In algorithmic trading, the visual representation offered by payoff graphs plays a pivotal role in guiding decision-making processes. These graphs present a clear picture of potential profit and loss scenarios based on various trade strategies and market conditions. Let’s explore how payoff graphs aid decision-making in algorithmic trading.

Visual Representation of Trade Strategies

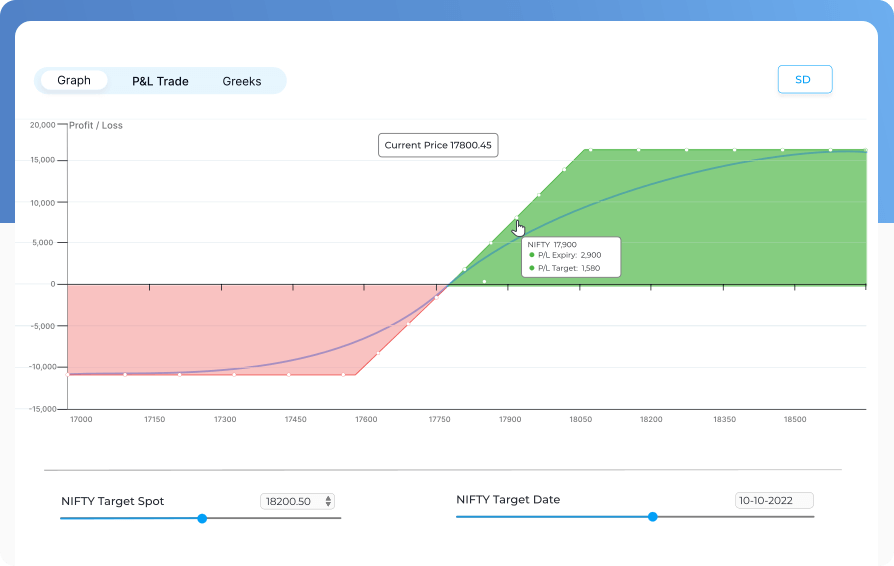

- Payoff graphs serve as visual representations, offering a comprehensive view of potential profit or loss scenarios for diverse trade strategies.

- Traders swiftly grasp the intricacies of different strategies by observing the graph’s shape and trajectory, aiding in understanding risk-reward profiles and identifying breakeven points.

Assessment of Risk-Reward Ratios

- By observing payoff graphs, traders evaluate the risk-reward ratios inherent in different strategies.

- This evaluation involves visually analysing how the profit curve and the loss curve interact across the range of underlying asset prices. By assessing these curves on the graph, traders can gauge the potential rewards against the associated risks for different strategies, determining if the expected rewards outweigh the assumed risks and thereby making informed decisions about strategy selection.

- The graphs vividly display the trade-off between potential risks and rewards, aiding traders in selecting strategies that strike a favourable balance.

- A clear visualisation of this ratio assists in identifying strategies that offer more substantial potential rewards in relation to the assumed risks.

- On uTrade Algos, you can experience the simplicity of crafting intricate strategies effortlessly. You can visualise your strategy’s risk-reward ratios through graphs, thus enabling you to anticipate outcomes and gain a competitive edge in the market.

Breakeven Analysis

- Breakeven points on a payoff graph are represented as specific points where the profit or loss curve intersects the x-axis (horizontal axis). At these points, the strategy neither yields a profit nor incurs a loss upon the underlying asset’s price reaching that level at expiration.

- Visually, on the graph, this intersection indicates the price levels at which the strategy breaks even, showing where the profit or loss becomes zero.

- Analysing these points helps traders identify the price movement required for the strategy to become profitable, allowing them to set realistic expectations and make informed decisions about trade entry and exit.

Sensitivity to Variables

- Option payoff graphs are responsive to alterations in underlying variables such as volatility, time decay in options, and changes in the underlying asset’s price.

- Higher volatility can affect the potential range of asset prices at expiration. Increased volatility often widens the profit or loss range displayed on the graph, impacting the graph’s curvature and potentially enlarging or altering the position of the profit and loss zones.

- Time decay, also known as theta, influences the value of options contracts as they approach expiration. This decay affects the options’ profitability, reflected in the payoff graph. As time passes, the value of options diminishes, altering the graph’s positioning by shifting the profit and loss zones.

- Any fluctuations in the underlying asset’s price directly affect the profit or loss outcomes at expiration. These changes modify the overall shape, slope, and positioning of the graph, showcasing varying profit or loss levels at different asset price points.

- Traders observe how changes in these factors influence the graph’s shape and positioning, enabling them to anticipate necessary adjustments in their trading strategies according to market dynamics.

Maximum Profit and Loss Analysis

- Assessing the maximum potential profit and loss exhibited on payoff graphs aids traders in setting achievable profit targets and understanding their risk exposure.

- By identifying the maximum potential profit displayed on the graph, traders can establish realistic profit targets. Understanding this upper limit helps in setting achievable and rational profit objectives for the trade.

- On the other hand, assessing the maximum potential loss demonstrated on the graph offers insights into the worst-case scenario for the trade. It provides a clear understanding of the risks associated with the strategy. This insight aids traders in managing risk by implementing appropriate risk management techniques and setting predefined stop-loss levels to limit potential losses.

- These extremes, thus, help in implementing appropriate risk management techniques, guiding traders in refining their strategies to optimise performance while managing potential losses.

- Within the uTrade Algos platform, users have the capability to perform a comprehensive analysis of profit and loss without the necessity of coding. This user-friendly environment allows traders to evaluate and understand the financial implications of their strategies, enabling informed decision-making and strategy refinement without requiring programming expertise.

Multi-Strategy Comparison

- Payoff graphs enable traders to compare multiple strategies simultaneously.

- Each strategy’s profit and loss outcomes are depicted as distinct lines or curves on the same graph, showcasing how each strategy performs across various underlying asset prices at expiration.

- Having multiple strategies on one graph provides a clear visual comparison of their potential outcomes.

- Traders can analyse and contrast different strategies’ risk-reward profiles, breakeven points, maximum potential profit and loss, and overall sensitivity to market variables, all in one visual representation.

- This comparative analysis aids traders in selecting the most suitable strategy based on their risk tolerance, profit objectives, and the desired balance between risk and reward.

- This comparative analysis, hence, offers a comprehensive view of each strategy’s profit and loss scenarios, aiding traders in selecting the most suitable approach based on their risk tolerance and profitability objectives.

- At uTrade Algos, payoff curves across various strategies can be merged, presenting a panoramic perspective of potential profit and loss scenarios. This comprehensive amalgamation offers traders a holistic view, enabling them to gauge the combined impact of multiple strategies on profit and loss outcomes.

Customisation and Scenario Analysis

- Traders can customise payoff graphs to conduct scenario analysis by adjusting variables or combining multiple strategies.

- This customisation facilitates predictions of potential outcomes under various market conditions, empowering traders to make well-informed decisions based on specific scenarios and optimise their strategies accordingly.

Payoff graphs are indispensable tools for algo trading, offering invaluable insights into potential trade outcomes and risk assessment. Their visual nature simplifies complex strategies, allowing traders to make informed decisions and optimise their trading strategies for success in dynamic market environments. Understanding and leveraging these graphs are essential for informed and effective decision-making in algorithmic trading.

November 20, 2023

November 20, 2023