools

Real-time performance monitoring tools play a crucial role in assessing strategy performance and identifying potential issues. These tools provide insights into execution speed, latency, and other critical metrics. Continuous monitoring and analysis aid traders in optimising strategies and adapting to changing market conditions for improved performance.

What Algo Traders Need to Be Cautious About

On algo trading platforms, traders should be cautious about potential technological glitches that could disrupt trading operations, ensure data quality and integrity for accurate decision-making, avoid over-optimisation of strategies that might not perform well in live markets, understand market liquidity dynamics, comply with regulatory standards, and considering the ethical implications of algorithmic trading.

Future of Algo Trading

The future of algorithmic trading is propelled by advancements in AI, machine learning, big data analytics, and blockchain technology. These innovations are expected to revolutionise trading strategies, risk management techniques, and trade execution processes. Increased adoption of these technologies will likely lead to more sophisticated and adaptive algorithmic trading programs, empowering traders to navigate dynamic market conditions more effectively.

The success of algo trading platforms hinges on the effective utilisation of these essential tools. By employing robust trading platforms, sophisticated data analysis tools, risk management solutions, backtesting platforms, APIs, and performance analysis tools, algorithmic traders can navigate the complexities of financial markets with greater efficiency and precision, enhancing their potential for successful trading outcomes.

January 4, 2024

January 4, 2024