Amid the diverse strategies of options trading, payoff charts, on online algo trading platforms like uTrade Algos, stand as essential visual aids depicting potential profit or loss scenarios at different underlying asset prices upon options' expiration. These charts

Are you looking to create a successful trading strategy? A strategy builder can help you define and evaluate your strategy! By using payoff graph , margin calculator, and testing the historical performance of chosen asset, you can make informed decisions about your strategy and increase your chances of success in the market. Don't miss out on this valuable tool - read on to learn more about how a strategy builder can help you succeed in the markets.

Comparing Cash vs Futures Market

In a cash market, financial instruments are traded, and there is actual delivery of stocks. On the other hand, in a futures market, future contracts are bought and sold at a predefined price with a mutually agreed date in the future.

How to Improve the Probability of Backtesting Strategy

Want to increase your chances of success in the markets? Backtesting can help by testing your trading strategies on historical data. Follow our tips on how to effectively conduct backtesting, including using multiple data sets, considering relevant time periods and samples, and avoiding bias and data dredging. This valuable tool is useful for both systematic and discretionary traders and can help you make informed decisions about your strategies.

A Step-by-step Guide to Creating Your First Options Strategy

A step-by-step guide to creating a successful options strategy, beginning with the basic terminologies like premium, lot size, expiration day, spot price, and strike price. The guide covers evaluating the expectation for the underlying stock, determining the strike price, the option time frame, and option premium while considering market conditions.

A Complete Guide to Bet Sizing

Bet sizing is a crucial aspect of successful trading and investing. It involves setting the correct size while buying or selling an instrument or calculating the money amount that a trader will open a new trade with. One of the key principles of bet sizing is maintaining a consistent percentage of the total trading capital for each trade. Proper bet sizing helps prevent capital loss on a single trade, controls risk-taking, and maximizes performance.

5 Reasons to Choose an Algorithmic Trading Platform

With advanced features like lightning-fast backtesting, premade strategy forms, paper trading, interactive payoff curves, and a user-friendly interface, uTrade Algos has everything you need to take your algorithmic trading to the next level. Sign up now!

What are Options Greeks?

Option greeks are a set of statistical measures used to determine the sensitivity of the price of an option to various factors such as the underlying asset price, volatility, and time to expiration. The main option greeks are delta, gamma, theta, vega, and rho. In this article, we understand each measure deeply

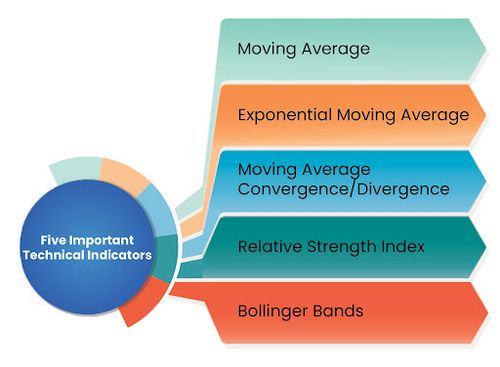

5 Technical Indicators that Traders Should Know

The all in one guide about the top 5 indicators that can make your trades a lot more reliable, systematic and higher the odds of withstanding different market scenarios.

What is strangle?

Let's take a deep dive into Strangle strategy and understand when and how to implement it in the markets. We'll also take the help of uTrade's Interactive Payoff curve to understand a strangle's payout.

Claim your 7-day free trial!

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

uTrade Algo’s proprietary features – Advanced Strategy form, fastest back testing engine, Pre-made strategies help you Level up your Derivatives Trading experience

The dashboard is a summarized view of how well your Portfolios are doing, with fields such as Total P&L, Margin Available, actively traded underlyings, Portfolio name and respective underlyings, etc. Use it to quickly gauge your strategy performance

You can sign up with uTrade Algos and get started instantly. Please make sure to connect your ShareIndia trading account with us as it’s essential for you to be able to trade in the live markets. Watch this video to get started – Getting Started with uTrade Algos

While algo trading is in use for decades now for a variety of purposes, its presence has been mainly limited to big institutions. With uTrade Algos you get institutional grade features, at a marginal cost so that everyone can experience the power of algos and trade like a pro.

On uTrade Algos, beginners can start by subscribing to pre-built algos by industry experts – called uTrade Originals.

While more advanced traders can create their own algo-enabled portfolios, with our no-code easy-to-use order form, equipped with tons of features such as – Robust risk management, pre-made strategy templates, payoff graph, options chain, and a lot more.

From single leg strategies to complex portfolios with upto 5 strategies, each strategy having up to 6 legs – uTrade Algos gives you enough freedom to create almost any strategy you’d like. What’s more is, there are pre-built algos by industry experts for complete beginners and premade strategy templates for those who want to try their hand at strategy creation.

An interesting feature that uTrade Algos is bringing to the table is a set of pre-built algorithms curated by top-ranking industry experts who have seen the financial markets inside out. These algorithms, called uTrade Originals, will be available for subscribers on the platform.

Algos have the capability to fire orders to the exchange in milliseconds – which is one-thousandth of a second. A speed which is impossible in Manual Trading. Experience the power of Algos for free with uTrade Algos – Signup now.