In the intricate landscape of call and put option trading via algorithmic trading, on platforms like uTrade Algos, the decision to choose between put and call options holds substantial significance. Puts and calls, the fundamental building blocks of options trading, provide traders with versatile strategies to navigate and capitalise on market movements. However, making informed choices between these options requires a comprehensive understanding of various factors. Read on if you are wondering which to choose.

How Do Margin Calculators Work in Algorithmic Trading

Margin calculators in algorithmic trading function by precisely determining the capital required to initiate positions and manage risks effectively. These tools assess leverage, asset volatility, and market conditions to calculate margin requirements accurately. By inputting specific parameters such as asset type and position size, traders can anticipate potential losses and optimise capital utilisation. Margin calculators enable traders to make informed decisions, assess risk exposure, and determine the ideal position size. uTrade Algos has an in-built easy-to-use calculator to help you with this and more.

The Impact of Backtesting on Risk Management in Algorithmic Trading

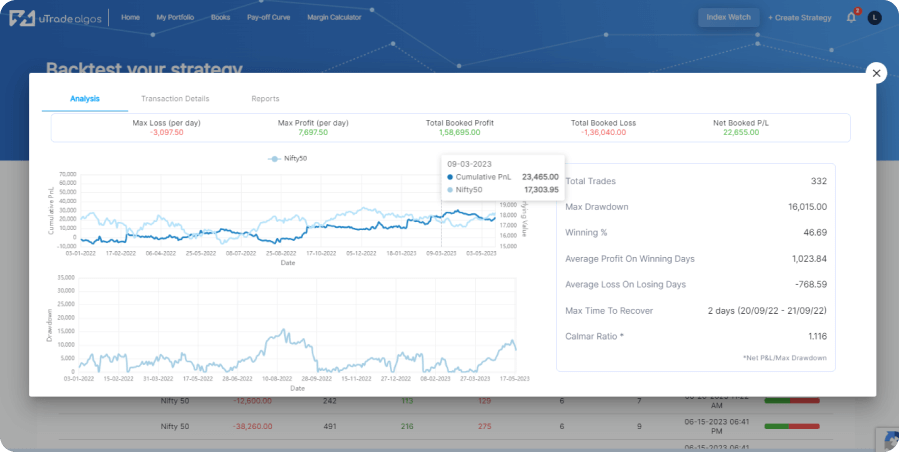

Backtesting is a method used in finance to evaluate the effectiveness of a trading strategy by applying it to historical market data. It involves simulating trades using past market conditions to assess how a strategy would have performed. Traders analyse metrics like returns, drawdowns, and risk exposure to identify the strategy's strengths and weaknesses. This process aids in refining and optimising trading strategies to make them more robust and adaptable to different market conditions. It stands as a cornerstone in algorithmic trading, and one of its significant impacts lies in shaping risk management practices. Let us find out how.

The Ultimate Guide: Understanding OI-Based Strategies in Algo Trading

Algorithmic trading, often referred to as algo trading, has revolutionised the financial markets. It involves the use of computer programs to execute trading strategies automatically. Among the various factors considered in algo trading, open interest (OI) stands out as a key metric used by traders to understand market sentiment and make informed decisions. Let us find out how it forms the basis of strategies in algo trading.

Top 7 Reasons Why Algo Traders Need an Integrated Margin Calculator

In algorithmic trading, the need for an integrated margin calculator stands as a critical component for traders navigating the complexities of financial markets. Integrated margin calculators serve as indispensable tools, offering precision and insight into risk assessment, position sizing, and effective risk management within automated trading systems. Here are the top seven reasons why these calculators are paramount for algo traders seeking to optimise strategies and make informed decisions in the dynamic landscape of financial trading.

How to Identify Market Trends for Effective Directional Trading Strategies

In the world of finance and trading, success often hinges on the ability to accurately identify market trends. Understanding market trends is crucial for directional trading strategies, allowing traders to make informed decisions and capitalise on profitable opportunities. In this guide, we will delve into the methodologies, tools, and techniques essential for identifying market trends to create effective directional trading strategies.

Mastering Algo Trading Without Coding: 7 Expert Tips

Algorithmic trading, often referred to as algo trading, is a powerful approach to trading that leverages automated strategies to make decisions and execute trades. While traditional algo trading often involves complex coding and programming skills, there is now algo trading without coding for traders to harness the benefits of algorithmic trading without having to write a single line of code. Whether you're a seasoned trader or a newcomer to the world of algorithmic trading, these tips will help you navigate this exciting and dynamic field.

How to Optimise Your Algorithmic Trading Strategies on a Platform

Algorithmic trading has transformed the world of finance, allowing traders to automate their strategies, increase efficiency, and potentially enhance profits. With the right approach, algorithmic trading can be a powerful tool in navigating the dynamic and often volatile financial markets. However, to harness its full potential, it's essential to optimise your algorithmic trading programs.

How to Backtest Your Trading Strategies for Success

Quantifying risk and return is essential for efficient trading. At the heart of this process lies backtesting, a method used to analyse a trading strategy's historical performance and predict its future potential. Unlike hasty, random trading tips, backtesting trading strategies offer a systematic, data-driven approach to trading strategy development. Read on to learn more about how to effectively backtest a trading strategy for success.

Basics of Algorithmic Trading: Concepts and Examples

Algorithmic trading, often referred to as algo trading, has revolutionised the world of financial markets. This approach to trading involves the use of computer programs and automated systems to execute trading strategies. Algorithmic trading leverages technology, quantitative analysis, and complex algorithms to make split-second trading decisions. In this comprehensive guide, we'll delve into the fundamentals of algorithmic trading and its key concepts and provide real-world examples to illustrate its impact on today's financial landscape.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

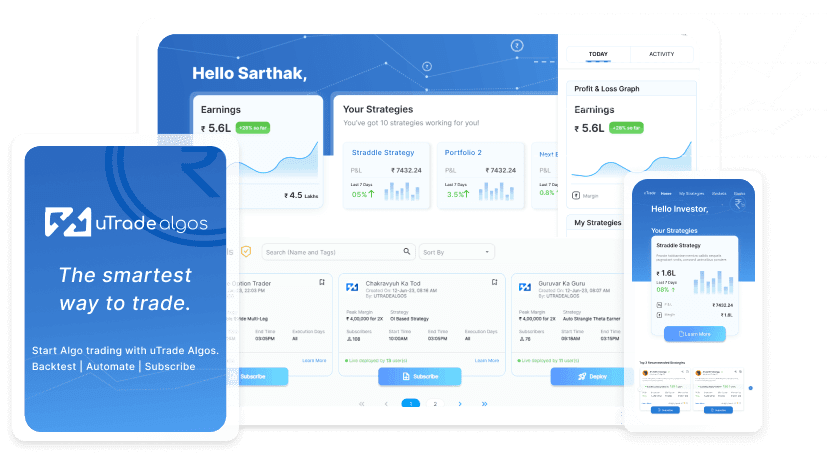

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.