In the dynamic landscape of financial markets, algorithmic trading has emerged as a cornerstone of modern trading practices, revolutionising the way transactions are executed. This article delves into the basics of algorithmic trading, unravelling its meaning, core concepts, and practical applications through illustrative examples. As technology continues to shape the financial world, understanding the basics of algorithmic trading becomes paramount for both seasoned traders and those new to the intricacies of this innovative approach.

What is Algorithmic Trading?

Algorithmic trading, known by various names such as automated trading, black-box trading, or algo trading, employs a computer program to execute trades based on predefined instructions or algorithms. Knowing the basics of algo trading can help a trader achieve profitability at a pace and frequency that surpasses human capacity. These instructions revolve around timing, price, quantity, or mathematical models. Beyond potential profits, it enhances market liquidity and introduces a systematic approach to trading by mitigating the influence of human emotions on trading decisions.

How Does Algorithmic Trading Work?

Algorithmic trading on online platforms like uTrade Algos operates through a well-defined sequence of actions that enable automated execution of trades:

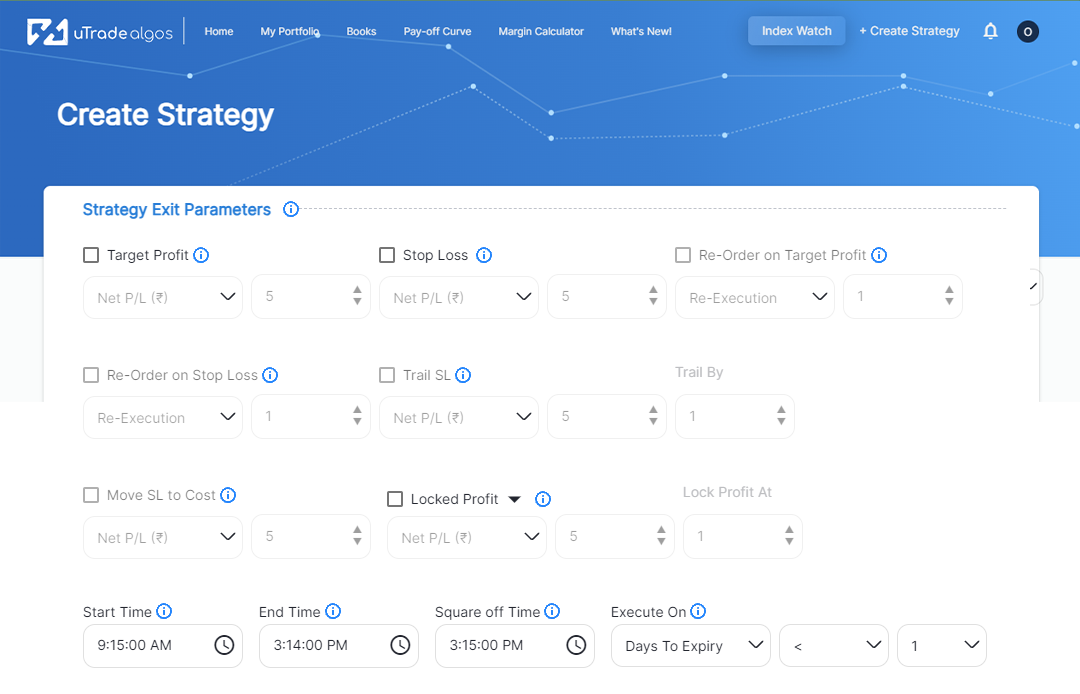

- Strategy Formulation: Traders or developers create trading strategies based on various factors such as technical indicators, market trends, and statistical models. These strategies define the conditions for initiating and closing trades.

- Algorithm Development: Programmers code the trading strategies into algorithms that are designed to process real-time market data, make decisions, and execute trades accordingly.

- Market Data Analysis: The algorithm continuously monitors and analyses market data, including price movements, trading volumes, and other relevant indicators. This real-time data forms the basis for making trading decisions.

- Signal Generation: Based on the predefined conditions and strategy rules, the algorithm generates buy or sell signals. These signals are triggered when specific market conditions are met.

- Order Placement: Once a signal is generated, the algorithm automatically places orders in the market. These orders specify the security to trade, the quantity, and the price range.

- Risk Management: Effective risk management rules are integrated into the algorithm. These rules determine the size of each trade, stop-loss levels, and overall portfolio exposure to manage potential losses.

