In financial markets, futures trading, be it algorithmic trading, on platforms like uTrade Algos, or manual, stands as a cornerstone of speculation and risk management. It is a complex yet vital component that drives global economies and provides opportunities for traders and investors alike. In this comprehensive guide, we will delve into the depths of futures trading, unravelling its intricacies, purposes, mechanics, and the role it plays in the financial world.

Why Risk Management Can Make or Break Algo Trading Strategies

In algorithmic trading, the importance of risk management cannot be overstated. Algo strategies, while offering speed and precision, are inherently intertwined with risks. Understanding and effectively managing these risks is paramount as it determines the success or failure of such strategies. Here, we explore the pivotal role of risk management in shaping the fate of algo trading strategies.

Advantages of Algo Backtesting Over Manual Testing

In trading, the validation and optimisation of strategies are pivotal for success. Backtesting, the process of testing a trading strategy using historical data, is a crucial step in this journey. While both algorithmic and manual testing methods have their merits, algo backtesting holds several advantages over manual testing. Let's find out the specific benefits of utilising algorithmic backtesting for refining trading strategies.

Analysing the Performance of Algorithmic Trading Strategies: A Comprehensive Guide

Algorithmic trading introduces potential risks due to automated processes, magnifying market exposure. Regularly evaluating your algo trading strategies becomes pivotal to mitigate risks and maintain performance standards amidst market volatility. Active tracking allows for identifying and rectifying minor discrepancies before they escalate into significant losses, aligning strategies with prevailing market trends. But how can you effectively evaluate algo trading strategies? By employing performance metrics. Let us find out more.

The Role of Algorithmic Trading in Diversifying Investment Portfolios

In the world of finance, achieving a diversified investment portfolio is a well-acknowledged strategy for minimising risk and enhancing potential returns. Over time, the emergence of algorithmic trading has significantly transformed the landscape of portfolio diversification. Let us find out about the critical role played by algorithmic trading in effectively diversifying investment portfolios, exploring its benefits, strategies, and considerations.

Comparing Algo Trading Software Vs. Manual Trading: Pros and Cons

In financial markets, two primary methods of trading stand out: algorithmic trading and manual trading. Each approach has its set of advantages and disadvantages, appealing to different types of traders based on their preferences, expertise, and goals. Read on to know more about the pros and cons of both algorithmic trading software and manual trading, allowing traders to make informed decisions about which method aligns best with their objectives.

Quantitative Trading Vs Algorithmic Trading

Interested in trading? Chances are you've encountered the terms quantitative trading and algorithmic trading. But what exactly do they involve, and how do they differ? Let's find out more.

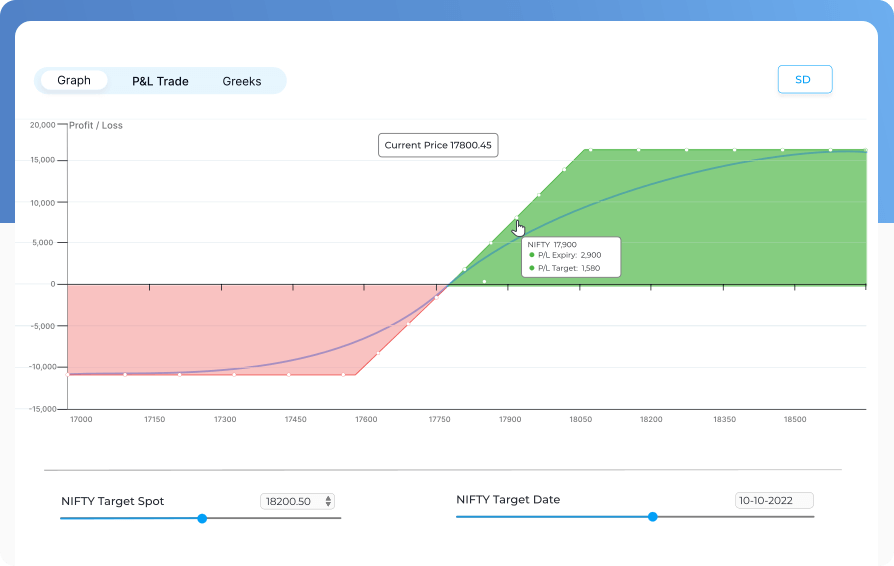

How Do Payoff Graphs Help in Decision-Making in Algorithmic Trading

In algorithmic trading, the visual representation offered by payoff graphs plays a pivotal role in guiding decision-making processes. These graphs present a clear picture of potential profit and loss scenarios based on various trade strategies and market conditions. Let's explore how payoff graphs aid decision-making in algorithmic trading.

7 Key Differences Between Underlying and Instrument in Algorithmic Trading

Algorithmic trading has revolutionised financial markets, employing sophisticated strategies to execute trades automatically. Central to this are two fundamental concepts: underlying and instrument. While often used interchangeably, these terms encapsulate distinct elements crucial for traders and investors navigating the complexities of automated algo trading. Read on to find out what the seven key differences between underlying and instrument are.

Top 7 Key Elements of Effective Payoff Graph Analysis for Algo Traders

In the dynamic world of algorithmic trading, mastering the art of analysing payoff graphs is crucial for making informed decisions. A payoff graph, also known as a profit and loss diagram, provides a visual representation of potential profit or loss outcomes for various trading strategies. Algo traders utilise these graphs to evaluate risk, understand trade scenarios, and optimise their strategies. Read on to learn the top seven key elements to consider for effective payoff graph analysis in algorithmic trading.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.