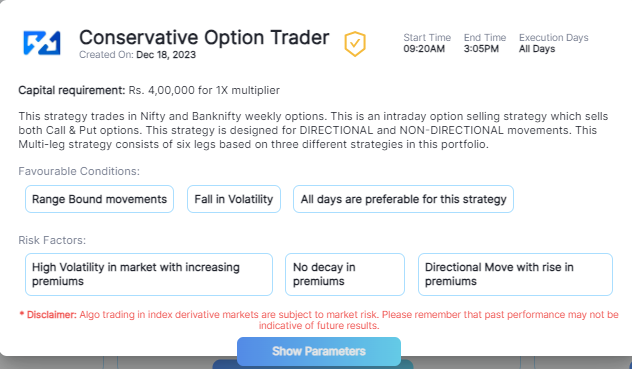

Conservative Option Trader

Also known as Stable Stride Multi Leg Strategy , an uTrade Originals strategy —an innovative intraday approach to Nifty and Bank Nifty weekly options. This strategy sells call and put options, catering to both directional and non-directional market movements. With a multi-leg structure derived from three distinct strategies, it offers a dynamic solution for navigating the options market.

Factor: Stable Stride Multi – Leg

Margin required: Rs. 4,00,000 for 1X multiplier

Start Time: 09:20 AM

End Time: 3:05 PM

Execution Days: All days

Preferable Days: All days

Favourable Conditions:

- Range Bound movements

- Fall in Volatility

Risk Factors:

- High Volatility in market with increasing premiums

- No decay in premiums

- Directional Move with rise in premiums

Default Parameters:

- Logs: 0,1

- Net Loss: 4400

- Net Profit: NA

- Option Type: BANK NIFTY – Sell Call, Sell Put, NIFTY – Sell Call, Sell Put

- Order Fill Price: 7

- Order Lot: 1

- Order Lot Slice: 20

- Premium Price:

- BANK NIFTY – 50, 20

- NIFTY – 10

- Premium Range: 50%

- Stop Loss for each leg: 50

- Strike Depth: OTM 20

- Strike Diff: 100

- Symbol: BANK NIFTY, NIFTY

- Time Interval (sec): NA

This strategy trades in NIFTY and BANKNIFTY weekly options. This is an intraday option selling strategy which sells both Call & Put options. This strategy is designed for DIRECTIONAL and NON-DIRECTIONAL movements. This multi-leg strategy consists of six legs based on three different strategies in this portfolio.

Note: – Trading in this strategy should be avoided on an event