- Trade Execution: When the market conditions align with the algorithm’s criteria, it executes the orders without manual intervention.

- Monitoring and Adjustment: If market dynamics change or trade outcomes deviate from expectations, the algorithm may adjust its strategy or risk parameters.

- Backtesting and Optimisation: Before deploying an algorithm in live markets, traders conduct backtesting using historical data to evaluate its performance. Optimisation may involve adjusting parameters for better results under different scenarios.

- Technological Infrastructure: Robust technological infrastructure is essential for efficient algorithmic trading. High-speed internet connections, low-latency trading platforms, and data feeds ensure timely execution of trades.

- Regulatory Compliance: Algorithms must comply with regulatory guidelines and market rules.

- Adaptation to Market Changes: Market conditions can change rapidly. Algorithmic strategies need to adapt to new market trends, news events, and economic data releases to remain effective.

Technical Prerequisites for Algorithmic Trading

Executing the algorithm through a computer program, accompanied by backtesting, completes the algorithmic trading process. The key lies in converting the identified strategy into an integrated digital process with trading account access for order placement. Thus, knowing the algo trading basics and its technical prerequisites is necessary for success.

- Proficiency in computer programming to code the desired trading strategy, employing skilled programmers, or utilising pre-existing trading software.

- Network connectivity and access to trading platforms to facilitate order execution.

- Availability of market data feeds, which the algorithm will analyse to identify order placement opportunities.

- Infrastructure for backtesting the system before deploying it to live markets, ensuring its effectiveness.

- Accessible historical data for backtesting based on the complexity of algorithm rules implemented.

- Having these technical components in place is crucial for seamlessly integrating algorithmic trading strategies into real-world trading scenarios.

An Example of Algorithmic Trading

Let us consider a trader in India who wants to implement an algo trading strategy based on moving averages for a specific stock.

- The trader’s strategy could be to buy the stock when its 50-day moving average crosses above its 200-day moving average, indicating a potential uptrend.

- Conversely, the trader might want to sell the stock when the 50-day moving average crosses below the 200-day moving average, suggesting a potential downtrend.

To put this strategy into action:

- The trader would first develop the algorithmic code that incorporates the moving average criteria.

- The algorithm would continually monitor the stock’s price data in real time.

- Once the 50-day moving average crosses above the 200-day moving average, the algorithm generates a buy signal.

- When the buy signal is generated, the algorithm automatically places a buy order for the stock in the market, adhering to the predefined conditions and risk management parameters.

- Similarly, when the 50-day moving average crosses below the 200-day moving average, the algorithm generates a sell signal, and a sell order is executed accordingly.

The key advantage of algo trading in this scenario is the speed at which the algorithm can detect and respond to market signals. This strategy eliminates the need for the trader to manually monitor the stock’s price movements and execute trades, which can be time-consuming and prone to human error.

Algo trading is widely used in India and around the world by various market participants, including institutional investors, hedge funds, and individual traders. It allows traders to execute trades efficiently, capitalise on market opportunities, and reduce the impact of emotions on trading decisions. However, it’s essential to note that while algo trading offers numerous benefits, it also comes with its own set of challenges and risks that traders need to manage effectively.

Pros and Cons of Algo Trading

Here’s a tabular representation of the pros and cons of algorithmic trading:

| Pros | Cons |

| 1. Speed and Efficiency: It executes trades swiftly, capitalising on market opportunities in real-time. | 1. Technical Failures: Glitches and software errors can lead to erroneous trades and financial losses. |

| 2. Reduced Emotional Bias: Algorithms eliminate emotional decision-making, reducing impulsive actions influenced by fear or greed. | 2. Over-Optimisation Risk: Strategies tailored to historical data might struggle in new market conditions. |

| 3. Precise Trade Execution: It adheres to predefined parameters, reducing the risk of manual execution errors. | 3. Lack of Human Judgement: Algorithms may struggle in rapidly changing markets without human intervention. |

| 4. Risk Management: Algorithms can incorporate risk management rules to control position sizes and potential losses. | 4. Market Manipulation Risks: High-frequency trading can potentially be exploited for market manipulation. |

| 5. Diversification: Algorithms can trade across multiple markets and instruments simultaneously, enhancing diversification. | 5. Regulatory Concerns: Algorithmic strategies may enter grey areas of market manipulation or unfair practices. |

