Financial markets have seen a significant transformation with the rise of algorithmic trading. Technology has played a crucial role in expanding this market, and this article explores its size, share, and growth drivers. From the integration of AI and machine learning to their influence on trading strategies, it provides insights into the dynamic world of algorithmic trading.

Market Overview of the Algo Market

The algorithmic trading market size is set to expand significantly, with an anticipated increase from USD 15.77 billion in 2023 to USD 23.74 billion by 2028. This growth trajectory reflects a robust Compound Annual Growth Rate (CAGR) of 8.53 percentper cent throughout the forecast period (2023-2028). TRADE’s January 2022 Algorithmic Trading Survey reveals intriguing insights into the adoption of algorithmic trading by hedge funds. The survey highlights the dependence on algorithms for trading portfolios, particularly emphasising multi-asset solutions. Various types of algorithms are employed, including single stock, VWAP, and dark liquidity-seeking algos. The survey’s findings also indicate a notable increase in automation and electronification, spurred by heightened market volatility and the demand for algorithmic trading solutions.

Driving Forces Behind Algorithmic Trading Industry

The rapid growth and evolution of the algorithmic trading industry can be attributed to a confluence of key driving factors.

Favourable Governmental Regulations

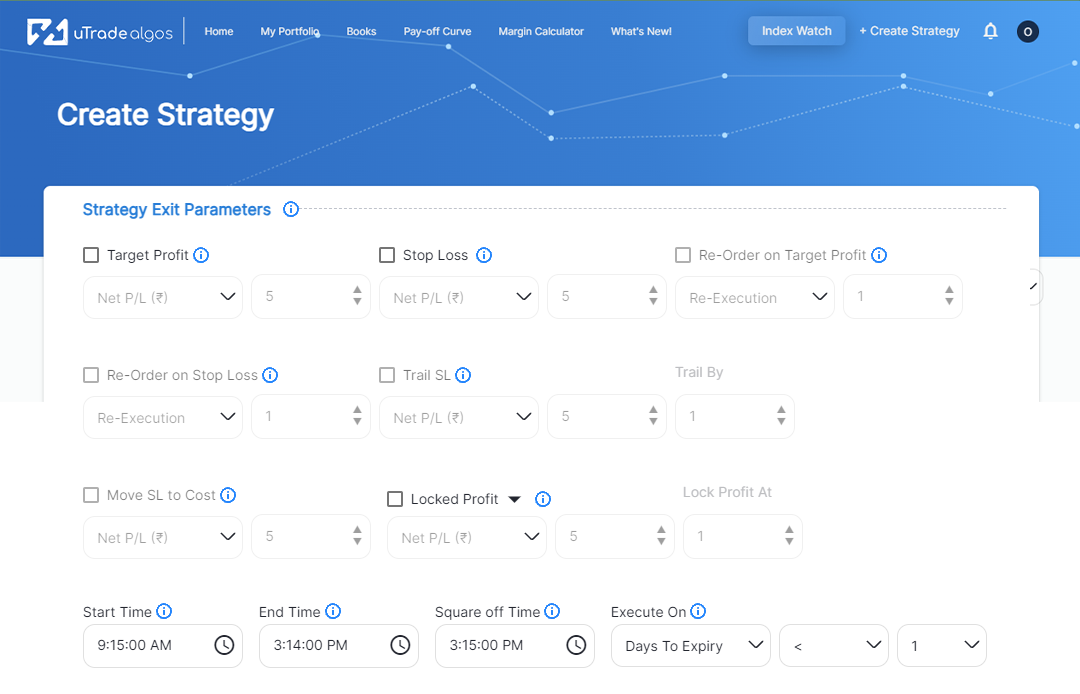

Algorithmic trading on platforms like uTrade Algos has gained traction due to regulatory frameworks that facilitate its implementation. Governments worldwide have recognised the potential benefits of algorithmic trading, including improved market liquidity, enhanced efficiency, and reduced price discrepancies. By establishing conducive regulatory environments, governments have encouraged market participants to explore algorithmic trading strategies, leading to the industry’s growth.

Escalating Demand for Efficient Order Execution

In today’s fast-paced financial markets, the speed and efficiency of order execution are paramount. Algorithmic trading enables traders to execute orders swiftly, leveraging pre-defined rules and algorithms. As the demand for near-instantaneous order execution increases, algorithmic trading provides a solution to capitalise on market opportunities promptly, and effectively.

