Options Greeks play a pivotal role in understanding and evaluating the risk and behaviour of options within algorithmic trading on platforms like uTrade Algos. These indicators, including Delta, Gamma, Theta, Vega, and Rho, are essential metrics for traders employing algorithmic strategies. However, misinterpreting or misusing these Greeks can lead to costly errors. Let's understand the top five mistakes to avoid when analysing options Greeks within algorithms.

The different types of derivatives and options, their flexibility and usefulness for managing risk and pursuing profits in the financial markets. A simple example is provided to illustrate how options work.

What is Chart Patterns?

Dive deep into some of the most common but reliable chart patterns to better spot opportunities in the market!

How to Maximize Returns On Investment?

This comprehensive trading guide would take you to an intermediate level when it comes to Trading. Not only will you understand the working of various Technical Indicators but it will also enable you to use several indicators in combination, thus being more certain when the trading system generates a signal and to be able to bet your money with more conviction!

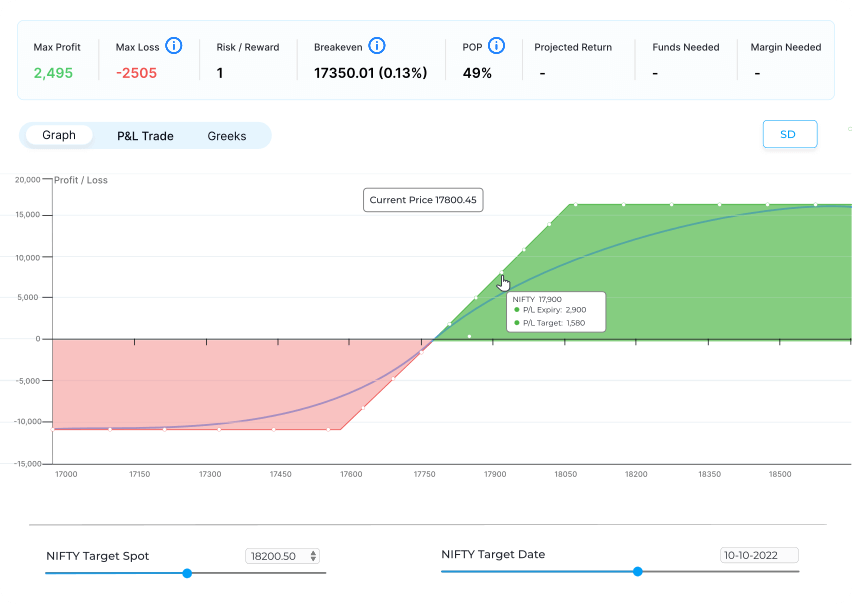

What is a Payoff Curve?

A payoff curve is a graphical representation of the profit or loss of a derivatives trade at expiration. It helps derivatives traders understand the potential outcomes of a trade and make informed decisions about risk and reward. The shape of the curve can indicate the likelihood of different levels of profit or loss, and can help traders identify potential strategies for managing risk.

How to trade in forward testing Without Risking Money

Don't wish to risk real capital while learning? Don't have a Demat account? Want to test your strategies in a simulated market before deploying them in the live markets? uTrade Algos automates the entire process using a proprietary, modern paper trading simulator which closely resembles real world stock trading.

Top Option Trading Strategies For Beginners

Lets understand top strategies that would help you immensely in your derivatives trading. From simple 2 legged strategies such as Bull call spread, to complex strategies such as Iron condor, straddle etc., this post has it all!

Impact of Economic and Political Events on Options Trading

The impact of economic and political events on options trading and nsights into the strategies and tools that traders can use to navigate the market. It also highlights the potential risks and challenges involved in options trading during unpredictable events.

The Different Types of Options: Calls, Puts, and Combinations

The different types of options - call options, put options, and combination options, and their applications. It provides numerical examples to explain the concepts and strategies.

Options Trading: Naked Options vs Multi-legged Strategies

Multi-legged strategies provide traders with greater flexibility and control over their trades, as well as the potential for higher profits and defined risks. uTrade Algos offers pre-made strategy forms that can be customized to suit individual requirements, helping traders to make informed decisions and improve their chances of success in the options market.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.