In the ever-evolving landscape of financial markets, algorithmic trading, or algo trading, has emerged as a game-changing phenomenon. This revolutionary approach to trading involves the use of computer algorithms on online platforms like uTrade Algos to execute trades at unprecedented speeds and efficiency. The advantages of algo trading are multifaceted and far-reaching, influencing market liquidity, risk management, and overall trading strategies. In this article, we will delve into the various advantages that algo trading brings to the table, exploring how it reshapes the dynamics of modern trading. From enhanced precision in trade execution to the potential for minimising emotional biases, we will uncover how algo trading is not just a technological advancement but a paradigm shift in the way financial markets operate.

Defining Algo Trading

Algo trading, black box trading, or automated trading, is a strategy that leverages computer programs to execute trades based on specific instructions. These instructions are grounded in factors like price, timing, quantity, and supporting mathematical models.

- With the rise in popularity, a substantial number of traders now engage in high-frequency trading within the market.

- One distinguishing characteristic of high-frequency trading is its capacity to place numerous orders across various markets.

- This is facilitated by its swift execution driven by preprogrammed instructions.

- In this trading framework, a computer programme is meticulously crafted to continuously monitor prices and execute orders once predetermined conditions are met. As a result, the need for manual intervention is significantly reduced, given that the trades are executed by the system rather than relying heavily on human input.

Requirements for Algo Trading

Algorithmic trading requires a combination of technical, financial, and operational components to develop and implement trading strategies effectively. Here are the key requirements for successful algo trading:

- Programming Skills: Proficiency in programming languages like Python, Java, C++, or R is essential for developing and coding trading algorithms. Strong coding skills enable traders to translate their strategies into functional software.

- Market Knowledge: In-depth understanding of financial markets, trading instruments, and market dynamics is crucial for creating effective trading strategies. This includes knowledge of different asset classes, market trends, and economic indicators.

- Data Analysis: Proficiency in analysing historical and real-time market data is vital. Data analysis skills help traders identify patterns, trends, and anomalies that form the basis for algorithmic strategies.

- Mathematical and Statistical Understanding: Algorithms often incorporate complex mathematical models and statistical techniques. A solid grasp of these concepts aids in designing algorithms that can identify opportunities and make informed trading decisions.

- Trading Strategy: A well-defined and thoroughly tested trading strategy is the foundation of algorithmic trading. Traders need a clear understanding of the strategy they want to automate, including entry and exit criteria, risk management rules, and performance metrics.

- Data Feeds: Access to accurate and timely market data feeds is essential. Reliable data sources provide the information required for algorithms to make informed trading decisions.

- Execution Platform: An execution platform or trading infrastructure is necessary to connect algorithms to the market. This can be a trading terminal, API (Application Programming Interface), or specialised trading platforms.

- Backtesting Tools: Backtesting allows traders to evaluate their strategies using historical data to assess performance under various market conditions. Backtesting tools help validate the viability of algorithms before deploying them in live markets.

- Risk Management: Implementing effective risk management measures is crucial to mitigate potential losses. Traders need to define position sizes, stop-loss levels, and risk limits within their algorithms.

- Network Infrastructure: A robust and reliable internet connection is essential for real-time data transmission and trade execution. Uninterrupted connectivity ensures that algorithms can react quickly to market changes.

- Monitoring and Maintenance: Continuous monitoring and maintenance of algorithms are necessary to ensure they are performing as intended. Regular updates may be needed to adapt to changing market conditions.

- Regulatory Compliance: Algo traders must comply with regulatory requirements and market rules. Understanding the legal framework and having mechanisms to ensure compliance is important.

- Capital: Adequate capital is needed to cover trading costs, margin requirements, and potential losses. Algo trading strategies may require significant initial investments.

- Psychological Discipline: While algo trading reduces emotional biases, traders still need the discipline to follow their strategies and avoid making impulsive decisions.

- Testing and Optimisation: Rigorous testing and optimisation are necessary to fine-tune algorithms for optimal performance. This involves refining parameters and settings based on historical and simulated data.

