In the world of finance, achieving a diversified investment portfolio is a well-acknowledged strategy for minimising risk and enhancing potential returns. Over time, the emergence of algorithmic trading has significantly transformed the landscape of portfolio diversification. Let us find out about the critical role played by algorithmic trading in effectively diversifying investment portfolios, exploring its benefits, strategies, and considerations.

Defining Algorithmic Trading

Algorithmic trading, often referred to as algo trading, on online platforms like uTrade Algos. involves the utilisation of automated algorithms to execute trades at high speed and frequency. These algorithms are designed to analyse market data, identify patterns, and execute trades without human intervention. The primary goals of algo trading are to capitalise on market inefficiencies, mitigate risks, and enhance trading efficiency.

The Role of Algorithmic Trading in Portfolio Diversification

Enhanced Diversification Opportunities

Algorithmic trading provides access to a broader range of assets and markets that might otherwise be challenging for individual traders to access manually. This expanded access allows for more diverse investment opportunities across various asset classes, geographies, and market segments.

- Expanded Asset Exposure: It broadens access to commodities, currencies, derivatives, and cryptocurrencies, reducing vulnerability by diversifying across varied assets.

- Global Market Access: It spans global markets, overcoming barriers, fostering diversification, and mitigating risks related to economic fluctuations or instability.

- Segmented Diversification: Strategies target specific sectors (e.g., technology, healthcare) within markets, enhancing risk diversification based on current trends.

- Efficient Analysis: Algorithms swiftly analyse extensive data, identifying diversified opportunities across multiple assets and markets in real time.

- Tailored Strategies: Customised strategies optimise returns based on risk appetite and market conditions.

- Mitigating Stock Risk: Diversification minimises the impact of significant losses in any single stock, fortifying portfolios against market volatility.

Reduced Correlation Among Assets

- Algorithmic trading programs pinpoint market movements uncorrelated with traditional assets, diversifying risk by investing in less correlated assets.

- Identifying uncorrelated assets reduces overall portfolio risk by spreading exposure across diverse market conditions.

- Investing in assets less influenced by traditional markets provides insulation against broader market fluctuations.

- Diversifying with uncorrelated assets increases portfolio stability during turbulent market phases.

- Spreading investments across less correlated assets minimises the impact of systemic risks affecting traditional markets.

Dynamic Portfolio Allocation

- Algorithmic trading programs swiftly alter portfolio allocations based on current market data and predefined criteria.

- Agility in portfolio adjustments allows for quick responses to market changes and evolving conditions.

- Dynamic allocation ensures portfolios align with the investor’s risk tolerance, adjusting to changing market dynamics.

- Algo trading ensures portfolios remain consistent with investors’ long-term goals by adapting to market shifts.

- Swift adjustments optimise portfolio performance, responding to market fluctuations effectively.

Strategies Employed in Algorithmic Trading for Portfolio Diversification

Statistical Arbitrage

- Identifies price disparities among correlated securities to capitalise on market inefficiencies.

- Executes simultaneous buying and selling of related instruments to exploit temporary mispricing.

- Utilises quantitative models and statistical analysis to detect deviations from expected price relationships.

- Implements risk management measures and stop-loss controls to mitigate potential losses.

- Focuses on short-term movements and aims to profit from short-lived pricing discrepancies.

Global Macro Strategies

- Utilises comprehensive global macroeconomic data for analysing economic indicators across various countries.

- Considers geopolitical events, interest rate differentials, and other macro factors to diversify investments.

- Assesses interest rate disparities among regions and evaluates their impact on currency values and capital flows.

- Incorporates diverse macro factors, including fiscal policies and socio-political dynamics, for diversified investments.

- Analyses long-term market trends to anticipate shifts driven by macroeconomic factors.

- Manages risks by considering geopolitical risks and potential market volatility arising from macroeconomic factors.

Sector Rotation

- Sector rotation swiftly reallocates investments based on economic indicators or business cycles.

- Allows timely adjustments in portfolio exposure across different industries.

- Responds to economic indicators indicating sector-specific growth or contraction.

- Strategic Resource Allocation: Aims to optimise returns by allocating resources to sectors showing strength and divesting from weaker sectors.

- Capitalises on changing economic conditions to outperform broader market indices.

- Strategically repositions investments to capture sector-specific growth opportunities within the portfolio.

