Trading in financial markets can be both rewarding and challenging. To navigate this complex landscape and increase the chances of success, traders must have well-defined and advanced trading strategies. Strategies for trading are like roadmaps that guide a trader’s decisions, helping them determine what, when, and how much to trade. Read on to find out what are the essential components of a successful trading strategy and explore ten fundamental rules that every trader should follow to maximise their potential in the financial markets.

Always Use a Trading Plan

A trading plan is the cornerstone of a successful trading strategy.

- A well-structured plan helps you make logical and objective trading decisions, reducing the influence of emotions.

- Trading should be approached as a business, not a hobby or job.

- Successful traders treat it as a business, understanding that it comes with expenses, losses, taxes, and risks.

Your Motivation for Trading

- Understand your reasons for trading. Are you looking to generate income, build wealth, or simply learn and challenge yourself in the markets? Knowing your motivation is essential for setting clear goals.

- Establish specific, measurable, attainable, relevant, and time-bound (SMART) goals for your trading. SMART goals provide clarity and help you stay focused on your objectives.

Time Commitment

Determine how much time you can dedicate to trading. Your trading plan should align with your schedule and lifestyle.

Risk-Reward Ratio

- Decide on an appropriate risk-reward ratio for your trades. A common approach is to aim for a risk-reward ratio of 1:3 or higher, where potential profits are at least three times the potential losses.

- Define your approach to managing risk. How much of your trading capital are you willing to risk on each trade? This is crucial for preserving your capital.

- Trading capital should be expendable, and you should never risk money that you cannot afford to lose.

Market Knowledge

Assess your familiarity with different asset classes and markets. Your trading plan should align with your knowledge and expertise.

- Understanding various asset classes is a fundamental step. Asset classes include stocks, bonds, commodities, currencies (forex), cryptocurrencies, and more. Each asset class has distinct characteristics, risk profiles, and factors that influence their movements.

- If you have expertise in equity markets, you may focus on trading stocks. Your trading plan should consider factors like company fundamentals, earnings reports, and industry trends.

- Trading bonds and other fixed-income securities require an understanding of interest rates, credit quality, and economic indicators

- Commodities like oil, gold, and agricultural products have unique supply and demand dynamics. A trading plan for commodities should consider factors such as global production, geopolitical events, and weather patterns. Assess your knowledge of these markets before trading commodities.

- Cryptocurrencies are a relatively new asset class that operates 24/7. For this, traders should have a grasp of blockchain technology, crypto news, and market sentiment.

- Stay informed about financial news, economic events, earnings reports, and geopolitical developments that can impact the markets you trade.

Record Keeping

Start a trading diary to document your trades, trading decisions, and emotions. A trading diary is a valuable tool for learning from your experiences and refining your strategy.

- A trading diary serves as your trading journal, documenting every trade you make. It includes details such as entry and exit points, position size, stop-loss and take-profit levels, and the rationale behind each trade. By reviewing your past trades, you can identify patterns and trends in your decision-making process.

- After each trade, review the trade’s outcome and compare it to your initial expectations. Did the strategies for trading align with your goals? What went right, and what went wrong? What could you have done differently? By asking these questions and recording the answers, you gain valuable insights into your trading behaviour and decision-making process.

- By reviewing your trading diary regularly, you can spot repetitive mistakes or errors in your trading approach. Whether it’s overtrading, ignoring stop-loss levels, or chasing after losses, recognising these patterns is the first step to correcting them.

Use Technology to Your Advantage

In today’s competitive trading environment, using technology to analyse markets and execute trades is crucial.

