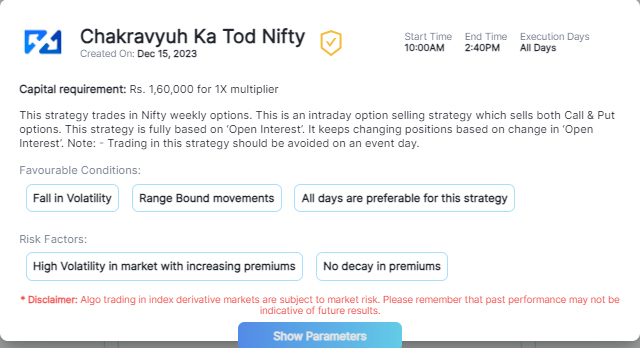

Chakravyuh Ka Tod Nifty

The OI Based Strategy by uTrade Originals, focusing on Bank Nifty weekly options, is an intraday selling strategy that adjusts positions dynamically based on open interest changes. It operates as an intraday selling strategy for both call and put options.

Factor: OI (Open Interest) Based Strategy Nifty

Margin required: Rs. 160,000 for 1x multiplier

Start Time: 10:00 AM

End Time: 2:39 PM

Execution Days: All days

Preferable Days: All Days

Favorable Conditions:

- Fall in Volatility

- Range Bound movements

Risk Factors:

- Rise in Volatility

- High Volatility in market with increasing premiums

- No decay in premiums

Default Parameters:

- Logs: 0,1

- Net Loss: 8000

- Net Profit: NA

- Option Type: FINNIFTY – Sell Call (x3), Sell Put (x3), NIFTY – Sell Call, Set Put

- Order Fill Price: 7

- Order Lot: 1

- Order Lot Slice: 20

- Premium Price: NA

- Premium Range: NA

- Stop Loss for each leg: NA

- Strike Diff: NA

- Strike Depth: NA

- Symbol: FINNIFTY, NIFTY

- Time Interval (sec): NA

This strategy trades in FINNIFTY & Nifty weekly options. This is an intraday option selling strategy which sells both Call & Put options. This strategy is designed for both DIRECTIONAL & NON-DIRECTIONAL movements. This multi leg portfolio consists of different strategies based on two different market indices traded accordingly with respect to the market conditions.

Note: – Trading in this strategy should be avoided on an event day