In options trading, be it manual or on algo trading platforms like uTrade Algos, implementing various strategies is essential for achieving a diversified and balanced portfolio. Among these strategies, the strangle stands out as a versatile and potentially lucrative approach. A strangle strategy encompasses acquiring both a call and a put option with varying strike prices yet sharing the same expiration date for a specific underlying asset. This strategic combination not only presents traders with an option payoff graph that exhibits profit and loss potentials at various price levels but also aligns well with algorithmic trading methodologies. These aspects offer distinctive advantages that substantially enhance overall portfolio performance. Here are the top five benefits of integrating strangles into your trading portfolio.

Know About the Advantages of Algo Trading

In the ever-evolving landscape of financial markets, algorithmic trading, or algo trading, has emerged as a game-changing phenomenon. This revolutionary approach to trading involves the use of computer algorithms on online platforms like uTrade Algos to execute trades at unprecedented speeds and efficiency. The advantages of algo trading are multifaceted and far-reaching, influencing market liquidity, risk management, and overall trading strategies. In this article, we will delve into the various advantages that algo trading brings to the table, exploring how it reshapes the dynamics of modern trading. From enhanced precision in trade execution to the potential for minimising emotional biases, we will uncover how algo trading is not just a technological advancement but a paradigm shift in the way financial markets operate.

Algo Trading: How it Works?

Algo trading, short for algorithmic trading, is a revolutionary approach to financial markets that leverages computer algorithms to execute trading strategies. This technology-driven method has transformed the trading landscape, providing investors with faster, more efficient, and more systematic ways to participate in global markets. Here, we will find out how algo trading works, its benefits, challenges, and its impact on the modern financial industry.

Importance of Risk Management in Algo Trading

In the domain of trading and investing, where rapid fluctuations determine outcomes, algorithmic risk management assumes a crucial position. As markets become increasingly complex and interconnected, the integration of algorithms for risk assessment has revolutionised the approaches utilised by financial professionals. By harnessing data analysis and automation, algorithmic risk management seeks to enhance the precision, speed, and efficiency of risk evaluation, empowering traders and investors to navigate unpredictable landscapes with greater confidence. Let us find out more.

Learn the Difference Between Algo Trading vs Manual Trading

Picture this: You’re a trader who has been working hard to analyse trends and make trades. You spend hours in understanding various markets and analysing the movement of the stock prices before you finally decide which stock you should buy or sell. Suddenly, you find yourself surrounded by a computer program that executes trade swiftly by just following a pre-existing strategy of investment that is fed into. This is where the debate of algo trading vs. manual trading begins dominating the current scenes in the financial markets globally.

A Beginner’s Guide to Algorithmic Trading

Algorithmic Trading is the use of computer programs to make trade decisions automatically. It follows specific rules using mathematical models and market conditions, providing efficient and precise execution while minimizing human error and emotional biases.

Algorithmic trading has many advantages, including high-profit opportunities, increased liquidity, removal of emotional bias, efficient trade execution, and the ability to trade multiple markets and assets efficiently. Additionally, it can be backtested using historical and real-time data to determine if a trading strategy is viable.

The algorithms used in algo trading are generally tested logically or historically to determine their effectiveness. Logical testing involves following a set of rules and calculations to determine if a strategy will be profitable. Historical testing involves applying a rule or set of rules over past years to see if they would have made money.

10 Traits of a Successful Algo Trader

Successful traders possess certain traits that help them make the right decisions and maximize their profits. It is also important to have a solid understanding of the market and to continuously educate oneself about trading strategies and techniques. Algorithmic trading platforms can be useful in helping traders develop discipline and control. It is also important to be realistic in one's expectations and to have patience and persistence.

Press Release of uTrade Algos

Starting April 7, some users will receive beta access to uTrade Algos’ platform.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

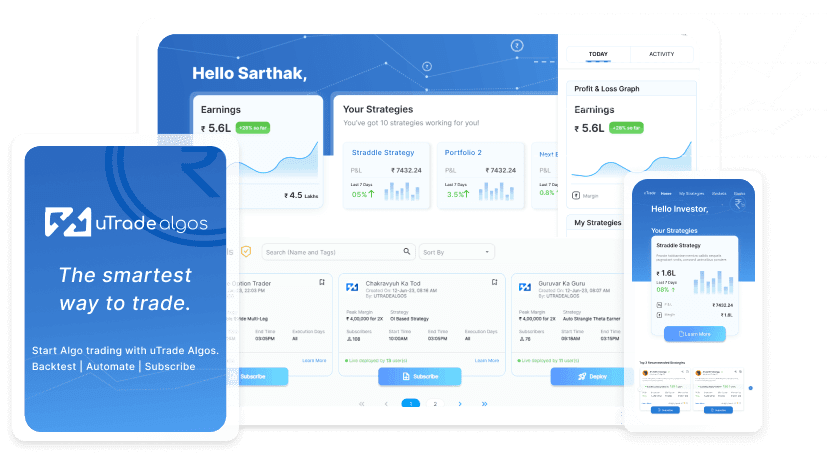

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.