Growing Need for Effective Market Surveillance

Market surveillance plays a crucial role in maintaining market integrity and preventing manipulation or unfair practices. Algorithmic trading’s automated nature allows for real-time monitoring of trading activities, identifying irregularities, and enforcing compliance with trading rules. The ability to monitor vast amounts of data and identify patterns quickly enhances market surveillance efforts, contributing to a transparent and trustworthy trading environment.

Reduction of Transaction Costs

Algorithmic trading has demonstrated its capability to reduce transaction costs associated with trading. By automating trade execution, minimising human intervention, and optimising order placement, algorithmic trading reduces slippage and minimises transaction costs. This cost-efficient approach attracts both institutional investors and retail traders seeking to enhance profitability by mitigating unnecessary expenses.

Increased Use of Technology in Financial Markets

Advancements in technology have transformed financial markets, and algorithmic trading is at the forefront of this transformation. High-speed internet connectivity, sophisticated trading platforms, and powerful computing capabilities have empowered traders to execute complex algorithmic strategies seamlessly. The integration of technology into trading practices has facilitated the growth of algorithmic trading as a mainstream approach.

Evolving Market Dynamics and Liquidity Needs

Market dynamics have evolved, and the need for liquidity has become paramount. Algorithmic trading strategies, such as market-making algorithms, contribute to maintaining market liquidity by efficiently matching buy and sell orders. As market participants seek efficient ways to provide and access liquidity, algorithmic trading has emerged as a vital tool.

Innovations in Artificial Intelligence (AI) and Machine Learning (ML)

The advancements in AI and ML have revolutionised algorithmic trading strategies. Machine learning algorithms can analyse vast datasets, identify patterns, and adapt trading strategies based on changing market conditions. AI-powered algorithms enhance decision-making processes, leading to more sophisticated and effective trading strategies.

Market Dynamics and the Pandemic: Accelerating Algorithmic Trading Adoption

The landscape of algorithmic trading has been significantly influenced by a combination of dynamic market conditions and the unprecedented global impact of the COVID-19 pandemic. These factors have synergistically driven the adoption and growth of algorithmic trading strategies.

Volatile Market Conditions and Trading Volumes

Volatile market conditions, characterised by rapid price fluctuations and heightened uncertainty, create an environment conducive to algorithmic trading strategies. Traders can capitalise on price movements and market opportunities within fractions of a second. Algorithmic trading algorithms, equipped to swiftly execute trades based on predefined rules, thrive in these conditions. The increase in trading volumes during such periods further amplifies the importance of algorithmic trading’s speed and precision.

Rapid Digital Transformation in Remote Working Environments

The shift towards remote working brought about by the pandemic necessitated rapid digital transformation across industries, including finance. Traders, working from home or remote locations, required efficient tools to execute trades seamlessly. Algorithmic trading, with its automated and algorithm-driven approach, offered a solution that aligned well with remote working environments. Traders could continue to execute strategies without being physically present on trading floors.

Pandemic-Driven Surge in Algorithmic Trading Adoption

The COVID-19 pandemic acted as a catalyst for the adoption of algorithmic trading. The need to ensure business continuity amid lockdowns and disruptions led financial institutions to explore digital alternatives. Algorithmic trading, with its ability to operate without human intervention, emerged as a valuable tool to maintain trading operations during volatile times. As a result, many market participants embraced algorithmic trading strategies to navigate through the pandemic’s challenges.

Positive Effect on the Algorithmic Trading Growth Rate

The pandemic’s impact on global financial markets was substantial, creating significant market movements and uncertainties. In response, traders sought tools that could help them make quick and informed decisions while minimising human errors. Algorithmic trading’s automated execution and ability to react swiftly to market changes became even more appealing. This positive correlation between market volatility and algorithmic trading adoption contributed to an accelerated growth rate for the sector.

Flexibility and Adaptability in Changing Market Conditions

Algorithmic trading algorithms are designed to adapt to changing market conditions, making them well-suited for volatile and unpredictable scenarios. As the pandemic-induced market dynamics evolved, algorithmic trading strategies could be fine-tuned and adjusted to align with new patterns and trends. This adaptability provided traders with a competitive edge in navigating the uncertainties posed by the pandemic.