Considerations in Leveraging Algorithmic Trading for Portfolio Diversification

Stop-loss Orders

- Implementation of stop-loss orders is crucial to limit potential losses and protect investments.

- Automatically triggers selling at predetermined levels to mitigate downside risk in volatile markets.

Diversification of Algorithmic Strategies

- Diversifying algorithmic approaches minimises dependency on a single strategy or asset class.

- Spreading investments across various strategies reduces the overall portfolio’s vulnerability to specific market conditions.

Continuous Monitoring

- Regularly monitoring portfolio performance ensures swift identification of deviations from predefined risk parameters.

- Allows for prompt adjustments and corrective actions to maintain risk tolerance levels.

Thorough Historical Testing

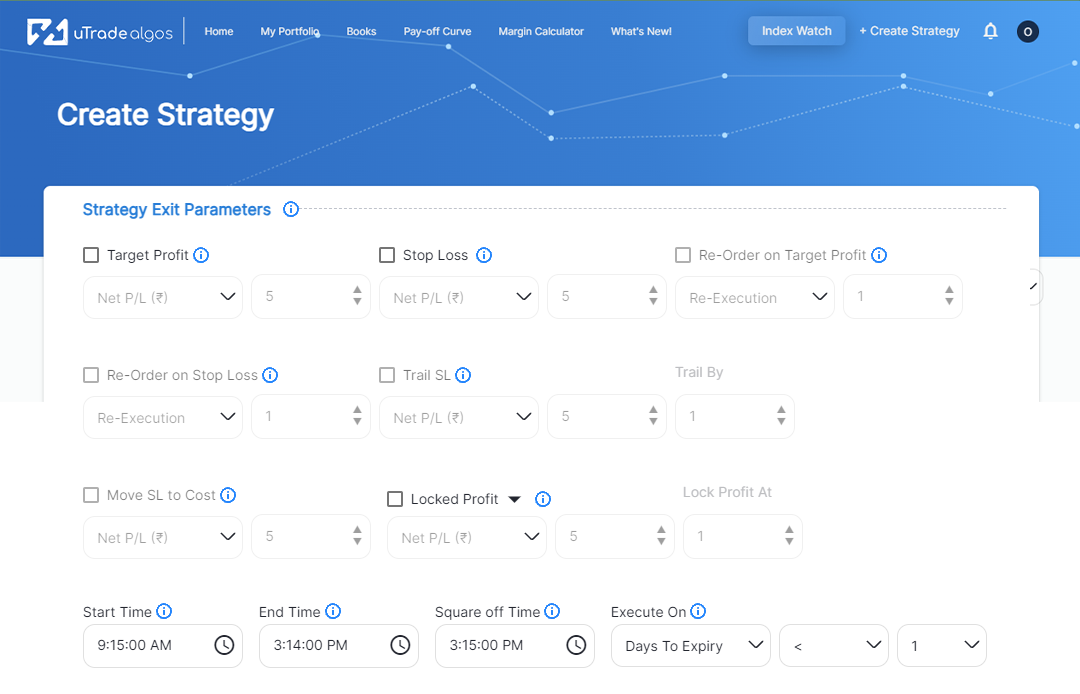

- Conducting comprehensive backtests, on online algo trading platforms like uTrade Algos, using historical data ensures algorithms perform as expected under various market conditions.

- Validates strategies’ effectiveness and their alignment with investor risk profiles and objectives.

Risk Profile Alignment

- Validation with historical data helps in confirming that chosen algorithms align with the investor’s risk appetite and objectives.

- Allows for adjustments or refinements to better suit the desired risk-return trade-off

The integration of algorithmic trading strategies plays a pivotal role in cultivating a diversified investment portfolio, fortifying its resilience against market volatility and potential downturns. By expanding access to a wide array of assets, markets, and strategies, algorithmic trading enables investors to mitigate risks associated with overexposure to specific assets or market conditions. This diversification not only disperses risk but also contributes to enhancing the stability and robustness of the portfolio, ensuring it can weather various market scenarios. Through this integrated approach, algorithmic trading has the potential to optimise the overall performance of the portfolio by leveraging the strengths of multiple assets and strategies, ultimately fostering a well-balanced and resilient investment portfolio.

November 27, 2023

November 27, 2023