In the dynamic and fast-paced world of financial markets, traders are constantly seeking an edge that can give them a competitive advantage. Algorithmic trading, or algo trading, has become increasingly popular as it offers a way to automate trading strategies and execute orders at a speed and precision that human traders find challenging to match. However, the road to successful algorithmic trading is not without its challenges. To increase the likelihood of profitable trading, algo traders turn to a powerful tool in their arsenal: backtesting. Read on to know how algo backtesting can significantly improve your algo trading strategies.

Understanding Algo Backtesting

Backtesting is the process of evaluating a trading strategy using historical data to assess its performance under various market conditions. By simulating past trading scenarios, traders can gain valuable insights into how their strategies would have fared, helping them fine-tune their approaches and make more informed decisions in real-time trading. The process typically involves the following steps:

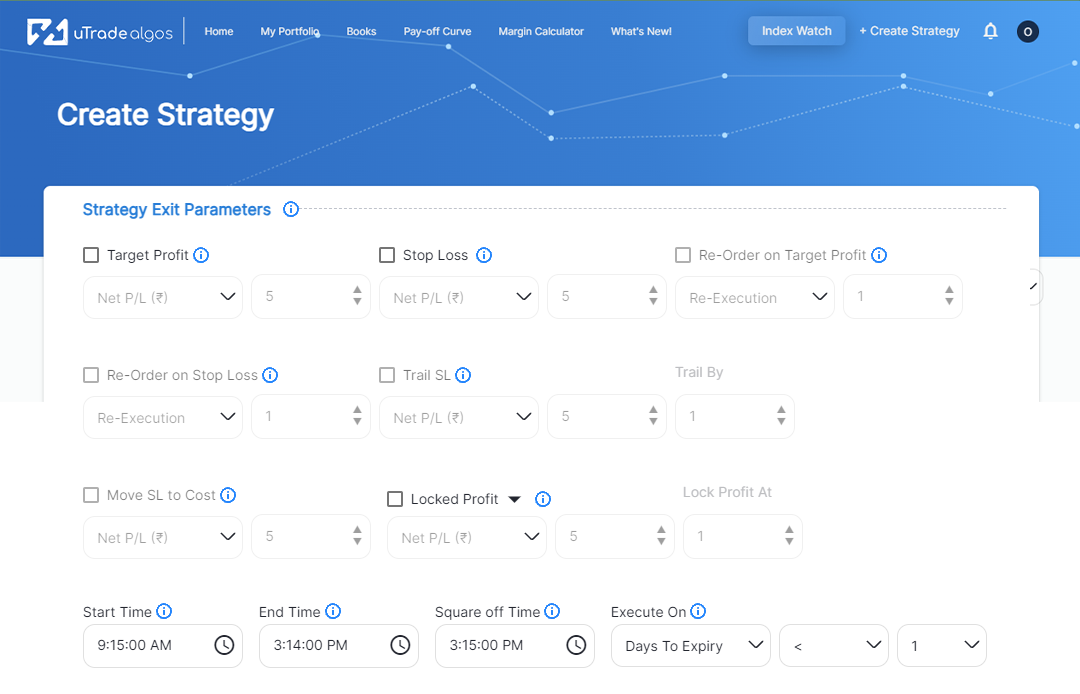

- Strategy Formulation: Algo traders create a set of rules and conditions that define their trading strategy. This may include entry and exit criteria, risk management parameters, position sizing rules, and any technical indicators or patterns to be used.

- Historical Data Selection: To backtest a strategy, traders need historical data for the assets they plan to trade. This data can include price, volume, and other relevant information. The quality and completeness of historical data are critical for accurate strategy backtesting. This is where backtesting on platforms like uTrade Algos becomes beneficial as they provide accurate historical data.

- Simulation: Traders simulate the execution of their strategy using historical data. This involves applying the strategy’s rules to past market conditions, determining when trades would have been entered and exited, and calculating the resulting profits or losses.

- Performance Analysis: After the simulation, traders analyse the results to evaluate the strategy’s performance. Key metrics, such as the total return on investment (ROI), maximum drawdown (the largest peak-to-trough decline), and risk-adjusted returns, are considered to assess the strategy’s profitability and risk.

- Refinement: Based on the performance analysis, traders may refine their strategies by adjusting parameters and rules or even changing the entire approach. The goal is to optimise the strategy for better future performance.

How Algo Backtesting Improves Trading Strategies

Performance Assessment

Algo backtesting allows traders to thoroughly assess a trading strategy’s historical performance. It provides a quantitative, data-driven evaluation of how the strategy would have fared in different market conditions. By analysing key performance metrics such as total return on investment (ROI), average return, maximum drawdown, and risk-adjusted returns, traders can gauge the strategy’s profitability and risk exposure.

Risk Management

Effective and comprehensive risk management is crucial for long-term trading success. Algo backtesting on platforms like uTrade Algos assists in fine-tuning risk management parameters, such as setting stop-loss and take-profit levels. By simulating various market scenarios, traders can determine the optimal risk-reward ratios for their strategies. Backtesting helps in identifying potential vulnerabilities and ensuring that risk control measures are aligned with the strategy’s objectives.

Strategy Optimisation

Backtesting trading strategies provide a controlled environment to test and optimise strategies. Through a series of iterations, traders can refine their strategies, tweaking parameters, rules, and conditions to improve performance. The goal is to identify weaknesses and enhance strengths, ultimately resulting in a more robust and profitable strategy. It serves as a critical tool in the continuous improvement of trading approaches.

