In financial markets, two primary methods of trading stand out: algorithmic trading and manual trading. Each approach has its set of advantages and disadvantages, appealing to different types of traders based on their preferences, expertise, and goals. Read on to know more about the pros and cons of both algorithmic trading software and manual trading, allowing traders to make informed decisions about which method aligns best with their objectives.

Algorithmic Trading Software

Pros

1. Speed and Efficiency

- Execution Speed: Algorithms operate at incredibly high speeds, swiftly executing trades based on predefined conditions. This swift action minimises delays, significantly enhancing overall efficiency in trading operations.

- Emotion Elimination: By following pre-set parameters, algorithms remove emotional biases inherent in manual trading. This absence of emotions ensures a consistent execution strategy, unaffected by human sentiments, leading to more reliable decision-making.

2. Backtesting and Optimisation

- Historical Data Analysis: Algorithms can be backtested using historical data, allowing traders to optimise strategies and fine-tune parameters for better performance. For example, uTrade Algos is a platform designed for users to thoroughly backtest their strategies using reliable historical data, enabling the generation of comprehensive reports that are both reliable and accurate.

- Complex Strategies: Ability to implement complex strategies involving multiple parameters, indicators, and variables for precise decision-making.

3. Automation and Consistency

- Automation: Trading occurs automatically based on predefined criteria, eliminating the need for constant monitoring and allowing for 24/7 trading. As an example, uTrade Algos has introduced uTrade Originals, pre-built trading algorithms, crafted by seasoned industry experts. These strategies, born from extensive research, cater to various market conditions, safeguarding your capital from inflation’s impact.

- Precision in Execution: Algorithms execute trades with unwavering consistency, strictly adhering to the defined trading strategy without deviations or inconsistencies.

- Discipline in Trading: By following pre-programmed rules rigorously, algorithms maintain a disciplined approach to trading, avoiding impulsive decisions or deviations from the established strategy. This consistency ensures reliability and stability in trading outcomes over time.

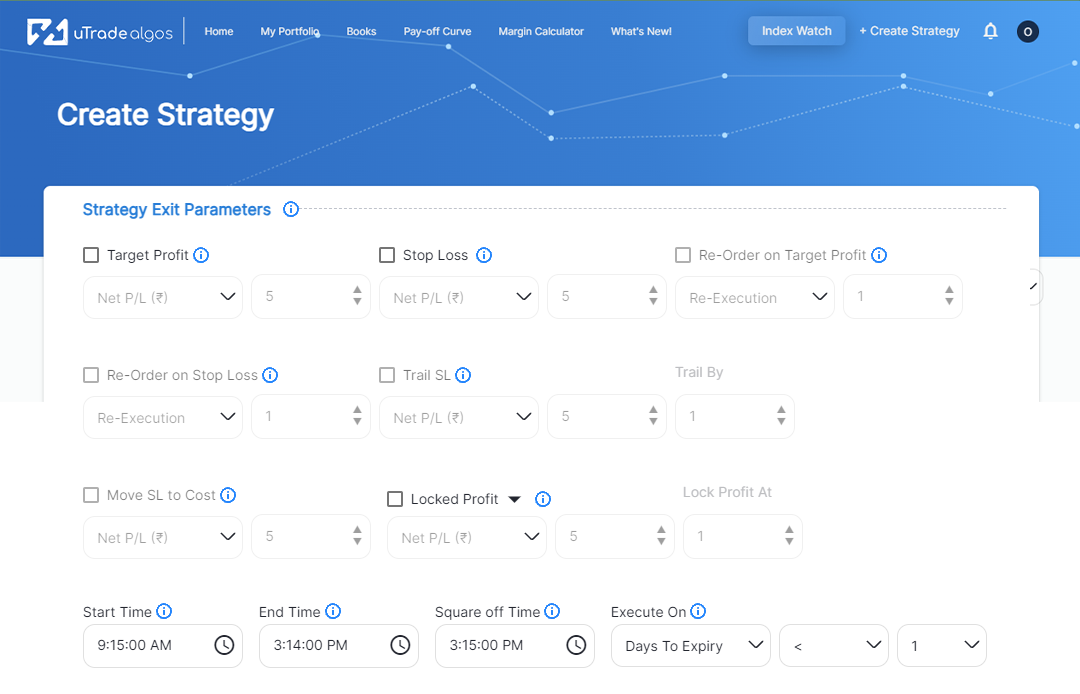

4. Risk Management

Algo trading integrates advanced risk management techniques better than manual trading.

- Real-time Monitoring and Instantaneous Execution: Automated algo trading systems continuously monitor market conditions and can instantly execute predefined risk management strategies without hesitation. This rapid response to market changes reduces exposure to potential risks.

- Diversification and Portfolio Allocation: Algo trading can efficiently diversify across various assets or markets while effectively allocating positions based on predefined risk tolerance levels. This diversification spreads risk, minimising the impact of adverse movements in any single asset or market.

- Adaptive Risk Controls: Some advanced algo trading systems include adaptive risk controls that dynamically adjust risk parameters based on market volatility or specific predefined conditions. This adaptive nature helps in mitigating risks during turbulent market phases.

