The different types of options – call options, put options, and combination options, and their applications. It provides numerical examples to explain the concepts and strategies.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date. In other words, this means that the holder of an option can buy/sell it when he deems it fit – he is not under any compulsion to do so.

Types of Options

There are two main types of options: call options and put options.

Call Options

Call options give the holder the right to buy the underlying asset. Investors often use call options to speculate on the future price of an asset or to hedge against potential price increases.

If we take an example:

If an investor believes that the price of a stock will increase in the future, he is likely to buy a call option on the stock. If the price of the stock does indeed increase, he can exercise his option to buy the stock at the predetermined price, known as the strike price, and sell it at the higher market price, resulting in a profit. On the other hand, if the stock price does not increase or instead decreases, he can choose not to exercise the option and simply let it expire, resulting in a loss.

Let us take a numerical example to understand how a call option works.

A trader, say, buys 100 shares of a stock X as a call option. He pays a total premium of ₹100 to buy the call option. The strike price of the call option is ₹20. On expiration, the shares sell at ₹25. The investor uses his right to buy the shares.

So,

He buys the shares for ₹20 * 100 = ₹2,000

He also pays a premium of ₹100 (This is his transaction cost)

He sells the shares for ₹ 25 * 100= ₹2,500

His net profit is ₹2,500 – ₹2,000 – ₹100 = ₹400

So,

For an investment of ₹100, he gets a profit of ₹400, which is a decent return on investment.

Put Options

Put options give the holder the right to sell the underlying asset. They are often used by investors to speculate on the future price of an asset or to hedge against potential price decreases.

If we take an example:

If an investor believes that the price of a stock will decrease in the future, they may buy a put option on the stock. If the stock price decreases, the investor can exercise his option to sell the stock at the predetermined strike price and buy it back at the lower market price, resulting in a profit.

On the other hand, if the stock price does not decrease or increase, he can choose not to exercise the option and simply let it expire, resulting in a loss.

Combination Options

Simple Combinations

Other than just holding a call or a put option, an investor can hold various combinations of call and put options as well. These can be used to achieve different investment objectives. The following are some of the combinations:

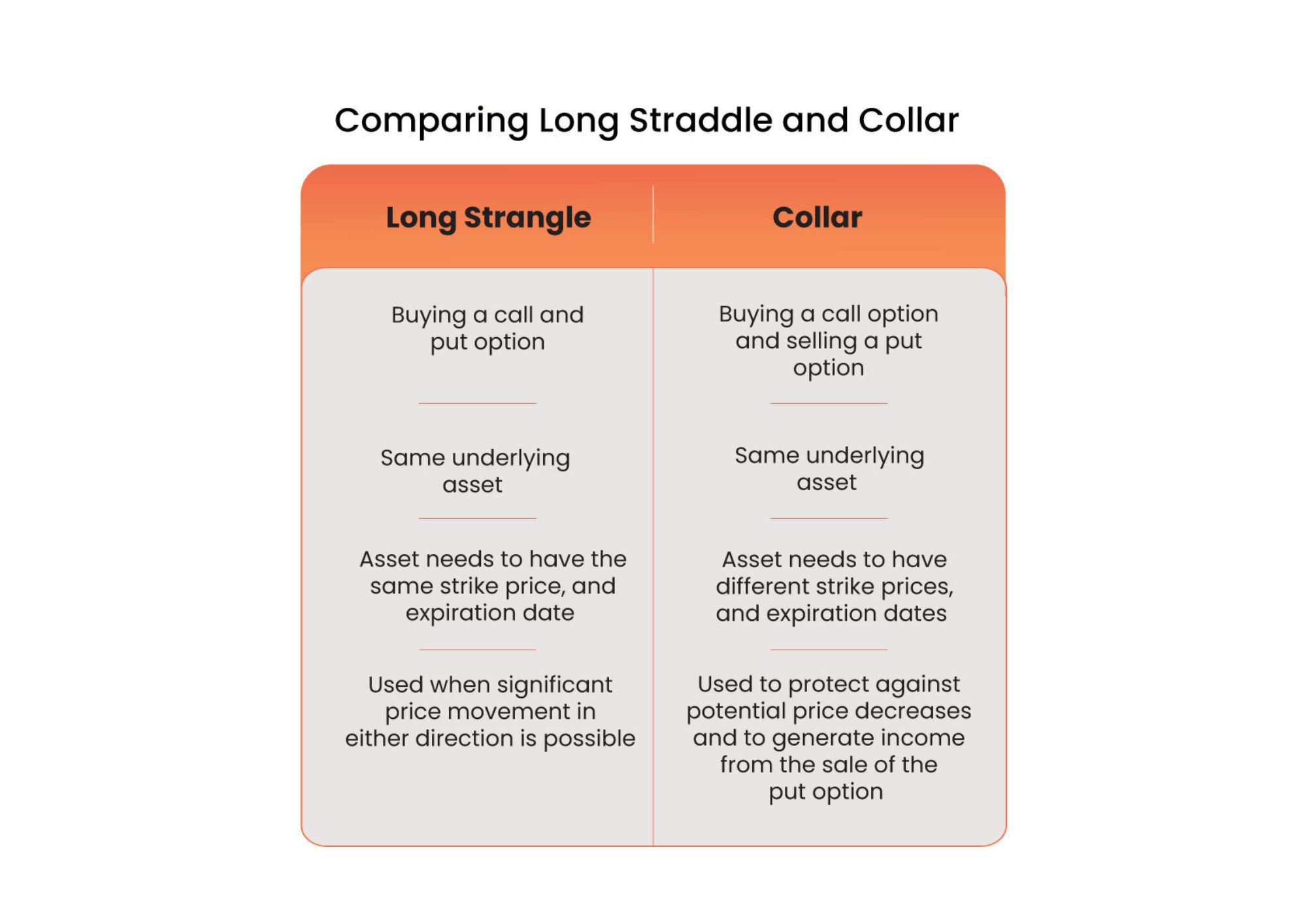

- Long Straddle – A long straddle involves buying a call option and a put option on the same underlying asset with the same strike price and expiration date. This strategy is used when the investor expects a significant price movement in either direction but is unsure of the direction. If the price of the underlying asset moves significantly in either direction, one of the options will expire in the money and generate a profit, offsetting the loss on the other option.

- Collar – A collar is one that involves buying a call option and selling a put option on the same underlying asset with different strike prices and expiration dates. This strategy is used to protect against potential price decreases while also generating income from the sale of the put option. If the price of the underlying asset declines, the put option will increase in value and offset the loss on the underlying asset. However, if the price of the underlying asset increases, the call option will increase in value and provide additional profit.

Complex Combinations

Other than the above there are various other complex combinations of call and put options, such as butterflies, condors, and spreads, which can be used to achieve specific investment objectives and manage risk.

- Butterfly – A butterfly spread involves buying and selling call and put options with three different strike prices on the same underlying asset with the same expiration date. This strategy is used to profit from a narrow range of price movement in the underlying asset.

- Condor – A condor involves the simultaneous purchase and sale of call and put options with four different strike prices on the same underlying asset with the same expiration date. This strategy is used to profit from a narrow range of price movement in the underlying asset while limiting potential losses if the price moves significantly in either direction.

- Spread Strategy – A spread strategy involves the purchase and sale of options on the same underlying asset simultaneously with different strike prices or expiration dates. The aim is to profit from a specific price movement in the underlying asset and hedge against price changes.

Let us understand one of these complex combination options with a numerical example (Similar examples can be taken for the others as well).

An investor feels that the stock prices will fluctuate. So, he chooses a short call butterfly spread.

He buys two call options at a strike price of ₹50 each

He pays ₹7 as a premium to buy two call options

He sells these call options at ₹45 and ₹55

He receives ₹7 and ₹1 premiums for selling the call options

His net profit is ₹7 + Re.1 – ₹7 = Re.1

So,

If the stock price goes above ₹55 or falls below ₹45, the trader can earn an income of Re.1.

However, if the stock price stays at ₹50 on expiration, he will earn a loss.

This loss, though, is only ₹5 – Re.1 = ₹4

[₹5 is the difference between the lower and middle strike price, and Re.1 is the received net income]

Hence, as we can see, this strategy comes with profits and losses that are defined.