Confidence Building

Algo backtesting results instil confidence in traders by providing empirical evidence of a strategy’s historical success. The knowledge that a strategy has performed well under various market conditions can boost a trader’s confidence in executing it with discipline and conviction. This confidence is particularly valuable during challenging market phases, as traders are more likely to stick to their strategies.

Scenario Testing

Traders can use backtesting to conduct scenario-based testing. This involves evaluating how a strategy would have performed in specific historical scenarios or events, such as market crashes, economic releases, or geopolitical crises. Scenario testing helps traders assess a strategy’s resilience and adaptability to different types of market turbulence.

Strategy Diversification

Algo backtesting allows traders to evaluate and optimise multiple strategies. By conducting backtests on various strategies and combinations, traders can explore portfolio diversification opportunities. Diversification helps reduce risk and enhance the stability of overall trading performance. Backtesting serves as a tool to identify complementary strategies and allocate capital effectively. For example, uTrade Algos has introduced uTrade Originals, a curated collection of pre-built algorithms meticulously crafted by seasoned industry professionals to enhance trading. These strategies are designed to protect the trader’s capital from the effects of inflation across various market conditions.

Precision Timing and Stress Reduction

Algorithmic trading eliminates the need to time trades perfectly, relieving investors from the stress and anxiety associated with manual trading. These systems execute trades at the optimal moments, reducing the risk involved in decision-making. Moreover, algo trading can fragment a large trade into smaller parts, a task too time-consuming for individuals. Embracing algorithmic trading not only reduces stress but also minimises risks while saving valuable time, ultimately leading to improved trading performance. This precision timing can be especially advantageous in volatile markets where split-second decisions matter.

Multi-Market and Asset-Class Opportunities

Algo trading systems excel at monitoring and executing trades across various markets, sectors, or asset classes with exceptional precision. This multi-market approach enhances diversification and allows traders to capitalise on multiple sources of potential profit, mitigating the risks associated with overexposure to a single market.

Emotion-Free Trading

Algo trading is inherently devoid of emotional influences, as it operates based on predefined rules and algorithms. By eliminating emotional biases, traders can adhere to their strategies consistently, avoiding impulsive or emotionally driven actions. This disciplined and rational approach to decision-making can significantly improve trading performance over time. Emotional trading is often fraught with erratic decision-making and inconsistent results, making algorithmic trading an attractive alternative.

Challenges and Considerations in Algo Backtesting

Overfitting

Overfitting occurs when a strategy is excessively optimised for past data, resulting in a good fit to historical information but poor performance in real-time trading. Traders should exercise caution when adjusting strategy parameters based solely on backtest results. It’s essential to strike a balance between historical performance and real-world adaptability to avoid overfitting.

Market Assumptions

Backtesting relies on certain assumptions that may not hold in real trading. For instance, it assumes accurate fills at desired prices and may not account for liquidity issues. Traders should be aware of these assumptions and exercise prudence when applying backtest results to live trading.

Limited Forward-Looking Information

Backtesting is unable to predict or account for future market events. Unexpected news, black swan events, or sudden market shifts can impact trading outcomes. Traders should acknowledge that while a well-performing strategy is valuable, it may still face challenges in unforeseen circumstances.

Data Quality

The quality of historical data used for backtesting is critical. Inaccurate or incomplete data can lead to unreliable backtest results. Traders should ensure that the data used is trustworthy, representative of actual market conditions, and properly adjusted for splits, dividends, and other corporate actions.

Transaction Costs

Backtesting often neglects transaction costs, such as commissions, spreads, and slippage, which can impact real trading performance. To address this, traders should factor in transaction costs when designing and assessing backtesting trading strategies, ensuring that they accurately reflect the true cost of executing trades.

Best Practices for Algo Backtesting

Use High-Quality Data

Ensure the historical data used for backtesting is accurate, clean, and comprehensive. High-quality data should cover a relevant time period, include various market conditions, and be sourced from reputable data providers.

Avoid Over-Optimisation

Resist the temptation to over-optimise algo trading strategies based solely on historical data. Over-optimisation can lead to strategies that perform well historically but fail to deliver in real-time trading due to overly specific settings.

Incorporate Transaction Costs

Account for transaction costs, including commissions and spreads, when conducting backtests. This ensures that the results align with real trading conditions and reflect the true cost of executing trades.

Consider Slippage

Slippage, the difference between the expected price and the actual executed price can affect the outcome of trades. It’s important to factor in slippage when conducting backtests to simulate real-world trading conditions accurately.

Use Out-of-Sample Testing

Divide historical data into in-sample and out-of-sample periods. The in-sample data is used for strategy development, while the out-of-sample data is reserved for validation. This approach helps assess a strategy’s ability to perform well with unseen data, reducing the risk of overfitting.

Maintain Realistic Expectations

Understand that backtesting provides historical insights but does not guarantee future success. Real trading involves uncertainties and market dynamics that can’t be entirely captured in backtests. Maintain realistic expectations and be prepared for variations in live trading results.

Algo backtesting is a powerful tool that can significantly improve trading strategies. It empowers traders to make data-driven decisions and enhance their chances of success in the dynamic world of algorithmic trading. However, traders should be aware of its limitations and challenges and adhere to best practices to ensure the accuracy and reliability of backtesting results.

November 5, 2023

November 5, 2023