Create powerful algorithmic trading strategies effortlessly without having to code!

- Reliable

- Comprehensive

- Fast

- Accurate

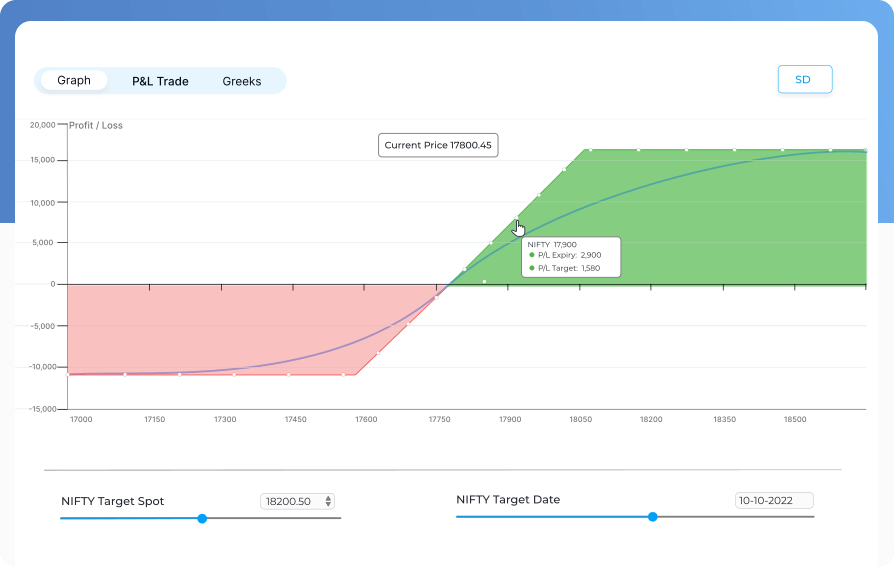

Interactive Payoff Curve

On uTrade Algos, you can set a Target Date and an Expected Spot Price at that date to customise the payoff curve to fit your specific trade conditions. This gives you a deeper understanding of how changes in these parameters would affect your potential trading outcomes.

Unleash the Power of Expert-Backed Algorithms

uTrade Originals is a collection of pre-built algos designed by industry experts to optimise your trading experience. These strategies are a result of extensive experience and meticulous research. With a focus on diverse market conditions, uTrade Originals is a great tool for novices and pros alike.

Claim your 7-day free trial!

Experience uTrade Algos on the web and mobile app without any commitment.

- Access to uTrade Originals

- Create Upto 5 Algos

Frequently Asked Questions

Expand All

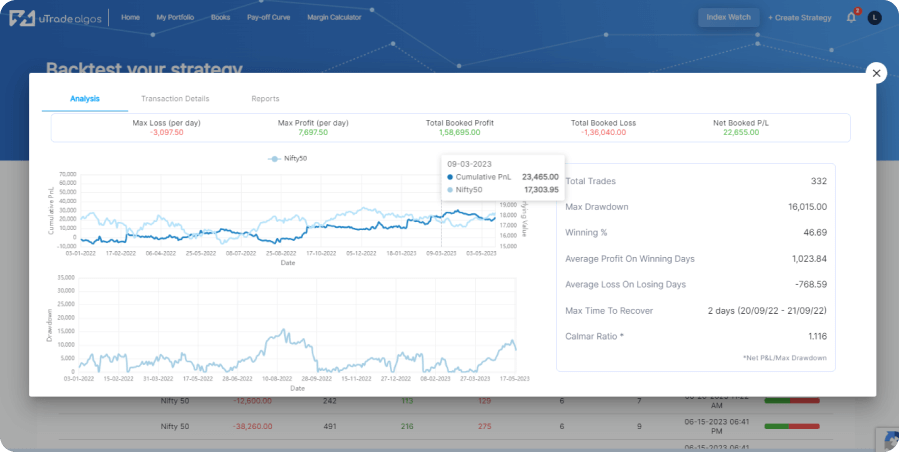

uTrade Algos has some amazing features, such as Advanced Strategy form, Fastest backtesting engine, Interactive Payoff Graph, Margin Calculator and a lot more.

Level up your Derivatives Trading experience with uTrade’s proprietary No-code strategy form and single-click deployment.

Not at all! You can start Forward Testing with 0 Capital amount and even without a brokerage account! Try your hand at simulated trading, refine your strategy logics, and when you’re confident – you can choose to trade in the live market – for which both trading account and enough capital would be mandatory to be able to deploy the strategies.

There are various types of algorithms used in Algo Trading, including:

-

Momentum-based algorithms

-

Mean reversion algorithms

-

Statistical arbitrage algorithms

-

Market-making algorithms

-

Volume-weighted average price (VWAP) algorithms

-

Time-weighted average price (TWAP) algorithms

While having programming skills can be beneficial, you don't necessarily need to be an expert programmer to use Algo Trading. Many platforms and libraries offer user-friendly interfaces and visual tools that allow traders to create algorithms without extensive coding knowledge. However, learning programming basics can provide more flexibility and customization options.

Knowledge Centre

Introducing the New uTrade Algos App: Trading Power in Your Pocket!

Empowering Traders on the Go In today’s fast-paced world, mobility …

India Becomes the 4th Largest Stock Market in the World; Surpasses Hong Kong

In recent years, India's stock market has seen a remarkable surge, catapulting it to the status of the 4th largest in the world, leaving behind Hong Kong. This growth is not just a stroke of luck but a result of a confluence of several dynamic factors. The young Indian population, a burgeoning economy, increased retail participation in the stock market, and a boost in local manufacturing of global brands are key contributors to this phenomenon. Let's delve deeper into these elements to understand the Indian market's impressive ascent.

What is Futures Trading? A Comprehensive Guide

In financial markets, futures trading, be it algorithmic trading, on platforms like uTrade Algos, or manual, stands as a cornerstone of speculation and risk management. It is a complex yet vital component that drives global economies and provides opportunities for traders and investors alike. In this comprehensive guide, we will delve into the depths of futures trading, unravelling its intricacies, purposes, mechanics, and the role it plays in the financial world.