Expanding Role of AI and ML in Algorithmic Trading

The pandemic underscored the importance of data-driven decision-making. Algorithmic trading, powered by artificial intelligence (AI) and machine learning (ML), demonstrated its ability to analyse vast amounts of data and generate insights. This enhanced predictive capability allowed traders to navigate the complex market environment created by the pandemic, further validating the role of AI and ML in algorithmic trading.

The confluence of volatile market conditions, substantial trading volumes, the imperative for remote digital transformation, and the COVID-19 pandemic’s impact has, indeed, accelerated the adoption of algorithmic trading strategies.

Algorithmic Trading Market Trends

Institutional Investors

Institutional investors wield significant influence in the algorithmic trading arena. These entities, encompassing pension funds, mutual fund families, insurance companies, and exchange-traded funds, leverage algorithmic trading to execute large orders efficiently. Algorithmic strategies tailored for high-frequency trading empower institutional investors to break down substantial trade sizes into manageable portions. This approach ensures adherence to predefined time frames and strategies, enabling them to optimise execution and minimise market impact.

Epicentre of Growth

Anticipated to emerge as a leader, North America is poised to claim a substantial market share. Key drivers include escalating investments in trading technologies, the proliferation of algorithmic trading suppliers, and robust government support for international trading. Notably, algorithmic trading accounts for a significant portion of US equity trading, reaching up to 73 per cent. The region’s tech prowess, exemplified by companies like Sentient Technologies, showcases its leading role in algorithmic trading innovation.

Technological Transformation and Democratisation

The fusion of technology and finance continues to redefine conventional investment models. Automation of trading procedures is at the heart of this transformation, ushering in a secure and accessible ecosystem for potential investors. Innovations like the Dex Finance ecosystem and Streak’s algorithmic trading application democratise advanced trading capabilities, enabling both newcomers and professionals to harness algorithmic strategies and seize trading opportunities.

Industry Landscape and Key Players

The algorithmic trading share analysis is marked by a moderately fragmented landscape, featuring players such as Virtu Financial Inc., Algo Trader AG, MetaQuotes Software Corp., and Refinitiv Ltd. These industry leaders constantly innovate, deploying AI and other technologies to provide cutting-edge solutions. Notably, PlatinX secured significant funding for its AI-based PTX Algo, a low-latency software enriching the digital assets ecosystem.

Strategic Collaborations for Enhancing Customer Experience

Strategic partnerships amplify the industry’s capabilities. For instance, Software AG partnered with Tractor Supply, enhancing the retail experience by integrating various channels. Such collaborations optimise operational excellence and improve customer experiences.

Focus on Digital Assets and Crypto Trading

The algorithmic trading market size is dynamically evolving to accommodate the burgeoning digital assets and crypto trading sector. Companies like AlgoTrader are raising substantial funds to drive unique digital asset growth strategies. Partnerships, such as Fernhill Corp.’s collaboration with MainBloq for smart order routing and automated algorithmic trading, reflect the industry’s commitment to enhancing trading performance in the realm of cryptocurrencies.

Market Concentration

The market’s landscape features a mix of major players, with companies like 63 Moons Technologies Limited, MetaQuotes Software Corp., Algo Trader AG, Refinitiv Ltd, and Virtu Financial Inc. holding prominent positions. Noteworthy news, such as MCX’s collaboration with 63 Moons Technologies and AlgoTrader’s pre-Series B funding, underscores the dynamic evolution of the algorithmic trading market.

Restraining Factors of Algorithmic Trading Market

- Regulatory Challenges: The algorithmic trading market faces constraints due to complex and evolving regulatory frameworks. Stringent regulations related to market manipulation, fair trading practices, and data privacy can pose hurdles for algorithmic trading strategies, requiring constant adaptation to comply with changing rules.

- Technological Dependencies: Algorithmic trading heavily relies on advanced technology infrastructure, including high-speed networks, servers, and data feeds. Any technical glitches, network failures, or cyberattacks can disrupt trading operations, leading to substantial losses and eroding investor confidence.

- Liquidity Concerns: While algorithmic trading can enhance market liquidity, it also faces challenges related to liquidity constraints during extreme market conditions. Algorithms may struggle to execute trades smoothly when market volatility surges, leading to increased slippage and potential losses.

- Over-Reliance on Models: Algorithmic trading strategies are often based on complex mathematical models and historical data analysis. Over-reliance on these models without considering real-time market dynamics and unexpected events can lead to poor trading decisions and losses.