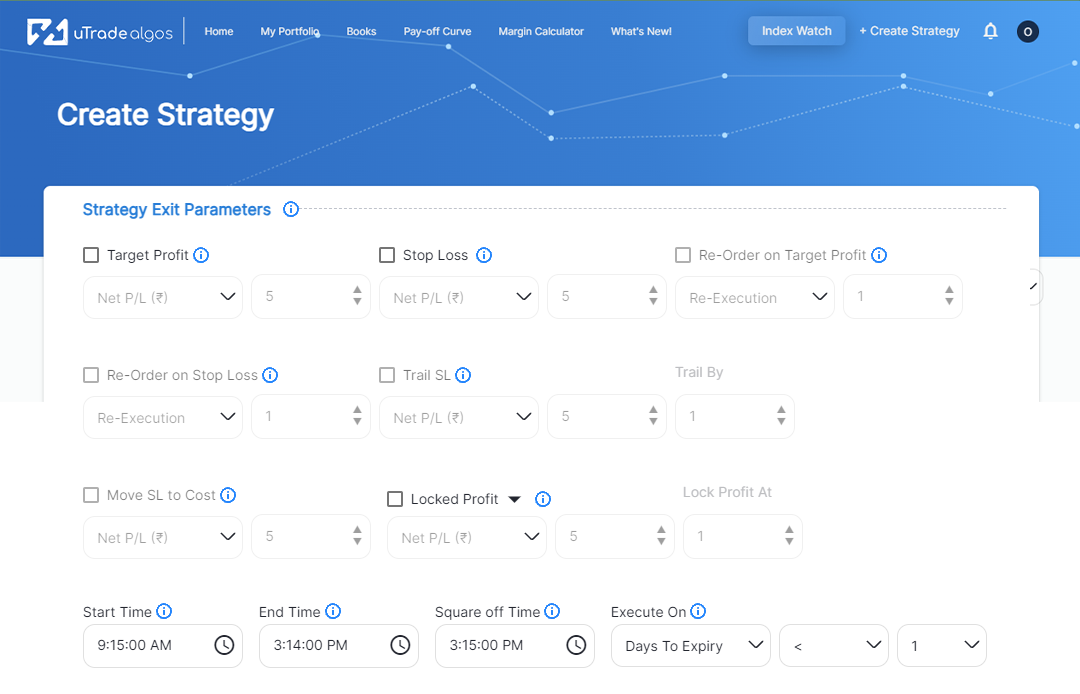

- Modern trading platforms like uTrade Algos offer advanced charting tools that provide in-depth insights into market movements. These help traders to analyse price patterns, apply technical indicators, and identify potential entry and exit points with precision.

- Algorithmic trading, also known as automated or algo trading strategies, has gained popularity due to its ability to execute trades swiftly based on predefined criteria. Algo trading strategies can help traders take advantage of market opportunities 24/7 without being tied to their screens.

- Access to real-time market data is crucial for making timely decisions. Technology allows traders to stay updated on price movements, news, and economic events that impact the markets.

- Social trading platforms enable traders to follow and replicate the trades of experienced traders. This technology-driven approach allows beginners to learn from experts and diversify their portfolios effectively.

- Technology has democratised access to educational resources. Traders can enrol in online courses, webinars, and tutorials to enhance their trading knowledge.

Protect Your Trading Capital

Preserving your trading capital is essential.

- Determining the appropriate position size for each trade is critical. Risking too much capital on a single trade can lead to significant losses, potentially depleting your trading account. It is recommended to risk only a small percentage of your total capital on each trade, typically less than two per cent of your trading account balance.

- Diversifying your portfolio involves spreading your capital across different assets or strategies for trading. This reduces the risk associated with overexposure to a single asset or market.

- Stop-loss orders are essential risk management tools. These orders allow you to define the maximum amount you are willing to lose on a trade.

- Have contingency plans in place for adverse market conditions or unexpected events.

Develop a Methodology Based on Facts

Your trading strategy should be based on factual research and analysis, not wishful thinking or emotions.

- Start by conducting thorough research and analysis of the assets or markets you plan to trade.

- Utilise both technical and fundamental analysis techniques to gain a comprehensive view of the markets.

- Backtesting is a process in which you test your trading strategy using historical data to assess its performance.

- Incorporate risk management principles into your methodology.

- Continuously monitor and stay informed about market developments.

Successful advanced trading strategies require a well-structured trading plan and adherence to fundamental rules that guide your trading decisions. Whether you are a novice trader or an experienced professional, these components are essential for navigating the financial markets with confidence and increasing your chances of success. Remember, trading is a continuous learning process, and by following these principles, you can build a strong foundation for your trading journey.

November 2, 2023

November 2, 2023