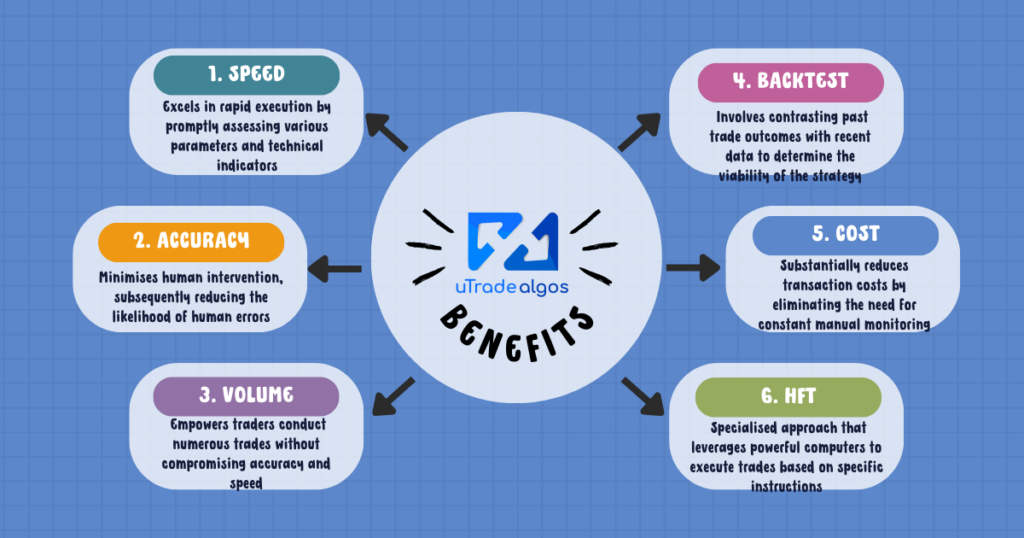

Benefits of Algo Trading

- Increased Speed: In trading, speed is paramount. Algorithmic trading excels in rapid execution by promptly assessing various parameters and technical indicators. This swiftness is crucial as algorithmic strategies capitalise on price fluctuations in securities, making timely execution a key factor for success.

- Increased Accuracy: By automating trading processes, algorithmic trading minimises human intervention, subsequently reducing the likelihood of human errors. Human traders might misinterpret technical indicators or analyse them incorrectly, but algorithmic trading operates based on predefined rules, avoiding such discrepancies.

- Capacity for Multiple Quick Trades: Algorithmic trading empowers traders to conduct numerous trades concurrently without compromising accuracy and speed. This capability enhances the potential for profit generation through the execution of multiple trades simultaneously.

- Back Test Capability: Recognising the importance of refining trading systems to prevent significant losses, algorithmic trading enables traders to back-test their strategies using historical data. This process involves contrasting past trade outcomes with recent data to determine the viability of the strategy under various market conditions.

- Lower Transaction Costs: Another one of the benefits of algo trading is that it substantially reduces transaction costs by eliminating the need for constant manual monitoring. The automated nature of algorithmic trading means that it supervises trading activities without constant human oversight. This saves both time and costs that would otherwise be required for continuous monitoring.

- High-Frequency Trading (HFT): Algorithmic trading encompasses HFT, a specialised approach that leverages powerful computers to execute trades based on specific instructions. These intricate algorithms enable lightning-fast transaction processing. HFT systems often boast high trading turnover rates, making them particularly attractive for users seeking rapid and frequent trades.

In essence, algorithmic trading revolutionises trading by providing speed, accuracy, and the ability to execute multiple trades simultaneously. It empowers traders with the means to refine strategies through back-testing, reduces transaction costs, and opens the door to high-frequency trading, driving trading efficiency to new heights.

Drawbacks of Algo Trading

While algorithmic trading offers remarkable advantages, it comes with notable drawbacks and should be considered by traders before they embark on this journey.

- Technical Vulnerabilities: Glitches and failures in complex software can lead to erroneous trades.

