Interested in trading? Chances are you’ve encountered the terms quantitative trading and algorithmic trading. But what exactly do they involve, and how do they differ? Let’s find out more.

Quantitative Trading

Defining Quantitative Trading

Quantitative trading revolves around leveraging mathematical models and analytics to drive decisions and spot trading opportunities for increased profitability.

- Traders handling these strategies are known as quant traders.

- This approach heavily relies on mathematical models using price and volume data inputs to devise trading strategies.

- It’s commonly embraced by financial institutions and hedge funds but is gradually making its way into the realm of independent retail traders.

Advantages of Quantitative Trading

- The key advantage lies in its reliance on data-driven decision-making, reducing emotional biases during trades, potentially leading to more successful outcomes.

- Quant trading allows for comprehensive market analysis by utilising vast amounts of data, unlike typical traders who might focus on limited variables they are familiar with.

Disadvantages of Quantitative Trading

- This method demands specialised skills in advanced math, coding proficiency, and extensive market experience.

- It also involves inherent risks due to changing markets and emerging patterns.

Steps Involved in Quantitative Trading

Quantitative trading involves several sequential steps that traders typically follow before developing a trading program. Here’s an overview of these steps:

- Research: The trader starts by researching various trading concepts and tools, aligning them with investment goals and risk tolerance to select a suitable trading strategy.

- Strategy Selection: Choosing either a simple or complex strategy, the trader opts for specific analysis tools such as moving averages or oscillators.

- Data Analysis: Analysing the dataset, the trader identifies statistically significant variables crucial for constructing their model.

- Model Development: Based on the chosen strategy, the trader develops a model. Subsequently, they backtest, customise, and refine the model as required.

- Risk Management: Utilising risk management tools like stop-loss orders, the trader evaluates the outcomes of their model.

- Live Implementation: When confident, the trader implements the quantitative trading model in the live market.

- Monitoring and Adaptation: Continuously observing and assessing outcomes, the trader remains open to making adjustments to the strategy if necessary based on market performance.

What Data Points to Quant Traders Usually Use?

Quant traders primarily focus on price and volume as the fundamental data points. However, they explore various parameters convertible into numerical values for strategy formulation. Some traders might track investor sentiment via social media tools, expanding beyond conventional data sources. Utilising publicly accessible databases, quant traders integrate alternative datasets into their statistical models. These datasets, distinct from traditional financial sources like fundamentals, help identify unique patterns essential for their strategies.

Quant Developers: Their Roles and Skills

Becoming a quantitative trading model developer requires specific skills and expertise that set them apart in financial software development. While algorithmic trading platforms like uTrade Algos, where zero coding is needed and which has predefined strategies called uTrade Originals, make trading accessible, excelling as a quant developer demands a distinctive skill set. If you aspire to enter this domain, mastering the following skills is crucial:

- Advanced Econometrics: A deep understanding of advanced econometrics forms the backbone of quantitative modelling, aiding in the creation of sophisticated trading strategies.

- Proficiency in Financial Modelling Software: Familiarity with financial modelling software is essential for analysing market trends and formulating effective trading models.

- Comprehensive Financial Knowledge: A strong grasp of financial concepts and familiarity with target markets are imperative for informed decision-making in quantitative trading.

- Core Data Structures Understanding: Proficiency in core data structures is crucial for handling and analysing large volumes of financial data efficiently.

- Programming Languages Proficiency: Mastery in coding languages like C++, Python, R, and Java is essential for developing, implementing, and optimising trading algorithms.

Algorithmic Trading

Defining Algorithmic Trading

Algorithmic trading, also called algo trading or automated trading, uses computer programs (algorithms) guided by predefined instructions to execute trades swiftly based on timing, price movements, and market data. It aims to generate profits faster than human traders and removes emotional influences from trading decisions. Algo trading relies on preset rules and historical data to automate trade executions, allowing traders to focus on developing effective strategies rather than constantly monitoring trades.

Advantages of Algorithmic Trading

- Algorithmic trading programs employ computer programs to automatically make trade decisions.

- These programs operate based on preset rules, using mathematical models and market conditions like price, timing, and volume. For instance, uTrade Originals by uTrade Algos is a curated collection of pre-built algorithms crafted by seasoned industry professionals through meticulous research and extensive expertise. With a keen focus on diverse market conditions, uTrade Originals provides a spectrum of strategies meticulously designed to protect your surplus capital from the effects of inflation.

- Algorithmic trading programs facilitate quick order execution, aid in maintaining organised trading, minimise emotional influences, and potentially lower transaction costs.

However, it has its risks, thus, emphasising the importance of rigorous testing and cutting-edge technology to mitigate such failures.

