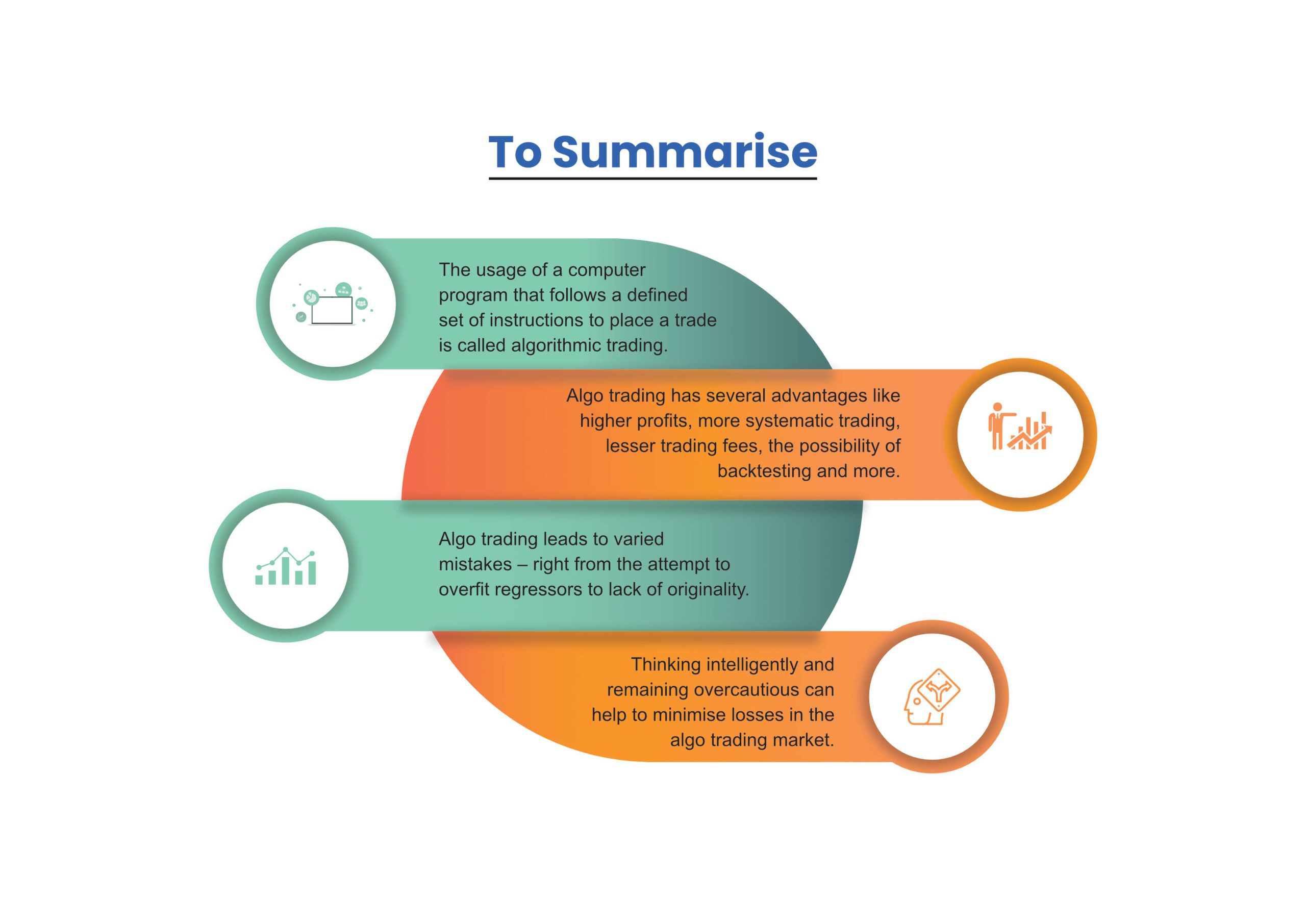

Algorithmic trading has many advantages, including high-profit opportunities, increased liquidity, removal of emotional bias, efficient trade execution, and the ability to trade multiple markets and assets efficiently. Additionally, it can be backtested using historical and real-time data to determine if a trading strategy is viable.

Welcome the new era of ‘velocity, scope, and systems impact’. In short, The Fourth Industrial Revolution (4IR).

The current breakthroughs in the fields of artificial intelligence, robotics, the Internet of Things, quantum computing and more have clearly stated that not only does the 4IR have exponential growth aspects but also that not a single field will remain unaffected. In this article, we will touch upon the convergence of financial markets with technology, i.e., algo trading, and the mistakes to avoid.

Defining Algorithmic Trading

An algorithm is a sequence of unambiguous instructions to obtain a required output, for any legitimate input, within a finite amount of time. When we use such a computer program, which follows a defined set of instructions to place a trade, it is called algorithmic trading.

