In today's rapidly evolving financial landscape, choosing the right algo trading platform is pivotal for traders seeking automated solutions. This blog aims to elucidate essential factors to contemplate when selecting an algorithmic trading platform, empowering traders to make informed decisions for their automated trading endeavours.

What Are the Different Types of Trading Strategies and Their Benefits?

Trading in financial markets is a dynamic and multifaceted endeavour where investors and traders aim to profit from price fluctuations in various assets, such as stocks, commodities, currencies, and more. To navigate the complex world of trading successfully, it is crucial to adopt well-defined strategies for trading that suit your financial goals, risk tolerance, and trading style. Whether you are a seasoned trader or a novice looking to enter the world of finance, understanding these various advanced trading strategies can be a valuable asset in your trading toolkit.

What to Look for in Automated Algo Trading Software for the Indian Market

When it comes to algo trading software, a multitude of indispensable features empowers traders in India, bolstering the efficiency and effectiveness of automated algo trading strategies. These features equip investors with the tools they need to seize opportunities within the market.

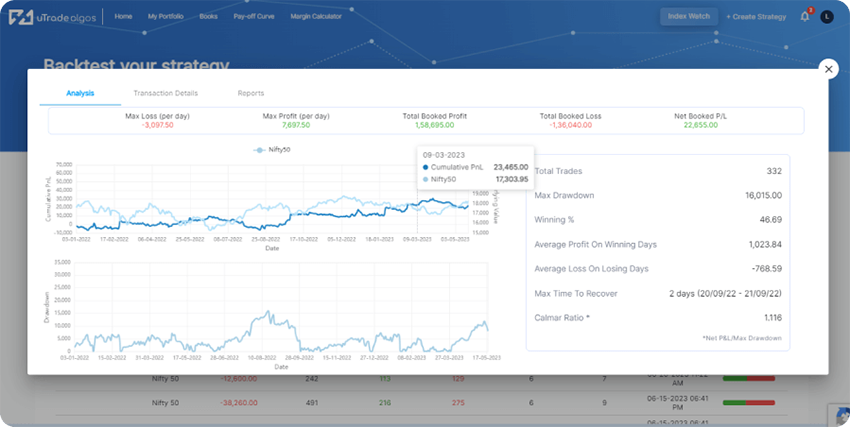

What Is Algo Backtesting and How Does It Work?

In the fast-paced world of financial markets, traders and investors are constantly seeking an edge to stay ahead of the curve. Algorithmic trading, or algo trading, has emerged as a powerful tool to gain this competitive advantage. It involves the use of automated trading systems, often fuelled by complex algorithms, to execute trades with speed and precision. However, before deploying these algorithms in live markets, algo traders employ a crucial step to evaluate and fine-tune their strategies: backtesting. Here, we will find out what algo backtesting is and how it works.

Read About Algo Trading Market Size & Share Analysis

Financial markets have seen a significant transformation with the rise of algorithmic trading. Technology has played a crucial role in expanding this market, and this article explores its size, share, and growth drivers. From the integration of AI and machine learning to their influence on trading strategies, it provides insights into the dynamic world of algorithmic trading.

What is Futures Trading? Meaning, Types, and More

Futures trading is a dynamic and widely practised form of financial investment that revolves around the buying and selling of derivative contracts known as futures. At its core, a futures contract is an agreement between two parties to buy or sell a specific underlying asset at a predetermined price on a future date. Read on to know more.

What is High Frequency Algo Trading?

In the dynamic world of finance, high-frequency trading (HFT) algorithms have changed trading practices. These intricate computer programs rapidly execute multiple trades within milliseconds, leveraging minor price differences for profits. Read on to learn more about the mechanics, impact, and debates surrounding HFT algorithms, offering insight into their crucial role in today's trading environment.

What is an Option Strategy Builder?

Risk management is a pivotal aspect of trading and investment, be that if you trade manually or on online platforms like uTrade Algos. It demands well-structured plans to minimise risks and optimise returns. An essential tool in risk management is the option strategy builder, aiding traders and investors in formulating and executing successful trading tactics. It serves as a robust tool, equipping traders and investors, who carry out algo trading or otherwise, to conceive and assess intricate options trading strategies. Through this user-friendly platform, individuals can explore a broad spectrum of options combinations, assess potential risks and rewards, and make well-informed decisions grounded in real-time data. In this article, we delve into the role of option strategy builders in refining risk management for enhanced trading outcomes.

Algorithmic Trading in Indian Stock Market

High-speed information flow. Decisions in the blink of an eye. A rush of adrenaline. In the good old days, the frenzy of a stock trading floor was pulsating, with hand signals moving millions of dollars and brokers shouting orders across each other. Today, trillions have replaced millions and are moved silently across accounts by computers in split seconds, the only noise being the soft hum of computer fans trying to cool the frenzy now locked inside their machines. All is calm outside. Welcome to the world of algorithmic trading, where men no longer solely lord the floors.

Algo Trading Basics: Concept & Examples

In the dynamic landscape of financial markets, algorithmic trading has emerged as a cornerstone of modern trading practices, revolutionising the way transactions are executed. This article delves into the basics of algorithmic trading, unravelling its meaning, core concepts, and practical applications through illustrative examples. As technology continues to shape the financial world, understanding the basics of algorithmic trading becomes paramount for both seasoned traders and those new to the intricacies of this innovative approach.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.