Steps Involved in Algorithmic Trading

The process of developing an algorithmic trading strategy involves several key steps:

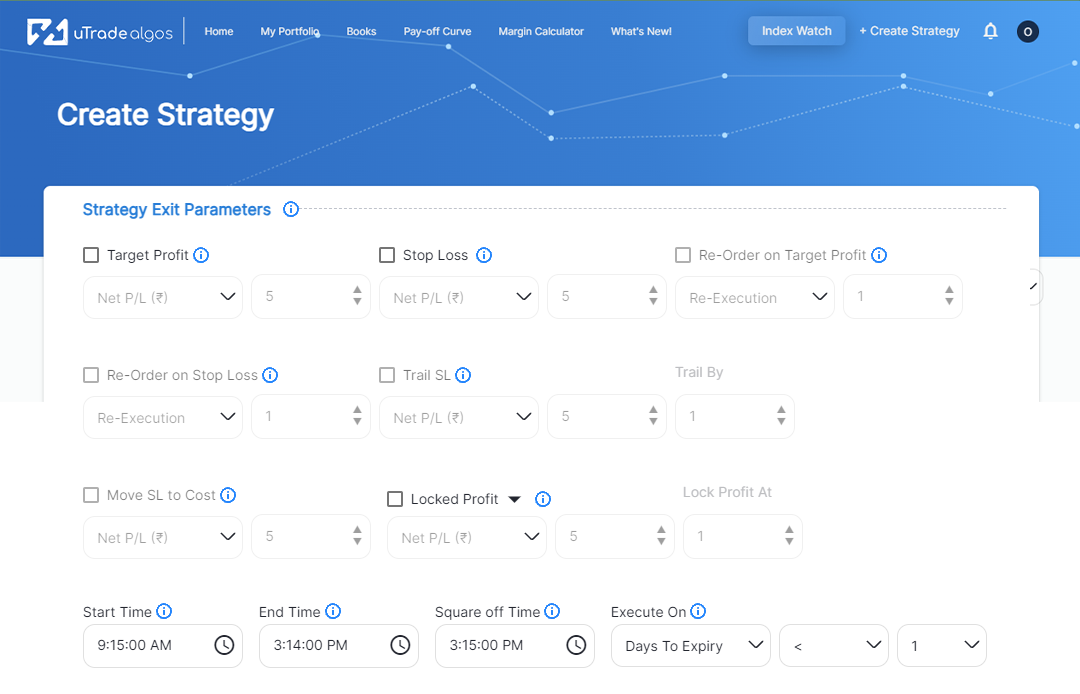

- Strategy Creation: Crafting an effective strategy is pivotal in algorithmic trading, influencing potential profits. This can involve employing common strategies like mean reversion or arbitrage or developing a unique strategy tailored to specific needs.

- Algorithm Setup: Compiling a set of if/then rules based on past market data and price history to integrate into the algorithmic trading application.

- Acquiring or Building Trading Software: Obtaining automated trading software is crucial. Consider purchasing reputable pre-built solutions from established providers like TradeSanta. Using such software allows testing strategies in simulated environments for accurate market movement predictions.

- Trade Execution: After strategy development, algorithm automation, and infrastructure setup, deploying the algorithm into the live environment for trade execution is the final step. Developers continually refine algorithms based on test data to enhance predictive accuracy.

Distinguishing Quantitative Trading and Algorithmic Trading

Distinguishing between quantitative and algorithmic trading reveals notable differences:

- Approach to Strategy Development: Algorithmic trading centres on trend analysis and price history, while quantitative trading relies on mathematics and technical analysis for strategy formulation.

- Complexity and Data Usage: Quantitative models are more intricate, employing multiple datasets and statistical implications. In contrast, algorithmic trading is simpler, using fewer variables in strategy development.

- Automation and Execution: Algorithmic trading fully delegates the trading process to software, automating trade executions without human intervention. Quantitative trading models often involve manual transactions, although some may utilise automated trading software.

- Accessibility and User Base: Algorithmic trading is more beginner-friendly and accessible to individual traders, whereas quantitative trading demands greater expertise and is typically employed by hedge funds and financial institutions.

Can Both Types of Trading Be Combined?

Absolutely. Algorithmic trading is a subset of quantitative trading, requiring pre-programmed algorithms. Quantitative analysis frequently underpins algorithmic trading. Algorithms and trading software, including crypto trading bots, are utilised in both types of trading. However, in quantitative trading, these algorithms are based on mathematical models developed by quant traders.

Quantitative and algorithmic trading, though distinct, synergise to form a powerful strategy. This fusion leverages their respective strengths, empowering traders to make informed decisions, mitigate risks, and potentially enhance profits in dynamic markets. This convergence presents a multifaceted approach to navigating financial complexities effectively.

November 24, 2023

November 24, 2023