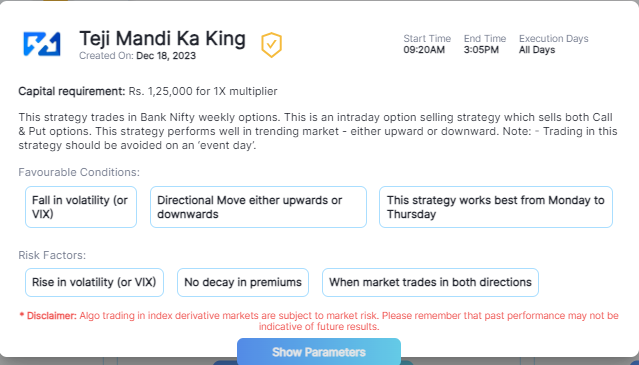

Teji Mandi Ka King

This strategy is also known as Intraday Directional Strangle,within uTrade Originals, is an intraday selling strategy for call and put options in the Bank Nifty weekly options market, particularly effective in trending markets. It’s advised to avoid trading on designated event days.

Factor: Intraday Directional Day

Margin required: Rs. 125,000 for 1x multiplier

Start Time: 09:20 AM

End Time: 3:05 PM

Execution Days: All Days

Preferable Days: Monday To Thursday

Favourable Conditions:

- Fall in volatility (or VIX)

- Directional Move either upwards or downwards

Risk Factors:

- Rise in volatility (or VIX)

- No decay in premiums

- When market trades in both directions’.

Default Parameters:

- Logs: 0,1

- Net Loss: 1200

- Net Profit: NA

- Option Type: Sell Call, Sell Put

- Order Fill Price: 7

- Order Lot: 1

- Order Lot Slice: 20

- Premium Price: 150 Each Leg

- Premium Range: 50%

- Stop Loss for each leg: 25%

- Strike Depth: 2 ITM, ATM 15 OTM

- Strike Diff: NA

- Symbol: BANK NIFTY

- Time Interval (sec): NA

This strategy trades in BANK NIFTY weekly options. This is an intraday option selling strategy which sells both Call & Put options. This strategy performs well in trending market – either upward or downward.

Note: – Trading in this strategy should be avoided on an ‘event day’.