In recent years, algorithmic trading has emerged as a compelling option for retail investors, transforming the landscape of how individuals participate in financial markets. Read on to learn the reasons behind the escalating popularity of the algorithmic trading program among retail investors and explore the advantages that have propelled its rise.

How to Get Started with Algo Trading: A Step-by-Step Guide

Algorithmic trading, often referred to as algo trading, is a powerful and automated approach to trading that has gained significant popularity in recent years. It enables traders to execute complex strategies by using pre-defined rules and algorithms. If you're interested in getting started with algorithmic trading, this step-by-step guide will help you embark on your journey into the exciting world of automated trading.

How Automated Algo Trading Software Works in India

The world of finance has been transformed by technology over the past few decades, and India is no exception. Automated algo trading software on platforms like uTrade Algos has gained immense popularity among Indian traders and investors. Read on to know more about the intricacies of how automated algo trading software works in India.

How Algo Backtesting Can Improve Your Trading Strategies

In the dynamic and fast-paced world of financial markets, traders are constantly seeking an edge that can give them a competitive advantage. Algorithmic trading, or algo trading, has become increasingly popular as it offers a way to automate trading strategies and execute orders at a speed and precision that human traders find challenging to match. However, the road to successful algorithmic trading is not without its challenges. To increase the likelihood of profitable trading, algo traders turn to a powerful tool in their arsenal: backtesting. Read on to know how algo backtesting can significantly improve your algo trading strategies.

Top 7 Mistakes to Avoid in Algorithmic Trading Strategy Development

Algorithmic trading, often referred to as algo trading, has revolutionised the world of financial markets. It involves the use of automated systems and computer algorithms to make trading decisions and execute orders. Algorithmic trading strategies offer the potential for increased efficiency, speed, and precision in trading, but it is not without its challenges and pitfalls. Successful algo trading requires a deep understanding of markets, disciplined risk management, and the ability to adapt to changing conditions. It's a world where technology and human decision-making intersect and where even the smallest mistake can lead to significant financial losses. Here, we will explore the top seven mistakes to avoid in algorithmic trading strategy development. These mistakes encompass various aspects of trading, from inadequate research and overreliance on automation to poor risk management and emotional decision-making. By understanding and avoiding these common pitfalls, traders can enhance their algorithmic advanced trading strategies and increase their chances of success in today's dynamic and competitive financial markets.

No Coding Required: Algo Trading Platforms for Newbies

Algorithmic trading has undeniably revolutionised the financial industry, offering an innovative approach to trading that caters to both investors and traders. By utilising computer programs and mathematical models, algo trading allows for the automated execution of trades based on predefined rules and data. It brings about the capability to adapt to diverse market conditions, making it especially valuable for those seeking to reduce emotional influences and make decisions with precision.

What Are Backtesting and Forward Testing in Trading Strategies?

Trading in financial markets, whether stocks, commodities, or currencies, is a challenging endeavour. It requires a thorough understanding of market dynamics, effective strategies, and the ability to adapt to changing conditions. To increase the chances of success, traders often use backtesting and forward testing. These techniques help evaluate the performance of trading strategies and determine their viability in real-world scenarios. Here, we will find out what backtesting and forward testing are, their importance, and how they can be used effectively in trading strategies.

Top 7 Tips for Optimising Your Algorithmic Trading Strategies

If you're a quantitative analyst or a trader, you're likely well aware of the importance of optimising the execution and performance of your trading algorithms. Algorithmic trading strategies are automated programs designed to execute trades based on predefined rules, data, and strategies. They offer the potential to reduce costs, increase profits, and manage risks efficiently in dynamic and complex markets. However, they also come with their share of challenges, including issues like latency, slippage, market impact, and feedback loops. How can you overcome these challenges and improve the efficiency and effectiveness of your trading algorithms? Here, we'll give you seven tips to optimise your algo trading strategies.

Why Algo Strategies Are Suitable for Different Market Conditions

In today's fast-paced financial markets, traditional methods of trading are being eclipsed by the rise of some of the best algo trading strategies. These are automated processes that execute buy or sell orders according to predefined rules, mathematical models, or statistical analyses. These algorithms, often referred to as ‘algos’, have gained popularity due to their ability to adapt and perform well under various market conditions. Whether markets are calm and stable or experiencing extreme volatility, algo strategies have demonstrated their versatility and effectiveness. Algorithmic trading is not a new concept; it has been around for decades. However, the widespread use of computers and high-speed Internet has revolutionised the way traders approach financial markets.

What Are the Key Components of a Successful Trading Strategy?

Trading in financial markets can be both rewarding and challenging. To navigate this complex landscape and increase the chances of success, traders must have well-defined and advanced trading strategies. Strategies for trading are like roadmaps that guide a trader's decisions, helping them determine what, when, and how much to trade. Read on to find out what are the essential components of a successful trading strategy and explore ten fundamental rules that every trader should follow to maximise their potential in the financial markets.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

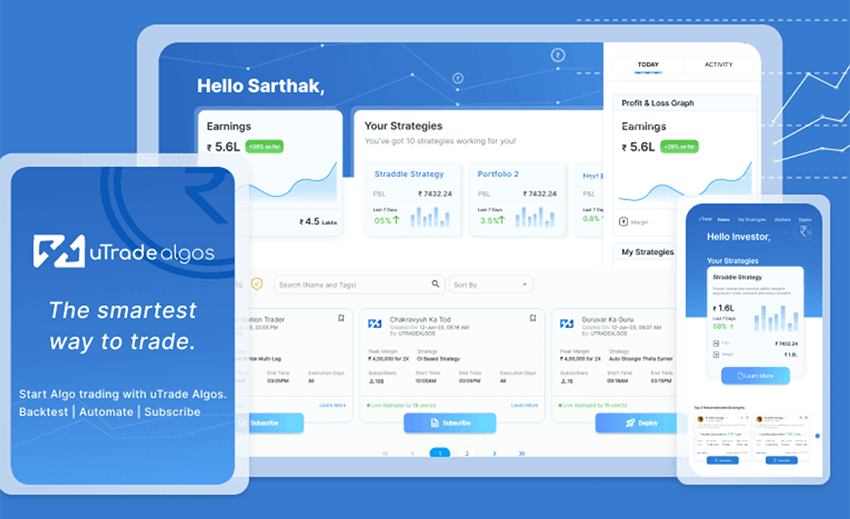

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.