Importance of Algorithmic Trading

So why does one need algorithmic trading? Here are a few reasons to consider.

- It has high-profit opportunities.

- It renders the market more liquid; hence, trading becomes more systematic.

- It rules out the impact of human emotions on trading activities.

- It can be used to trade in multiple markets and assets far more efficiently than a flesh-and-bones trader can hope.

- It ensures the most efficient execution of a trade, places orders instantaneously and may even lower trading fees.

- Trade order placement is instant and accurate (there is a high chance of execution at the desired levels). Trades are timed correctly and instantly to avoid significant price changes, thus promising low latency.

- There are simultaneous automated checks in multiple market conditions.

- Algo-trading can be backtested using available historical and real-time data to see if it is a viable trading strategy.

With so many perks, algorithmic trading becomes a no-brainer. After all, technology comes as a saviour. However, the story does not end here. Even technology has its restrictive zone. Let’s find out what the common mistakes are that are made during algorithmic trading and see how they can be rectified.

Mistakes in Algo-trading

Mistake #1: Designing Complex Algo Strategies

With human experience and technology in place, the various trading approaches can weave complexities since the two are likely to work in opposite directions. This will lead to innumerable lines of code and dozens of variables that need optimisation and tweaks. Amateur traders are likely to think that the more indicators that line up and the better the fit of their algorithm to past data, the better off the strategy is. This is not true in all cases, though. A complicated approach may give an investor a false sense of confidence, thus urging him to constantly think of adding indicators or another rule in the algorithm.

Investors often feel that complex strategies imply comprehensiveness. However, more often than not it is the simple approaches are usually the best. A clean chart with only one or two indicators, coupled with a thorough understanding of price action and market dynamics, is always better than a chart clouded with multiple lines and indicators.

uTrade Algos helps eliminate the coding necessity and enables you to customise your strategy and design it the way you deem fit.

Mistake #2: Fitting the Prices Using Regressors

Regressors are best used when there exists a correlation between the underlying factors of success or values. For example, predictions of a flat or house considering its surface. Nevertheless, there hardly exists a direct correlation between the stock, currency variables, and time values. Surprisingly, a lot of people support the method, but in my opinion, this is just like selling dreams to unaware people. If you are overfitting your regressors to price values, you may receive a satisfying fit curve, but a blessing-in-disguise concept scarcely works in the world of technology. If you are wise, you will know what you need to do.

Mistake #3: Ignorance of the Unexpected

When trading online, the unexpected can happen at any time. For example, unanticipated events can happen, servers can crash, internet connections might start fluctuating, or even the exchange as a whole can go awry. Hence, a trader needs to be aware of this and remain cautious. He should never risk more than the maximum loss that he is willing to lose and that his account can take. This is the only way he can remain prepared for such unpredictable eventualities.

Mistake #4: Lack of Originality

Markets are dynamic. As preferences change, the market exhibits changes as well. Hence, operating with a preconceived notion and being unwilling to adapt can lead to losses. Sometimes, originality is needed, and it is essential to make strategies that suit your risk appetite.

uTrade Algos has 20+ pre-made strategy forms developed by experts that can be tweaked to suit your needs. Whether you are a novice or an experienced trader, you can set your strategies in minutes.

Mistake #5: Overconfidence

Traders, sometimes, get ‘lucky’ in their algo trading ventures. The profit they earn is by fluke and not because of a well-thought strategy or analysis. This leads to overconfidence then they start to play around with the algorithms. This often exposes them to high risks. The key is to understand market scenarios and what worked and what may not have worked. It is easy to go off track when you start marking profits, so evaluation at every stage is critical.

Mistake #6: Lack of Testing

Testing your strategies is a great way to mitigate risks and understand possible areas of improvement. Going head-first into the market may mean you burn through money quicker than anticipated without having a chance to rectify your mistakes. uTrade Algos offers two great ways of testing your trading strategies without spending a single penny. The platform allows you to backtest with accurate historical data and algo forward testing in simulated market conditions to give you insights into how you may have performed.

It is important to recognise that algorithms can help in strategy development but should not be solely relied upon. They are designed to make data-driven decisions and provide analysis based on available data, but they require human insight at some stages. Ultimately, combining the power of algorithms with human insight can lead to more productive and profitable trading results.

Algorithmic trading is the use of computer programs to place trades automatically according to pre-set rules and instructions.

Algorithmic trading is important because it provides high-profit opportunities, makes the market more liquid, rules out the impact of human emotions on trading activities.

It ensures the most efficient execution of a trade, places orders instantaneously and may even lower trading fees, and can be backtested using historical and real-time data to see if it is a viable.

It is used to buy or sell securities, commodities, or currencies based on mathematical algorithms and technical analysis.

May 1, 2023

May 1, 2023