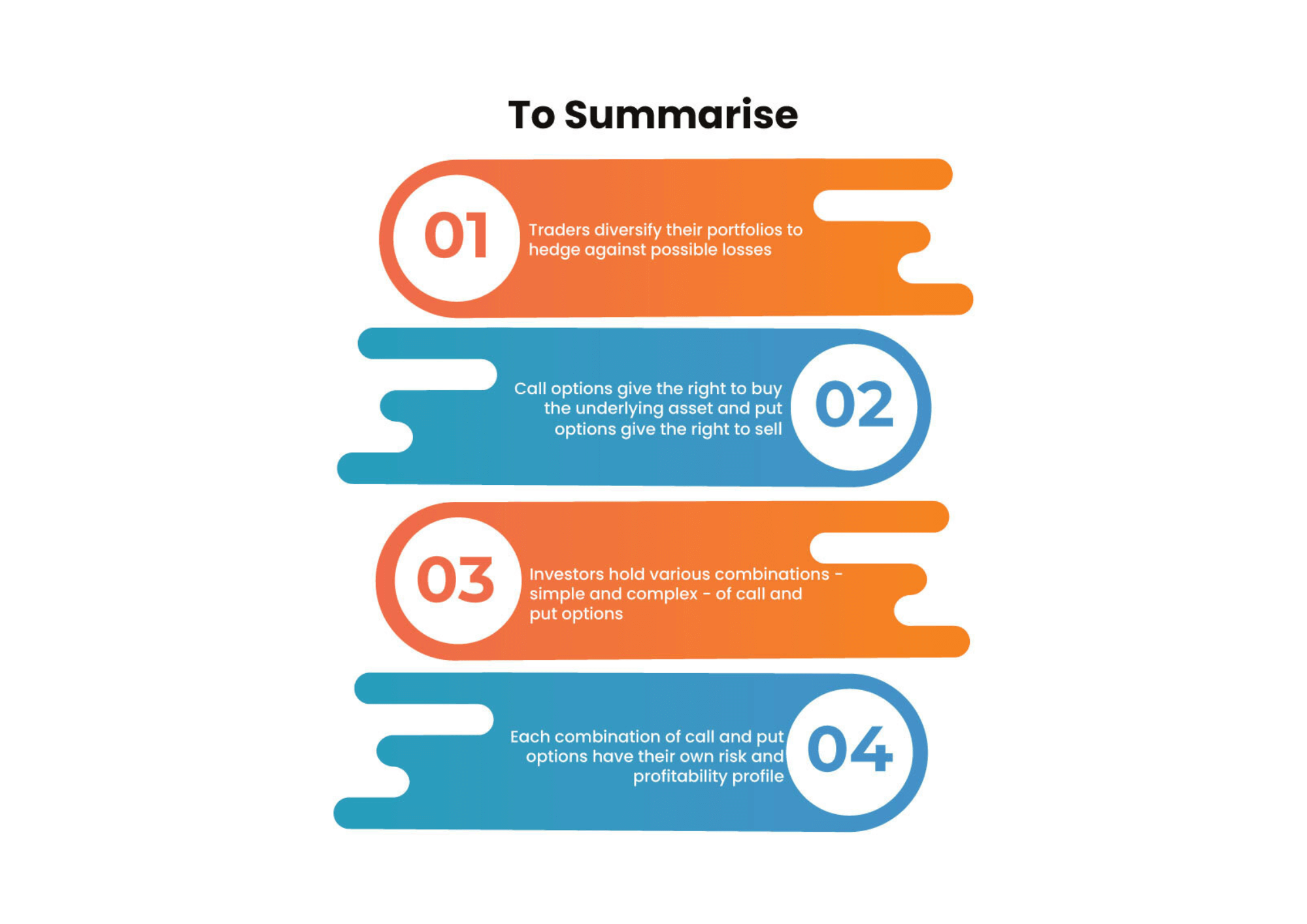

Traders are always seeking ways by which they can both diversify their portfolios and hedge against possible losses. Options are often used, hence, as they come with rights and not compulsions. By using the various combinations of call and put options, each of which produces a different risk and profitability profile, the trader can effectively strategise methods by which he can maximise the chances of profit for himself and minimise the loss possibilities.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date.

Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell the underlying asset.

Long straddles and collars are simple combinations of call and put options that can be used to achieve different investment objectives.

Butterfly, condor, and spread strategies are complex combinations of call and put options that can be used to manage risk and profit from specific price movements.

April 3, 2023

April 3, 2023