| 6. Backtesting and Optimisation: Strategies can be tested and optimised using historical data to enhance performance. | 6. Data Dependency: Accurate and timely market data is essential for effective algorithmic trading. |

| 7. Reduced Transaction Costs: It can reduce costs by avoiding excessive spreads and slippage. | 7. High Initial Costs: Developing, testing, and maintaining algorithms can require significant upfront investment. |

| 8. Elimination of Manual Monitoring: Algorithms monitor markets 24/7, eliminating the need for constant human oversight. | 8. Black Swan Events: Algorithms may struggle to predict or respond to rare and extreme market events. |

| 9. Improved Order Placement: Algorithms can split and execute large orders efficiently to minimise market impact. | 9. Psychological Distance: Reduced human involvement can lead to a disconnect from trading decisions. |

| 10. Simultaneous Multitasking: Algorithms can manage multiple trades simultaneously, enhancing efficiency. | 10. Market Impact: High-frequency trading can create abrupt price movements and increased volatility. |

Algo Trading Time Scales

Algo trading operates across diverse time scales, influencing trading strategies and execution frequencies. Here are some common ones:

- High-Frequency Trading (HFT): Executing trades within milliseconds, HFT aims to capitalise on small market inefficiencies through rapid order placement and large volume trades.

- Mid- to Long-term Investors: These are those such as pension funds and mutual funds. They employ algo trading to buy stocks in substantial quantities without influencing stock prices.

- Short-term Trading: This time scale involves trades over minutes to hours, leveraging news events, technical indicators, or sentiment-driven price movements. These traders, market makers, and arbitrageurs benefit from automated execution, enhancing liquidity in the market.

- Swing Trading: Holding positions for days to weeks, swing traders capture price swings resulting from short-to-medium-term trends.

Algorithmic Trading Strategies

Algorithmic trading strategies are designed around profitable opportunities that enhance earnings or reduce costs. These strategies drive the automated decision-making process in algorithmic trading. Here are some common trading strategies employed:

- Trend-Following Strategies: These strategies track trends in moving averages, channel breakouts, price level movements, and technical indicators. They are straightforward to implement through algorithms, relying on identified trends rather than predictive analysis. For instance, using the 50- and 200-day moving averages as indicators is a prevalent trend-following strategy.

- Arbitrage Opportunities: Leveraging price differentials between markets, arbitrage strategies involve buying an asset at a lower price in one market and selling it at a higher price in another. Algorithmic trading efficiently identifies and captures these opportunities for risk-free profit.

- Index Fund Rebalancing: Algorithmic traders capitalise on the periodic rebalancing of index funds, exploiting expected trades that yield profits during the process. Efficient algorithmic systems execute these trades timely and at optimal prices.

- Mathematical Model-Based Strategies: Utilising proven mathematical models like delta-neutral strategies, traders engage in options and underlying security trading. Delta-neutral strategies manage positions with offsetting positive and negative deltas to maintain an overall delta of zero.

- Mean Reversion (Trading Range): This strategy assumes that asset prices revert to their mean value periodically. Algorithms define price ranges and execute trades automatically when assets break in and out of their designated range.

- Volume-Weighted Average Price (VWAP): Fragmenting large orders into smaller segments based on stock-specific historical volume profiles, this strategy aims to execute orders near the volume-weighted average price.

- Time Weighted Average Price (TWAP): Dividing large orders into smaller portions using evenly distributed time slots, this strategy executes trades close to the average price within the designated time frame.

- Percentage of Volume (POV): This algorithm continually sends partial orders based on the defined participation ratio and market volumes until the trade order completes.

- Implementation Shortfall: Focusing on minimising order execution costs, this strategy trades off real-time market conditions to save on order costs and capitalise on the opportunity cost of delayed execution.

- Specialised Algorithms: These algorithms, such as ‘sniffing algorithms’, aim to detect activities on the opposing side of trades. Used by sell-side market makers, they identify large order opportunities and adjust strategies accordingly.

Algorithmic trading revolutionised the trading landscape by leveraging computer programs to execute trades swiftly and systematically. It has eliminated human biases and enhanced trade execution precision. With the advancement of technology and the increasing adoption of algorithmic strategies by traders, this approach will continue to shape the future of financial markets, ushering in a new era of efficient and data-driven trading practices. So jump onto the bandwagon of algo trading and remember that we at uTrade Algos are always there to help you.

September 21, 2023

September 21, 2023