The fusion of Artificial Intelligence (AI) with algorithmic trading has redefined the landscape of financial markets. AI-driven strategies and technologies have revolutionised how trading decisions are made, enhancing precision, speed, and efficiency.

Artificial Intelligence encompasses diverse areas like machine learning, deep learning, and natural language processing, offering ample chances to enhance algorithmic trading strategies. AI-based trading systems can dynamically learn from market data, improving decision-making and yielding more precise predictions.

This blog explores the impact of AI in algorithmic trading, elucidating its transformative effects and future implications.

The Evolution of Algorithmic Trading

Algorithmic trading programs, often referred to as algo trading, on trading platforms like uTrade Algos, employ computer algorithms to execute trades based on predefined conditions. Its evolution has been remarkable, leveraging technological advancements to analyse vast amounts of data and swiftly respond to market dynamics. However, the integration of AI marks a significant leap forward, introducing unparalleled capabilities in decision-making and adaptability.

The Influence of AI in Algorithmic Trading

Enhanced Decision-Making

AI-powered algorithms possess the ability to learn, adapt, and evolve from data.

- Machine learning algorithms, such as neural networks and decision trees, scrutinise historical data to identify patterns and make predictive analyses. This enables more accurate and data-driven trading decisions, minimising human biases and emotions.

- Deep learning algorithms, a branch of machine learning, have garnered attention for their ability to uncover intricate patterns within extensive datasets. Convolutional Neural Networks (CNN) and Recurrent Neural Networks (RNN) find frequent use in algorithmic trading to handle and dissect sequential financial data, like stock prices or trading volumes.

Real-time Data Processing

The speed and efficiency of AI, on algo trading platforms like uTrade Algos, in processing vast quantities of real-time market data surpass human capabilities. AI algorithms swiftly analyse incoming data, thus quickly identifying potential opportunities or risks, and enabling traders to capitalise on fleeting market moments.

Adaptive Strategies

AI-driven systems possess adaptability, crucial in the ever-evolving financial markets. These systems continuously learn from new data, adjusting strategies to changing market conditions, thus ensuring relevance and effectiveness in different scenarios.

Risk Management

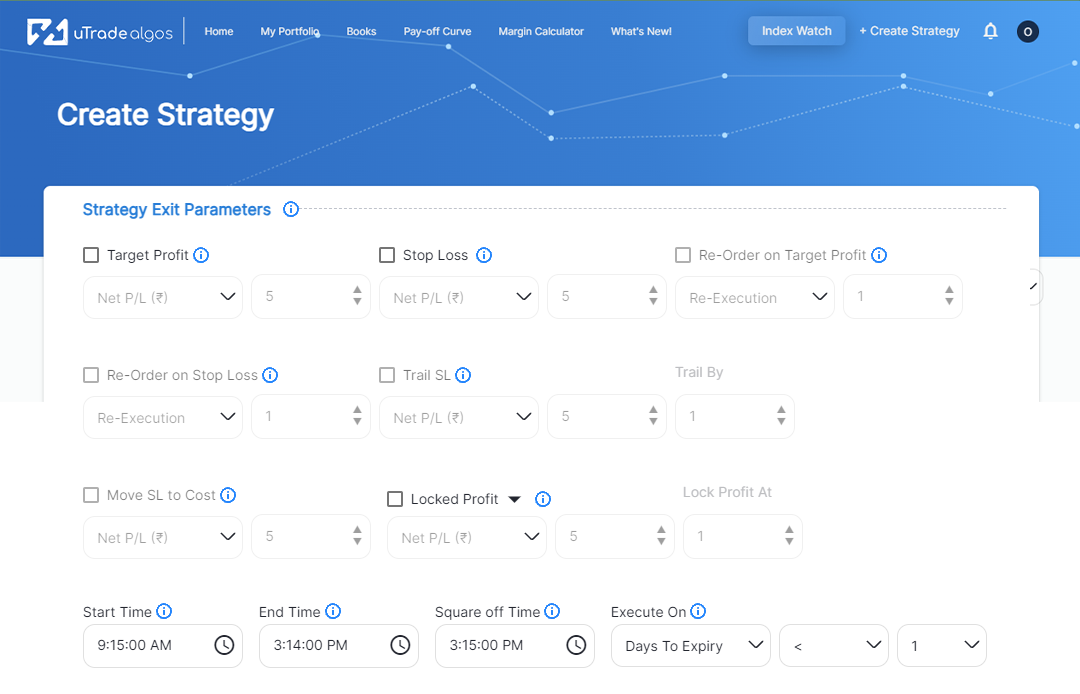

AI algorithms excel in risk assessment and management. They can swiftly detect potential risks and implement risk mitigation strategies, including dynamic adjustments to trading parameters, thereby minimising exposure to market volatility.

Market Accessibility and Democratisation

AI’s integration, on algo trading platforms like uTrade Algos, has reduced barriers to entry in algorithmic trading. Enhanced efficiency and reduced costs enable wider access, empowering a broader spectrum of traders and investors to participate in these markets.

Challenges and Future Prospects

Despite the transformative impact, challenges persist in the realm of AI-driven algorithmic trading. Issues related to data quality, model interpretability, and potential systemic risks demand careful consideration and regulation.

Also, while concerns about job displacement persist, the financial sector’s embrace of AI has created fresh employment avenues. Roles in data science, AI development, and algorithmic trading programs now demand expertise in programming languages, machine learning/AI, and big data analytics. Forecasts indicate that the impact of automation on employment will be offset by the rise of new prospects, driving the need for individuals capable of blending human proficiency with AI precision.

In conclusion, it may be said that the integration of AI in algorithmic trading marks a significant shift, fostering data-driven decisions, heightened efficiency, and broader market access. Advancements in AI technologies, coupled with regulatory frameworks and continuous research, will likely bolster its role in shaping the future of financial markets. Further enhancements in data processing, model transparency, and risk management are expected, ensuring a more robust and efficient trading ecosystem. Despite challenges, the undeniable potential benefits promise a redefined trading landscape, offering new opportunities and heightened market efficiency. Thus, embracing this revolution with caution and innovation is vital for AI to enhance human decision-making and transform financial markets.

January 5, 2024

January 5, 2024