- Systemic Risks: The interconnected nature of algorithmic trading systems can amplify systemic risks. A glitch or error in one algorithm can trigger a cascade of unintended consequences across the market, causing flash crashes or sudden market disruptions.

- Human Intervention Challenges: Algorithms can execute trades automatically, but they may require human intervention during unprecedented events or when algorithms encounter unfamiliar scenarios. The timely and appropriate human intervention is crucial to prevent potential losses.

- Market Manipulation: Algorithmic trading’s speed and volume can potentially be exploited for market manipulation, such as spoofing, layering, or front-running. Regulatory agencies closely monitor such activities, creating challenges for algorithmic traders to navigate the fine line between legitimate strategies and manipulation.

- Data Privacy and Security: Algorithmic trading involves handling large volumes of sensitive market data. Ensuring data privacy and security to prevent unauthorised access, data breaches, or information leakage is a significant concern for market participants.

- Complexity and Skill Gap: Developing and implementing successful algorithmic trading strategies requires expertise in finance, mathematics, and computer science. The complexity of building and managing algorithms can create a skill gap, limiting the adoption of algorithmic trading by smaller market participants.

- Market Fragmentation: Algorithmic trading can lead to market fragmentation, as various trading platforms and exchanges cater to different algorithms and trading strategies. This can potentially hinder price discovery and market efficiency.

- Unpredictable Market Events: Algorithmic trading models may not account for unprecedented market events, such as geopolitical crises, natural disasters, or black swan events. These events can disrupt normal market behaviour and impact algorithmic trading strategies.

Algo Trading in Different Markets

- Stock market captured maximum revenue share in 2022. Since big customers demand this, algorithms are gaining a lot of traction here. It has, also, become popular in the equity markets. For both, the high trading volumes, liquidity, and continuous tracking of the price movements make them conducive for algorithmic trading strategies to execute quickly and efficiently.

- Other than this, algorithmic trading has also gained popularity in other financial markets such as foreign exchange (forex), futures, options, and commodities. These markets offer unique characteristics and trading opportunities that can be exploited through algorithmic strategies tailored to their specific dynamics.

- Algorithmic trading is gaining attention in the cryptocurrency market due to factors like high volatility, 24/7 trading availability, liquidity, and the potential for arbitrage. Cryptocurrencies’ continuous trading, speed of execution, and opportunities for market making and statistical analysis make them suitable for algorithmic strategies. However, challenges such as regulatory uncertainties and technical complexities need to be considered.

Traders Who Would Benefit from Algo Trading

- High-Frequency Traders: These traders execute numerous trades rapidly, capitalising on small price discrepancies and market inefficiencies.

- Institutional Investors: Institutions dealing with large orders use algorithms for efficient trade execution, minimising market impact and achieving better prices.

- Market Makers: Market makers provide liquidity by quoting bid and ask prices; algorithms help them manage risk and profit from spreads.

- Quantitative Traders: These traders rely on data analysis and mathematical models; algorithms execute trades systematically based on predefined criteria.

- Arbitrageurs: Arbitrageurs exploit price differences between markets or assets; algorithms swiftly identify and capitalise on these opportunities.

- Retail Traders: Algorithms enable retail traders to automate strategies, ensuring disciplined execution without emotional biases.

- Risk Managers: Algorithmic trading aids risk managers in setting and enforcing risk limits and taking automated actions to mitigate losses.

- Multi-Asset Traders: Algorithms efficiently execute trades across various markets and instruments, catering to traders dealing with multiple asset classes.

- Volatility Traders: Traders focusing on volatility use algorithms to react to rapid price changes and execute trades during market fluctuations.

- Passive Investors: Algorithms help passive investors execute buy-and-hold trades, maintaining portfolio asset allocation over time.

The algorithmic trading market is experiencing remarkable growth, driven by a combination of technological advancements, increasing demand for efficient trading strategies, and the need to navigate complex financial markets. As investors and traders increasingly adopt algorithmic trading, the industry is poised for dynamic developments. However, while opportunities are abundant, careful attention must be paid to risk management and regulatory considerations to ensure the sustainable growth of this transformative market. If you are planning to enter the world of algorithmic trading, then give uTrade Algos a try!

September 21, 2023

September 21, 2023