- Automated Stops and Limits: Algo trading systems can automatically place stop-loss orders and profit-taking limits as part of risk management strategies. This automated approach ensures the timely execution of risk mitigation actions without the need for manual intervention.

Cons

1. Technical Knowledge Requirement

- Programming Skills: Developing algorithms requires proficiency in programming languages and quantitative analysis, which might be a barrier for some traders. This said, for algo trading in India, platforms such as uTrade Algos feature no-code algorithms, enabling users without coding knowledge to utilise them effectively. This accessibility benefits a wide range of people who wish to engage in trading strategies without the requirement of coding expertise.

- Continuous Monitoring: Despite automation, algorithms need regular monitoring for potential glitches or market changes that might require adjustments.

2. Over-Optimisation and Data Dependence

- Over-optimisation Concerns: Excessive fine-tuning of strategies using historical data might result in overfitting. This phenomenon occurs when an algorithm performs exceptionally well in historical data but struggles in live markets due to its narrow focus on past trends.

- Market Dynamics Variability: Relying solely on historical data might overlook unforeseen market events or rapid shifts in dynamics. This data dependency poses a risk as markets can evolve differently from past patterns, potentially impacting the algorithm’s effectiveness in real-time trading scenarios.

3. Higher Costs

- Technology and Software: Algo trading requires specialised software, often necessitating significant initial investment. Traders may need to purchase or license algorithmic trading platforms, data feeds, and sometimes proprietary software for strategy development.

- Programming Expertise: Developing algorithms demands skilled programmers proficient in coding languages like Python, C++, or specialised platforms like MetaTrader. Hiring or acquiring these skills can add to the development costs.

- Historical Data Access: High-quality historical market data is crucial for backtesting and optimising algorithms. Acquiring this data from reliable sources might involve subscription fees or one-time purchases, adding to the overall expenses. When it comes to algo trading in India, on the algo trading platform, uTrade Algos, you can start your algo trading free of cost for 15 days.

- Algorithm Updates: Markets evolve, requiring continuous refinement and updates to trading algorithms. Maintenance involves monitoring algorithm performance, making necessary adjustments, and updating strategies to adapt to changing market conditions. This ongoing maintenance incurs additional costs in terms of time, effort, and sometimes hiring experts.

- Hardware and Connectivity: Operating algo trading systems may require robust hardware setups, including servers, high-speed internet connections, and backup systems for uninterrupted operation. These infrastructure costs contribute to the overall expenses.

Manual Trading

Pros

1. Flexibility and Adaptability

- Human Judgement: Traders possess the ability to swiftly adapt to changing market conditions based on intuition, breaking news, and fundamental analysis, factors that algorithms may not always consider.

- Diverse Strategies: Manual traders can employ a wide array of trading strategies on the fly, adjusting their approach based on the current market situation and dynamics.

2. Emotional Intelligence and Intuition

- Emotional Control: Skilled manual traders can exercise emotional discipline, avoiding impulsive decisions driven by emotions like fear or greed, a trait not inherently present in automated algo trading systems.

- Intuitive Insights: Human traders have the capacity to perceive nuanced market shifts and make intuitive judgments that automated systems might overlook due to their reliance on predefined algorithms.

Cons

1. Emotion-Driven Decisions

- Emotional Biases: Human emotions, such as fear or greed, can significantly impact trading decisions, leading to inconsistencies and errors.

- Fatigue and Burnout: Manual trading can be mentally exhausting, leading to fatigue and impaired decision-making over extended periods.

2. Time-Intensiveness and Subjectivity

- Time Constraints: Constant monitoring of markets can be time-consuming, especially for day traders, limiting the ability to focus on other aspects of life.

- Subjectivity: Interpretation of market signals and data can vary among traders, leading to subjective analysis and inconsistent results.

Algo Trading or Manual Trading? Which Method Suits Your Goals Best?

When deciding between these two methods, consider these steps for a thoughtful decision:

Understanding the Differences

Differentiating between both is crucial. Algo trading automatically analyses the market using predefined rules, while manual trading involves personal analysis and trade execution.

Consider Your Trading Style

Your approach plays a pivotal role. If you favour a hands-off strategy and aim to minimise emotional biases, Algo trading might suit you. Conversely, if you enjoy market analysis and making informed decisions, manual trading could be a better fit.

Assess Your Skills

Trading demands various skills like market analysis and decision-making. Evaluate your strengths and weaknesses in these areas to align with the trading method that suits you better.

Evaluate Your Resources

Algo trading requires technical expertise and specialised software, whereas manual trading needs less technical know-how but more time and effort. Assess your resources, including time, money, and technical skills, to determine feasibility.

Test Both Methods

Before a final decision, experiment with both methods using small investments. This real-time testing helps assess which method aligns better with your profitability goals.

Both algorithmic trading software and manual trading offer unique advantages and drawbacks. The choice between the two often depends on individual preferences, skill sets, and trading objectives. Some traders may opt for a hybrid approach, combining the strengths of both methods. Ultimately, understanding the pros and cons of each approach is crucial for traders to make informed decisions aligned with their trading goals and personal preferences.

November 26, 2023

November 26, 2023