- Over-Optimisation Risks: Algorithms tailored to historical data might struggle in new market conditions.

- Lack of Human Judgement: Algorithms may fail in rapidly changing markets without human intervention.

- Market Impact: High-frequency trading can cause price volatility and liquidity issues.

- Data Dependency: Reliance on accurate market data is crucial; delays can lead to losses.

- Initial Costs: Developing and maintaining algorithms can be costly.

- Black Swan Events: Algorithms may struggle to handle rare and extreme market events.

Traders Who Benefit from Algo Trading

Algorithmic trading caters to a wide spectrum of trading styles and investment goals. It empowers traders and entities to execute trades with efficiency, precision, and speed, regardless of their trading horizons or strategies.

- Mid to Long-Term Investors: Algorithmic trading can be advantageous for mid to long-term investors who seek to capitalise on market trends and execute large trades efficiently over an extended period. Automated execution based on predefined criteria can help optimise entry and exit points.

- Buy-Side Firms: Entities like pension funds, mutual funds, and insurance companies benefit from algorithmic trading by efficiently managing and rebalancing their portfolios. This approach allows them to maintain desired asset allocations and execute trades while minimising market impact.

- Short-Term Traders: For traders seeking rapid gains over shorter time frames, algorithmic trading provides an edge by quickly identifying and capitalising on fleeting market opportunities. High-frequency trading strategies, often employed by day traders, benefit from the speed and precision of algo trading.

- Brokerage Houses: Brokerage firms use algorithmic trading to facilitate efficient order execution for their clients. This improves client satisfaction by reducing execution costs and achieving optimal prices.

- Trend-Following Traders: Traders who base their strategies on market trends and technical analysis find algorithmic trading highly beneficial. Automated algorithms can swiftly identify and act on trend reversals and momentum shifts.

- Hedge Funds: Hedge funds employ algorithmic trading to manage risk and generate alpha. These funds use intricate algorithms to spot arbitrage opportunities, identify market inefficiencies, and implement complex trading strategies.

- Pairs Traders: Pairs trading involves identifying correlated instruments and capitalising on deviations from their historical price relationships. Algorithmic trading aids pairs traders by executing simultaneous buy and sell orders swiftly when the price spread widens or narrows.

Popular Algo Strategies

Algorithmic trading employs diverse strategies for various trading and investment purposes. Some of the commonly used algorithmic trading strategies are outlined:

- Trend Following: This popular strategy leverages trends such as moving averages to execute straightforward trades without needing price predictions.

- Index Fund Rebalancing: Algorithmic traders capitalise on expected trades during index fund rebalancing, aiming for profits of 25-75 basis points.

- Mathematical Model Based: This strategy combines options and underlying security, often using delta-neutral portfolio strategies.

- Mean Reversion: Focusing on asset price mean values, this strategy identifies temporary highs and lows, aiming to profit as prices revert to their averages.

- Volume-Weighted Average Price (VWAP): Algorithmic traders break large orders into smaller chunks using historical volume profiles to execute trades near the VWAP.

- Time-Weighted Average Price (TWAP): Similar to VWAP, this strategy splits large orders into smaller portions, executing trades near the average price within a time frame.

- Percentage of Volume (POV): This strategy involves sending partial orders based on defined participation ratios and traded volume.

- Momentum Strategy: Traders capitalise on short-term uptrends by buying during value increases and selling when prices start to decline.

- Mean Reversion Strategy: Based on the principle that extreme price movements tend to revert to average levels, this strategy captures profits as prices normalise.

- Sentiment-Based Strategy: This approach fills market positions based on bullish or bearish sentiment, capitalising on market optimism or pessimism.

Algorithmic trading via online platforms like uTrade Algos presents a paradigm shift in finance, offering rapid execution, heightened accuracy, and simultaneous multitasking. Its advantages, including back-testing, cost reduction, and risk management, underline its transformative potential. As it adapts and advances, algorithmic trading remains a pivotal tool in modern trading strategies, promising a data-driven and efficient future for traders and investors.

September 21, 2023

September 21, 2023